FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

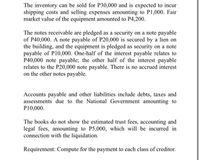

Transcribed Image Text:The inventory can be sold for P30,000 and is expected to incur

shipping costs and selling expenses amounting to P1,000. Fair

market value of the equipment amounted to P4,200.

The notes receivable are pledged as a security on a note payable

of P40,000. A note payable of P20,000 is secured by a lien on

the building, and the equipment is pledged as security on a note

payable of P10,000. One-half of the interest payable relates to

P40,000 note payable; the other half of the interest payable

relates to the P20,000 note payable. There is no accrued interest

on the other notes payable.

Accounts payable and other liabilities include debts, taxes and

assessments due to the National Government amounting to

P10,000.

The books do not show the estimated trust fees, accounting and

legal fees, amounting to P5,000, which will be incurred in

connection with the liquidation.

Requirement: Compute for the payment to each class of creditor.

Transcribed Image Text:Miner Company is being forced into bankruptcy. The

Company's creditors and stockholders have requested an

estimate of the results of liquidation of the Company. Miner's

trial balance follows:

Accounts

Debit Credit

Cash

P6,000

Accounts receivable

63,000

Allowance for bad debts

P2,000

Notes receivable

50,000

Accrued interest on notes receivable 1,200

Inventory

Buildings

Accumulated depreciation-Buildings

Equipment

Accumulated depreciation-Equipment

Prepaid insurance

60,000

182,000

63,000

14,600

1,400

1,100

Goodwill

8,500

Accrued wages

Taxes payable

Accounts payable and other liabilities

Notes payable

Accrued interest payable

Common stock

6,000

2,400

170,000

80,000

1,600

110,000

50,000

Retained earnings (deficit)

Total

P436,400 P436 400

The assets are expected to bring cash on conversion in the

following amounts

Accounts receivable

P50,000

Notes receivable including P1,000 accrued

interest

40,800

Building

75,000

Prepaid insurance

400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2) Prepare the journal entry under the direct write-off method that ABC company would record when it determines that $500 cannot be collected from its customer DEF from a previous sale on account: DR: Bad Debt Expense $500 CR: Accounts Receivable $500 3) After being written off inn question 2, DEF company winds up partially paying ABC $250 that it previously owed, before officially going out of business. Please prepare the necessary journal entries to reverse the write off for the appropriate amount, and to record the receipt of cash: DR: CR: DR: CR: PLEASE DO NOT ANSWER THE FIRST QUESTION. KIND THANKSarrow_forwardXavier Company is going through a Chapter 7 bankruptcy. All assets have been liquidated, and the company retains only $27,200 in free cash. The following debts, totaling $48,050, remain: Government claims to unpaid taxes $ 8,000 Salary during last month owed to Mr. Key (not an officer) 19,825 Administrative expenses 4,450 Salary during last month owed to Ms. Rankin (not an officer) 7,225 Unsecured accounts payable 8,550 Indicate how much money will be paid to the creditor associated with each debt.arrow_forwardShi Company is going through a Chapter 7 bankruptcy. All assets have been liquidated, and the company retains only $26,600 in free cash. The following debts, totaling $45,050, remain: Government claims to unpaid taxes Salary during last month owed to Mr. Key (not an officer) Administrative expenses Salary during last month owed to Ms. Rankin (not an officer) Unsecured accounts payable $ 7,400 19,225 3,850 Indicate how much money will be paid to the creditor associated with each debt. Types of Debts Administrative expenses Salary during last month owed to Mr. Key and Ms. Rankin 6,625 7,950 Answer is complete but not entirely correct. Amounts 3,850 $12.850 $ 3,716 $26,600 Government claims to unpaid taxesarrow_forward

- Martinez Corp. experienced a fire on December 31, 2020, in which its financial records were partially destroyed. It has been able to salvage some of the records and has ascertained the following balances. December 31, 2020 December 31, 2019 Cash $ 38,100 $ 11,100 Accounts receivable (net) 74,000 128,400 Inventory 204,600 183,400 Accounts payable 50,200 90,600 Notes payable 36,500 64,900 Common stock, $100 par 406,600 406,600 Retained earnings 120,000 106,300 Additional information: 1. The inventory turnover is 3.7 times. 2. The return on common stockholders’ equity is 19%. The company had no additional paid-in capital. 3. The receivables turnover is 11.8 times. 4. The return on assets is 19%. 5. Total assets at December 31, 2019, were $607,100. Compute the following for Martinez Corp.. (Round all answers to 0 decimal places, e.g. 2,150.) (a) Cost of goods sold for 2020. $ (b) Net credit…arrow_forwardCasilda Company uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $51,300; (2) up to 180 days past due, $14,800; and (3) more than 180 days past due, $5,000. Experience has shown that for each age group, the average loss rate on the amount of the receivables at year-end due to uncollectibility is (1) 4 percent, (2) 13 percent, and (3) 31 percent, respectively. At December 31, the end of the current year, the Allowance for Doubtful Accounts balance is $100 (credit) before the end-of-period adjusting entry is made. Required: 1. Prepare the appropriate bad debt expense adjusting entry for the current year. 2. Show how the various accounts related to accounts receivable should be shown on the December 31, current year, balance sheet. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Show how the various accounts related to accounts…arrow_forwardOn April 15, 2018 Mike’s Framing Co., declared Chapter 11 bankruptcy, owing James Wholesalers $375.00. James will immediately write off Mike’s account as uncollectible. Prepare the appropriate journal entry for James.arrow_forward

- A company going through a Chapter 7 bankruptcy has the following account balances: Cash Receivables (25% collectible) $ 49,000 69,000 Inventory (worth $34,850) 109,000 Land (worth $253,000) (secures note payable) 195,000 Buildings (worth $275,000) (secures bonds payable) 390,000 Salaries payable (4 workers owed equal amounts for last 2 weeks) 19,500 Accounts payable 109,000 Note payable (secured by land) 205,000 Bonds payable (secured by building) 490,000 Common stock 290,000 Retained earnings (235,000) How much will be paid to each of the following? > Answer is complete but not entirely correct. Salaries payable Accounts payable $ 19,500 Note payable Bonds payable $ 41,420 x $ 205,000 $ 356,700 ×arrow_forwardUse the trial balance presented for Lynch, Inc., in problem (51). Assume that the company will be liquidated and the following transactions will occur: • Accounts receivable of $18,000 are collected with remainder written off. • All of the company’s inventory is sold for $40,000. • Additional accounts payable of $10,000 incurred for various expenses such as utilities and maintenance are discovered. • The land and building are sold for $71,000. • The note payable due to the Colorado Savings and Loan is paid. • The equipment is sold at auction for only $11,000 with the proceeds applied to the note owed to the First National Bank. • The investments are sold for $21,000. • Administrative expenses total $20,000 as of July 23, 2017, but no payment has yet been made. a. Prepare a statement of realization and liquidation for the period from March 14, 2017, through July 23, 2017. b. How much cash would be paid to an unsecured, nonpriority creditor that Lynch, Inc., owes a total of $1,000?arrow_forwardShi Company is going through a Chapter 7 bankruptcy. All assets have been liquidated, and the company retains only $27,500 in free cash. The following debts, totaling $49,550, remain: Government claims to unpaid taxes $ 8,300 Salary during last month owed to Mr. Key (not an officer) 20,125 Administrative expenses 4,750 Salary during last month owed to Ms. Rankin (not an officer) 5,960 Unsecured accounts payable 8,850 Required: Indicate how much money will be paid to the creditor associated with each debt.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education