FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

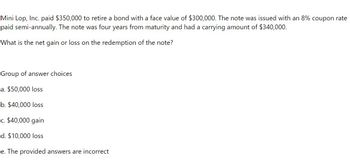

Transcribed Image Text:Mini Lop, Inc. paid $350,000 to retire a bond with a face value of $300,000. The note was issued with an 8% coupon rate

paid semi-annually. The note was four years from maturity and had a carrying amount of $340,000.

What is the net gain or loss on the redemption of the note?

Group of answer choices

a. $50,000 loss

b. $40,000 loss

c. $40,000 gain

d. $10,000 loss

e. The provided answers are incorrect

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Boxer Corp is issuing $600,000 8% 5 year bonds when bond investors want a return of 10%. Interest is payable semiannually Caculate Present Value of Bond Calculate Present Value of Interest Payments What is selling price of bond? did the bond sell at face value discount or premium?arrow_forwardChang Co. issued a $51,600, 120-day, discounted note to Guarantee Bank. The discount rate is 10%. Assuming a 360-day year, the cash proceeds to Chang Co. are ______ .Round your answer to the nearest whole dollar. a.$51,600 b.$56,760 c.$49,880 d.$52,030arrow_forwardApo Don't upload any image pleasearrow_forward

- A bank makes a 5-year $75,000 loan with no principal payments in years 1-2 and principal payments of $25,000 in Years 3, 4 and 5. The interest rate is 8% and will be paid every year. What interest and principal is paid in year 4 A $6,000 + $25,000 B $6,000+$50,000 C $4,000+$25,000 D $4,000+$50,000arrow_forwardListen A $5,000 bond paying interest at j-6%, redeemable at par on April 1, 2009 is priced at $4,600 on April 1, 2002. Find the yield rate to 2 decimal places. Show your work in your workbook. Your Answer: Answerarrow_forwardi need the answer quicklyarrow_forward

- A company issued bonds with a par value of $250,000 and a maturity of 25 years. The Bonds pay interest every six months based on a nominal interest rate of 8% per year. If on the date of issuance of the bonds the market rate (yield) is 10%: a. What will be the selling price of the bonds? b. If after 15 years the company retires the bonds, paying the amount of $225,000, how much will the gain or loss on debt retirement? Go back and assume that the market rate is 5.75%. a. What will be the selling price of the bonds? b. Make the journal entry to recognize interest expense in the third six-month period of the bonds. Assume that the bonds do NOT pay periodic interest. a. What will be the selling price of the bonds? b. Make the journal entry to recognize interest expense in the third year of the bonds.arrow_forwardA note with a face value of BD 2,600 will mature after 3 Years from today is sold to a bank that uses a 6% annual compound interest rate. The bank deducted BD15 as a commission and BD72 as a collection charge. Find the net present value and total discounts.arrow_forwarda. Assuming you purchased the bond for $350 what rate of return would you earn if you held the bond for 25 years until it matured with a value $1000? a. Rate of return____% b. Suppose under the terms of thebond you could redeem the bond in 2024. DMF agreed to pay an annual interest rate of 1.4 percent until the date. How much would the bond be worth at that time? b. Bond value_____ c. In 2024 instead of cashing in the bond for its then current value you decide to hold the bond until it mature in 2043. What annual rate of return will you earn over the last 19 years? c. Rate of return___%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education