FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:od 0123

po dass bie

Bluogely

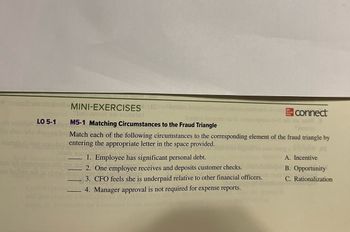

MINI-EXERCISES

achroval, Ybolin0391 31 25onsisd

LO 5-1

hude

chant desa y

Torinos Lamotni s

slavi M5-1 Matching Circumstances to the Fraud Triangle

Match each of the following circumstances to the corresponding element of the fraud triangle by

entering the appropriate letter in the space provided.

35r2 93m

aleonoqu

1. Employee has significant personal debt.

2. One employee receives and deposits customer checks.

290 Grave

3. CFO feels she is underpaid relative to other financial officers.

4. Manager approval is not required for expense reports.

connect

o W S

A. Incentive

B. Opportunity

C. Rationalization

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4 List the 3 main factors that will be present in committing fraud (Hint: The Fraud Triangle): ____________________ ____________________ ____________________arrow_forwardstifying M5-2 Identifying Internal Controls over Financial Reportingen/gp/ Fox Erasing has a system of internal control with the following procedures. Match the procedure to the corresponding internal control principle. Indoo raso Procedure 1-- ME 2 Identifina SAUNTOSON an 1. The treasurer signs checks. Internal Control Principle A. Establish responsibility 2B. Segregate duties volume C. Restrict access 2. The treasurer is not allowed to make bank deposits. dags orly savion 3. The company's checks are prenumbered. D. Document procedures 4. Unused checks are stored in the vault.ancien en proides B. Independently verify olar997 daga 5. A bank reconciliation is prepared each month. geland Fraud, Inter CHAPTER 5 antal Drinciples Anlied by a Morchandicar Larrow_forwards/ui/v2/assessment-player 80 F3 $ OCT 26 4 Q F4 Question 1 of 1 The statement from Jackson County Bank on December 31 showed a balance of $26,662. A comparison of the bank statement with the Cash account revealed the following facts. 1. 2 3. Your answer is incorrect. 4 The bank collected a note receivable of $2,500 for Sheffield Corp. on December 15 through electronic funds transfer. The December 31 receipts were deposited in a night deposit vault on December 31. These depasits were recorded by the bankid January Checks outstanding on December 31 totaled $1.200. On December 31, the bank statement showed an NSF charge of $630 for a check received by the company from L. Bryan, a customer on account Prepare a bank reconciliation as of December 31 based on the available information. (Hint: The cash balance per books is $26,292. This can be proved by finding the balance in the Cash account from parts (a) and (b)) (List items that increase cash balance first Reconcile cash balance per bank…arrow_forward

- Plz don't copy answer without plagiarism please little different answersarrow_forwardPlease help me solvearrow_forwardCertification Question 37 of 50 Your client is using advanced matching in the bank feed to find a match for a deposit that was made last week. While in the match transactions screen, he realizes that a rebate cheque was missing from the deposit, and he wants to enter it right onto the deposit. What two things are true about using the resolve difference feature in this scenario? One or more of your selected options was incorrect. Selecting even just one incorrect option will earn no credit for this question. Please try again. O QuickBooks Online creates a journal entry to reflect the added information QuickBooks Online creates a new deposit to reflect the added information O The total amount of the deposit - including the resolving transaction - will appear as two separate deposits on your bank reconciliation screen The total amount of the deposit - including the resolving transaction- will appear as a single deposit on your bank reconciliation scroen QuickBooks Online creates a…arrow_forward

- Answer multi choice question in photo pleasearrow_forwardRequired information Chapter 04 Problem 4-31 LO 4-6, 4-9 [The following information applies to the questions displayed below.] Management fraud (e.g., fraudulent financial reporting) is a relatively rare event. However, when it does occur, the frauds (e.g., Enron and World Com) can have a significant effect on shareholders, employees, and other parties. The PCAOB's AS 2401, Consideration of Fraud in a Financial Statement Audit, provides the relevant guidance for auditors. Chapter 04 Problem 4-31 Part b LO 4-6, 4-9 b. Select the three conditions that are generally present when fraud occurs: Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Management or other employees have an incentive or are under pressure that provides a reason to commit fraud. Circumstances exist that provide an opportunity for a fraud to be carried…arrow_forward0.69 8:34 KB/S 2:44 5G Vo 1 LTE 2 +91 98156 34462 Yesterday, 9:12 pmek 2.docx ACC1310 Lab 1-Week 2 Accounts Receivable Bad Debts • Recording Bad Debt - Percentage of sales Aging of receivables • Write off Bad Debt • Recovery of Bad Debt QS 8-1 Entries for sale on credit and subsequent collection LO1 Journalize the following transactions for Kimmel Company (assume a perpetual inventory system): a. On March 1, Kimmel Company sold $40,000 of merchandise costing $32,000 on credit terms of n/30 to JP Holdings. b. On March 27, JP Holdings paid its account in full. QS 8-5Adjusting entry to estimate bad debts- percentage of sales LO2,3 Lexton Company uses the allowance method to account uncollectible accounts receivable. At year-end, October 31, it was estimated that 0.6% of net credit sales were uncollectible based on past experience. Net sales were $690,000, of which 2/3 were on credit. Record the entry at year-end to estimate uncollectible receivables. QS 8-6Adjusting entry to estimate bad…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education