FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

A8 please help....

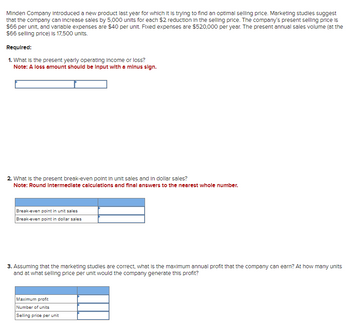

Transcribed Image Text:Minden Company Introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest

that the company can increase sales by 5,000 units for each $2 reduction in the selling price. The company's present selling price is

$66 per unit, and variable expenses are $40 per unit. Fixed expenses are $520,000 per year. The present annual sales volume (at the

$66 selling price) is 17,500 units.

Required:

1. What is the present yearly operating Income or loss?

Note: A loss amount should be input with a minus sign.

2. What is the present break-even point in unit sales and In dollar sales?

Note: Round Intermediate calculations and final answers to the nearest whole number.

Break-even point in unit sales

Break-even point in dollar sales

3. Assuming that the marketing studies are correct, what is the maximum annual profit that the company can earn? At how many units

and at what selling price per unit would the company generate this profit?

Maximum profit

Number of units

Selling price per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- 5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardBlackboard Learn Bb 2193555 + i learn-us-east-1-prod-fleet02-xythos.content.blackboardcdn.com/5f7ce11c673e5/2193555?X-Blackboard-Expiration=1648004400000&X-Blackboard-Signature=9lhjClppXf7wSeUqx.. E * O w WordCounter - Cou... y! Yahoo A Regions Bank | Che.. Welcome, Justin – B. * eBooks, Textbooks... O Jefferson State Co... Electronics, Cars, Fa. C Home | Chegg.com 2193555 1 / 1 100% + | PR 14-4B Entries for bonds payable and installment note transactions The following transactions were completed by Montague Inc., whose fiscal year is the calendar year: оВJ. 3, 4 V 3. $61,644,484 Year 1 Еxcel July 1. Issued $55,000,000 of 10-year, 9% callable bonds dated July 1, Year 1, at a market (effective) rate of 7%, receiving cash of $62,817,040. Interest is payable semiannually on December 31 and June 30. General Ledger Oct. 1. Borrowed $450,000 by issuing a six-year, 8% installment note to Intexicon Bank. The note requires annual payments of $97,342, with the first payment occurring on…arrow_forwardⒸ O D O H < UB Unblockit - Proxies to acce X C Solved P11-1A Gão Limited X b Home | bartleby C (4) How to study fo... Dropbox- 1st B.tec... (10) Lil Jaico - Toma Dropbox - 1st B.tec... (10) Lil Would you like to make Opera GX your everyday browser? How do I do that? www.chegg.com/homework-help/questions-and-answers/journalize-transactions-b-post-equity-accounts-use-j5-posting-refrence-c-prepare-share-cap-q90903484 Jaico-Toma (17) Liverpool reacti... (1) How To Study fo... (6) HABITS of SUCC... AMARIA BB - Slow... Type here to search MARM O x + Chegg Books Jan. 10 Mar. 1 Apr. 1 May 1 Aug. 1 Sept. 1 Nov. 1 Study Career Find solutions for your homework business/accounting / accounting questions and answers/p11-1a gão limited was organized on january 1, 2017, it is... Question: P11-1A Gão Limited Was Organized On January 1, 2017. It Is Authorized To Issue 10,000 8%, HK$1,000 Par Value Preference Share... P11-1A Gão Limited was organized on January 1, 2017. It is authorized to issue 10,000…arrow_forward

- A Acti Sear G diti : Clas x E Stoc S Sear A Socr 1 http te A Ap X e.com forms 1FAIpOLSeafd7pyb. L19k3KwA8ZPyAcexBZXgQKw/viewform?hr_submission=Chgic gle Classroom in moodle G dictionary english a.. StudentVUE A Minnesota State Ap. A Application | Status. A Apply to Augsbu Mutual Funds 6. Which of the following evaluates companies to determine if they are a safe or risky inveştment? * The New York Stock Exchange The Securities and Exchange Commission (SEC) Standards & Poor's/ Moody's The Dow Jones O us ačer 2$ 4. & 5 7 8 9. y u 口arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardBookmarks Profiles Tab Window Help C (4726) IFRS v x Accounting10 x Accounting10 × M Question 3-1 WiConn le Chrome File Edit View History Inbox (228) X ACC101 Princ X C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Chapter 7 Homework Saved 3 Part 2 of 2 15.96 points eBook Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, n/30). March 1 March 2 March 3 (a) March 3 (b) March 6 March 9 March 10 March 12 Purchased $31,000 of merchandise from Van Industries, terms 2/15, n/30. Sold merchandise on credit to Min Cho, Invoice Number 854, for $12,400 (cost is $6,200). Purchased $930 of office supplies on credit from Gabel Company, terms n/30. Sold merchandise on credit to Linda Witt, Invoice Number 855, for $6,200 (cost is $3,100). Borrowed $72,000 cash from Federal Bank by signing a long-term note payable. Purchased $15,500 of office equipment on…arrow_forward

- 2 pleasearrow_forwardttempt.php?attempt3D17649928&cmid%3D875183&page%3D22#3question-1984127-35 6 S a https://alternativet... 4 SQUCOFFEE - Goog... B BCOM2911-Busines... الم ميزة بنجمة - . . .Go o صفحتي الرئيسية (ACADEMIC) SQU LIBRARIES - SQU PORTAL ATTENDANCE E-LEARNING SERVICES - uestion XYZ Co. has the following information: yet wered Inventory at 1st rked out of Inventory at 31st Dec 2020 Jan 2020 Raw Materials Inventory OMR 20,000 OMR 30,000 Flag estion Work in Process Inventory OMR 18,000 OMR 15,000 Finished Goods Inventory OMR 30,000 OMR 20,000 Additional information for the year is as follows: Raw materials purchases OMR 100,000 Direct labor OMR 75,000 Manufacturing overhead applied OMR 85,000 Manufacturing overhead Actual OMR 80,000 Indirect materials OMR Compute the adjusted cost of goods sold. O a. OMR 257,000 O b. OMR 247,000 Oc. None of the given answer is correct O d. OMR 258,000 O e. OMR 252,000arrow_forwardBookmarks People Tab Window Help 192.168.1.229 60 83% Wed 12:20 PM Chapter 10 Homework (Applice X CengageNOWv2 | Online teach x lim/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false ☆ 青N Login Common A... A Common Black Co... *No Fear Shakespe... b Hamlet, Prince of... E 12th Grade PVA H.. O Paraphrasing Tool.. eBook Labor Variances. Verde Company produces wheels for bicycles. During the year, 656,000 wheels were produced. The actual labor used was 364,000 hours at $9.20 per hour. Verde has the following labor standards: 1) $10.40 per hour; 2) 0.48 hour per wheel. Required: 1. Compute the labor rate variance. 2. Compute the labor efficiency variance. Previous Next Check My Workarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education