Recording Bond Entries and Preparing an Amortization Schedule—Debt Issuance Costs

Mitchell Inc. issued 240, 6%, $1,000 bonds on January 1, 2020. The bonds pay cash interest semiannually each July 1, and December 31, and were issued to yield 7%. Debt issuance costs were $4,800. The bonds mature December 31, 2022, and the company uses the effective interest method to amortize bond discounts and debt issuance costs.

Required

a. Determine the selling price of the bonds, net of debt issuance costs. Round to the nearest dollar.

b. Prepare an amortization schedule for the full bond term.

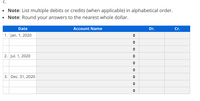

c. Prepare

1. January 1, 2020, bond issuance.

2. July 1, 2020, interest payment.

3. December 31, 2020, interest payment.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

- Temptation Vacations issues $58 million in bonds on January 1, 2021, that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: (1) (2) (3) (4) (5) Cash Paid for Interest Interest Expense Decrease in Carrying Value Carrying Value Date 1/1/2021 $65,279,805 6/30/2021 $1,740,000 1,631,995 $108,005 $65,279,805 12/31/2021 1,740,000 1,629,295 $110,705 65,171,800 5. What is the market annual interest rate? (Round your answer to the nearest whole percent.) Market annual interest ratearrow_forwardony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Date cash paid Interest Expense Increase in carrying value carrying value 01/01/2021 $218,690 06/30/2021 $11,500 $13,121 $1,621 220,311 12/31/2021 11,500 13,219 1,719 222,030 06/30/2022 11,500 13,322 1,822 223,852 12/31/2022 11,500 13,431 1,931 225,783 06/30/2023 11,500 13,547 2,047 227,830 12/31/2023 11,500 13,670 2,170 230,000 THA issued the bonds for: Multiple Choice $230,000. $218,690. $299,000. Cannot be determined from the given information.arrow_forwardCurrent Attempt in Progress On July 1, 2023, Ivanhoe Inc. issued $330000, 9% bonds, which mature on July 1, 2030. The bonds were issued for $313934 to yield 10%. Ivanhoe uses the effective interest method of amortizing bond discount. Interest is payable annually on June 30. At June 30, 2025, the adjusted balance in the Bonds Payable account should be O $315627. O $330000. $330427. $317490.arrow_forward

- Great Lake Glassware Company issues $1,050,000 of its 16%, 10-year bonds at 94 on February 28, 2024. The bonds pay interest on February 28 and August 31. Assume that Great Lake uses the straight-line method for amortization The journal entry to record the first interest payment on August 31, 2024 includes a OA. debit to Interest Expense for $87,150. OB. debit to Cash for $84,000. OC. debit to Discount on Bonds Payable for $3,150 OD. debit to Interest Expense for $80,850arrow_forwardThe balance sheet for Ivanhoe Consulting reports the following information on July 1, 2022. Long-term liabilities Bonds payable $4,500,000 Less: Discount on bonds payable 315,000 $4,185,000 Ivanhoe decides to redeem these bonds at 101 after paying annual interest.Prepare the journal entry to record the redemption on July 1, 2022.arrow_forwardSubject:: accountingarrow_forward

- Temptation Vacations issues $58 million in bonds on January 1, 2021, that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: (1) (2) (3) (4) (5) Cash Paid for Interest Interest Expense Decrease in Carrying Value Carrying Value Date 1/1/2021 $65,279,805 6/30/2021 $1,740,000 1,631,995 $108,005 $65,279,805 12/31/2021 1,740,000 1,629,295 $110,705 65,171,800 6. What is the total cash paid for interest assuming the bonds mature in 20 years? (Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000)) Total cash interestarrow_forwardhelp pleasearrow_forwardOn April 1, 2021, Marigold Corporation issued $352.000, 5-year bonds. On this date, Shoreline Corporation puurchased the bonds from Marigold to earn interest. Interest is received semi-annually on April 1 and October 1 and Shoreline's year end is March 31 Below is a partial amortization schedule for the first three interest periods of the bond issue Semi-Annual Interest Received Interest Interest Period Revenue Amortization Bond Amortized Cost April 1. 2021 $368.231 October 1, 2021 $7.040 $5.523 $1.517 366.714 April 1.2022 7.040 5.501 1.539 365,175 October 1, 2022 7.040 5,478 1,562 363,613 Were the bonds purchased at a discount or at a premium? Bonds purchased at a What is the face value of the bonds? Face value of the bonds s eTextbook and Media What will the bonds' amortized cost be at the maturity date? Bonds' amortized cost at the maturity date eTextbook and Media /1 E What is the bonds' contractual interest rate? The market interest rate? (Round answers to 2 decimal places, eg…arrow_forward

- On August 1, 2027, Concord Corporation issued $500,400, 9%, 10-year bonds at face value. Interest is payable annually on August 1. Concord's year-end is December 31. Prepare a tabular summary to record the following events. (a) The issuance of the bonds. (b) (c) The accrual of interest on December 31, 2027. The payment of interest on August 1, 2028. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) (a) Aug. 1, 2027 $ (b) Dec. 31, 2027 (c) Aug. 1, 2028 Assets Cash $ Bonds Payable Liabilities + $ Interest Payable + $ Paid in Capital Common Stock $ Revenue Stockholders' Equity $ Expense Retained Earnings $ Dividend Bonds payable Discount on bonds Interest expense Premium on bondsarrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forwardLincoln Company issued $110,000 of 10-year, 8% bonds payable on January 1, 2025. Lincoln Company pays interest each January 1 and July 1 and amortizes discount or premium by the straight-line amortization method. The company can issue its bonds payable under various conditions. Read the requirements. Requirement 1. Journalize Lincoln Company's issuance of the bonds and first semiannual interest payment assuming the bonds were issued at face value. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journal entries.) Journalize the issuance of the bond payable at face value. Date Jan. 1, 2025 Accounts Debit Creditarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education