FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

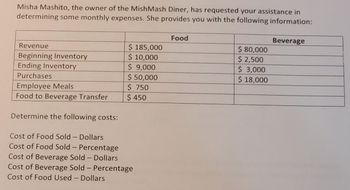

Transcribed Image Text:Misha Mashito, the owner of the MishMash Diner, has requested your assistance in

determining some monthly expenses. She provides you with the following information:

Revenue

Beginning Inventory

Ending Inventory

Purchases

Employee Meals

Food to Beverage Transfer

Determine the following costs:

$ 185,000

$ 10,000

$ 9,000

$ 50,000

$ 750

$ 450

Cost of Food Sold - Dollars

Cost of Food Sold - Percentage

Cost of Beverage Sold - Dollars

Cost of Beverage Sold - Percentage

Cost of Food Used - Dollars

Food

$ 80,000

$ 2,500

$ 3,000

$ 18,000

Beverage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information for the Quick Study below. (Algo) (11-14) Skip to question [The following information applies to the questions displayed below.]Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 15 units for $31 each. Purchases on December 7 10 units @ $17.00 cost Purchases on December 14 20 units @ $23.00 cost Purchases on December 21 15 units @ $25.00 cost QS 5-11 (Algo) Perpetual: Assigning costs with FIFO LO P1 Required:Determine the costs assigned to the December 31 ending inventory based on the FIFO method.arrow_forwardChef Amy does beginning inventory on Thursday night and finds that she has $4194 in food products in the restaurant. Throughout the week answered she purchases: out of 1.00 $2088 produce, question • $1678 protein, • $870 dry goods, and • $3914 dairy. The following Thursday she does ending inventory and finds that she has $3464 in food. She looks at her sales and finds that she made $30541 over the same 7 day period. What is her total food cost? Select one: a. $12,744 b. $16,208 C. $9,280 d. $8,550arrow_forwardTake me to the text JP Supermarkets bought $2,890 worth of groceries on account from a produce supplier on February 5, 2022. On February 6, JP's bookkeeper was informed that $270 worth of tomatoes was substandard and returned to the supplier. Prepare the journal entry to record the purchase return using the perpetual inventory system. Do not enter dollar signs or commas in the input boxes. Required Prepare the journal entry for JP Supermarkets on February 6. Account Title and Explanation Debit Credit Date 2022 Feb 6 To record the purchase return ÷arrow_forward

- Use the following information for the Quick Study below. (Algo) (11-14) [The following information applies to the questions displayed below.] Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 15 units for $32 each. Purchases on December 7 Purchases on December 14 Purchases on December 21 10 units @ $18.00 cost 20 units @ $24.00 cost 15 units @ $26.00 cost QS 5-11 (Algo) Perpetual: Assigning costs with FIFO LO P1 Required: Determine the costs assigned to the December 31 ending inventory based on the FIFO method.arrow_forwardRequired information [The following information applies to the questions displayed below.] In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 340 units at $9 on January 1, (2) 630 units at $10 on January 8, and (3) 930 units at $12 on January 29. Assuming 1,170 units are on hand at the end of the month, calculate the cost of goods available for sale, ending inventory, and cost of goods sold under LIFO. Assume a periodic inventory system is used. (Round "Cost per Unit" to 2 decimal places.) Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold LIFOarrow_forwardRequired information. In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 300 units at $5 on January 1, (2) 500 units at $9 on January 8, and (3) 910 units at $10 on January 29, Assume 1,110 units are on hand at the end of the month. Calculate the cost of goods available for sale, cost of goods sold, and ending inventory under the weighted average cost flow assumptions. Assume perpetual inventory system and sold 600 units between January 9 and January 28. (Round your intermediate calculations to 2 decimal places.) Goods Available for Sale Cost of Goods Sold Ending Inventory Weighted Average Costarrow_forward

- Required information [The following information applies to the questions displayed below.] Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 15 units for $34 each. Purchases on December 7 Purchases on December 14 10 units @ $20.00 cost 20 units @ $26.00 cost Purchases on December 21 15 units @ $28.00 cost Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method.arrow_forwardHi Please help with questions attached, thanks so much.arrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education