FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:**Budgeting for Milo Company: Beach Umbrellas**

**Overview:**

Milo Company manufactures beach umbrellas and is preparing budgets for the third quarter. Key data and tasks for planning sales, production, and material requirements are outlined below.

**Sales Estimates:**

- **Unit Sales Projections:**

- July: 36,000

- August: 82,000

- September: 51,000

- October: 26,000

- November: 12,500

- December: 13,000

- **Selling Price:** $15 per unit

**Sales Collection Pattern:**

- 30% collected in the month of sale

- 65% collected in the month following sale

- 5% considered uncollectible

*Example:* Sales for June totaled $465,000.

**Inventory Policy:**

- Finished goods inventory is 15% of the following month's sales. This is ensured by the end of June.

**Material Requirements:**

- Each umbrella requires 4 feet of Gilden material.

- Ending inventory of Gilden: 50% of the following month's production needs.

- Inventory on hand:

- June 30: 85,800 feet

- September 30: To be calculated

**Material Cost:**

- Gilden costs $0.60 per foot.

- Payment for Gilden purchases is split: half paid in the purchase month and half the following month.

- Accounts payable on July 1 for June purchases: $44,790.

**Tasks:**

1. **Estimated Sales Calculations:**

- Calculate estimated sales by month and total for the third quarter.

2. **Expected Cash Collections:**

- Determine expected cash collections by month and in total for the third quarter.

3. **Production Quantities:**

- Estimate umbrellas to be produced in July, August, September, and October.

4. **Material Purchases:**

- Calculate Gilden needed (in feet) by month and total for the third quarter.

5. **Material Costing:**

- Determine cost for Gilden purchases by month and total for the third quarter.

6. **Cash Disbursements:**

- Calculate expected cash disbursements for Gilden purchases by month and total for the third quarter.

**Data Entry:**

- Use provided tables and tabs to input calculations and analyze budget projections. Focus on the third quarter:

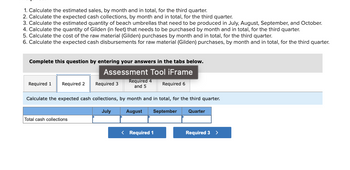

Transcribed Image Text:**Educational Exercise Overview**

This section focuses on financial and production calculations for the third quarter. It includes a series of tasks to help understand cash flow, production requirements, and material cost estimations over a specified period.

**Tasks:**

1. **Estimated Sales Calculation:**

- Calculate the estimated sales, by month and in total, for the third quarter.

2. **Cash Collections Estimation:**

- Calculate the expected cash collections, by month and in total, for the third quarter.

3. **Production Quantity Estimation:**

- Calculate the estimated quantity of beach umbrellas that need to be produced in July, August, September, and October.

4. **Material Quantity Calculation:**

- Calculate the quantity of Gilden (in feet) that needs to be purchased by month and in total, for the third quarter.

5. **Material Cost Estimation:**

- Calculate the cost of the raw material (Gilden) purchases, by month and in total, for the third quarter.

6. **Cash Disbursements for Material:**

- Calculate the expected cash disbursements for raw material (Gilden) purchases, by month and in total, for the third quarter.

**Interactive Component:**

- **Assessment Tool IFrame:** Complete this question by entering your answers in the tabs provided below.

**Answer Tabs:**

- **Tabs include sections labeled:**

- Required 1, Required 2, Required 3, Required 4 and 5, Required 6

**Detailed Explanation of the Table:**

- **Table Heading:** Calculate the expected cash collections, by month and in total, for the third quarter.

- **Columns Represent:**

- Months: July, August, September

- Quarter Total

- **Row:** Total cash collections input fields are provided for each month and for the quarter total.

**Navigation:**

- **Button Navigation:**

- Required 1, Required 3 (acts as a part of user flow control to guide inputs step-by-step)

This interactive exercise helps provide a practical understanding of budgeting and financial forecasting within a real-world production context.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Milo Company manufactures beach umbrellas. The company is preparing budgets for the third quarter and assembled the following information: The Marketing Department estimated unit sales as follows for the remainder of the year:July 33,000 October 23,000August 76,000 November 9,500September 45,000 December 10,000The selling price of the beach umbrellas is $15 per unit. All sales are on account. Based on past experience, sales are collected in the following pattern:30% in the month of sale65% in the month following sale5% uncollectibleSales for June totaled $375,000. The company maintains finished goods inventories equal to 15% of the following month’s sales. This requirement will be met at the end of June.Each beach umbrella requires 4 feet of Gilden, a material that is sometimes hard to acquire. Therefore, the company requires ending inventory of Gilden equal to 50% of the following month’s production needs. The inventory of Gilden on hand at the…arrow_forwardKimball Company manufactures drinking glasses. One unit is a package of eight glasses, which sells for $24. Kimball projects sales for April will be 2,500 packages, with sales increasing by 200 packages per month for May, June, and July. On April 1, Kimball has 100 packages on hand but desires to maintain an ending inventory of 20% of the next month's sales. Prepare a sales budget and a production budget for Kimball for April, May, and June. Begin by preparing a sales budget for April, May, and June. Kimball Company Sales Budget April, May, and June April May Budgeted packages to be sold Sales price per package Total sales 697 2,500 2,700 24 $ 60,000 $ 64,800 24 $ $ June 2,900 Total 8,100 24 24 $ 69,600 $ 194,400arrow_forwardYarbrough Company manufactures T-shirts printed with tourist destination logos. The following table shows sales prices and projected sales volume for the summer months: (Click the icon to view the data.) Prepare a sales budget for Yarbrough Company for the three months. - X Data Table Yarbrough Company Sales Budget June, July, and August Projected Sales in Units June July August Total T-Shirt Sizes Sales Price June July August Youth T-Shirts Youth $ 7 575 500 525 Adult-Regular T-Shirts Adult-regular 17 625 900 825 Adult-oversized 18 400 500 475 Adult-Oversized T-Shirts Total sales Print Done Activate Windows Enter any number in the edit fields and then click Check Answer.arrow_forward

- Beauty Spa & Co. manufactures a specialised luxury spa that is supplied to five-star hotels around the country. The owner provides you with the following information to prepare its 1st quarter budget: July, August, and September. Budgeted sales are as follows: Month Sales ($) Units Sold May 25,000 250 June 28,000 280 July 30,000 300 August 40,000 400 September 35,000 350 October 37,000 370 Additional information: i) Purchases are budgeted at $5.00 per unit and are paid for in full in the month after purchase. ii) Closing inventory must equal 50% of the next month’s sales. iii) Sales (which are all on credit) are collected as follows: 60% in the month of sale; 30% in the month after the sale; 5% in the second month after the sale. iv) The balance in the bank account as of 30 June is $10,000. Required (show your workings for each question): Prepare a purchases budget (in units and $) for the 1st…arrow_forwardJackson Inc. produces leather handbags. The production budget for the next four months is: July 5,300 units, August 7,700 units, September 8,400 units, October 8,100 units. Each handbag requires 0.5 square meters of leather. Jackson Inc.’s leather inventory policy is 30% of next month’s production needs. On July 1 leather inventory was expected to be 795 square meters. What will leather purchases be in July? Multiple Choice 2,760 square meters 4,035 square meters 3,010 square meters 3,160 square metersarrow_forwardBeauty Spa & Co. manufactures a specialised luxury spa that is supplied to five-star hotels around the country. The owner provides you with the following information to prepare its 1st quarter budget: July, August, and September. Budgeted sales are as follows: Month Sales ($) Units Sold May 25,000 250 June 28,000 280 July 30,000 300 August 40,000 400 September 35,000 350 October 37,000 370 Additional information: i) Purchases are budgeted at $5.00 per unit and are paid for in full in the month after purchase. ii) Closing inventory must equal 50% of the next month’s sales. iii) Sales (which are all on credit) are collected as follows: 60% in the month of sale; 30% in the month after the sale; 5% in the second month after the sale. iv) The balance in the bank account as of 30 June is $10,000. Required (show your workings for each question): Prepare the schedule of expected cash collections from…arrow_forward

- The following is a schedule of the projected unit sales of Western Company, which manufactures casual wear. Each unit sells for $25. The company began the period with a beginning accounts receivable balance of $10,000. Choose the correct answer from the options provided. Budgeted unit sales Percentage of sales collected in the quarter of the sale Percentage of sales collected in the quarter after the sale. Quarter First Second Third Fourth 1,500 1,300 1,400 1,300 Knowledge Check 01 What is the amount of budgeted sales revenue for the fourth quarter? O $32,500 $33,750 O $35,000 $37,500 $8,125 O $8,750 O $9,375 O $28,125 Year 5,500 75% 25% Knowledge Check 02 What is the amount of cash that is expected to be collected during the second quarter as a result of sales made during the first quarter?arrow_forwardMilo Company manufactures beach umbrellas. The company is preparing detailed budgets for the third quarter and has assembled the following information to assist in the budget preparation:a. The Marketing Department has estimated sales as follows for the remainder of the year (in units):05JulyAugustSeptember31,500 October73,000November42,000 December21,5008,0008,500The selling price of the beach umbrellas Is $12 per unit.b. All sales are on account. Based on past experience, sales are collected in the following pattern:30% in the month of sale65% in the month following sale5% uncollectibleSales for June totaled $264,000The company maintains finished goods inventories equal to 15% of the following month's sales. This requirement will be met at the end of JuneEach beach umbrella requires 4 feet of Gilden, a material that is sometimes hard to acquire. Therefore, the company requires that the ending inventory of Gilden be equal to 50% of the following month's production needs. The inventory…arrow_forwardanswer in text form please (without image)arrow_forward

- Dolson Appliances makes coffee machines for offices and homes. For next year, the production budget is 141,000 units. Beginning inventories will be 18,000 units and the desired ending inventory will be 16,000 units. Required: What is the sales budget for the coming year for Dolson Appliances? Sales budget unitsarrow_forwardVibrant Inc. manufactures two models of speakers, Rumble and Thunder. Based on the following production and sales data for June, prepare (a) a sales budget and (b) a production budget: Rumble Thunder Estimated inventory (units), June 1 258 70 Desired inventory (units), June 30 296 61 Expected sales volume (units): North Region 3,250 3,650 South Region 5,200 4,500 Unit sales price $95 $185 a. Prepare a sales budget. Vibrant Inc. Sales Budget For the Month Ending June 30 Unit Unit Total Sales Selling Sales Volume Price Product and Area Model Rumble: North Region South Region Total Model Thunder: North Region South Region Total Total revenue from sales b. Prepare a production budget. Vibrant Inc. Production Budget For the Month Ending June 30 Units Units Model Model Rumble Thunder Expected units to be sold Total units required Total units to be producedarrow_forwardAtlantic Surf manufactures surfboards. The company's budgeted sales units for the next three months is shown below. Company policy is to maintain finished goods Inventory equal (in units) to 40% of the next month's unit sales. As of June 30, the company has 1,600 finished surfboards In Inventory. Budgeted sales units July 4,000 August 5,500 September 4,200 Prepare the production budget for the months of July and August. ATLANTIC SURF Production Budget Desired ending inventory units Total required units Units to be produced July Augustarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education