Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

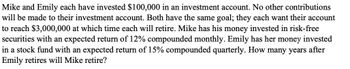

Transcribed Image Text:Mike and Emily each have invested $100,000 in an investment account. No other contributions

will be made to their investment account. Both have the same goal; they each want their account

to reach $3,000,000 at which time each will retire. Mike has his money invested in risk-free

securities with an expected return of 12% compounded monthly. Emily has her money invested

in a stock fund with an expected return of 15% compounded quarterly. How many years after

Emily retires will Mike retire?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Kourtney and Khloe Kardashian are receiving slightly different incomes from investments that they had made in the past. Kourtney will receive a perpetuity of $29,000 per year forever, while Khloe will receive the same annual payment for the next 50 years. If the interest rate is 7.3 percent, how much more are Kourtney's payments worth now?arrow_forwardBrad is working with a financial planner and is confident that he can invest in mutual funds that will average 10% annual returns. If he wants to retire after 40 years with $2 million in his retirement account, how much does Brad need to deposit at the end of each of the 40 years?arrow_forwardSOLVE TO HAND LEGIBLE; When a father dies, he leaves his children an inheritance of $3,000,000.00. When the father dies, his children are 5,8,9,12 and 15 years old. Each of the children must receive exactly the same amount of money when they turn 18. The money is deposited in a trust that pays 16% annually, convertible every 8 months: How much money will each of the children receive?arrow_forward

- Frank is planning for the day when his child, Laura, will go to college. Laurahas just turned eight and plans to enter college on her 18th birthday. She will need $25,000 at the beginning of each year in school. Frank plans to give Laura a Mercedes as a combination graduation and 22nd birthday present. The Mercedes is expected to cost $55,000. Frank currently has $10,000 saved for Laura. Also, Frank expects to inherit $25,000 nine years from now that will be used for Laura’s education. Frank expects to be able to earn 7 percent after tax on any investments.How much must Frank save at the end of each of the next 10 years in order to provide for Laura’s education and the Mercedes?arrow_forwardSuzy wants to retire in 30 years. She expects to live 25 years after retirement. She prepares a savings plan to meet the objectives: First, after retirement she would like to be able to withdraw $20,000 per month. The first withdrawal will occur at the end of the first month after retirement. Second, she would like to leave her daughter a $500,000 inheritance. Lastly, she wants to set up a fund that will pay $5000 per month forever to her favorite charity after she dies. These payments will begin one month after she dies. All the monies earn 10% annual rate compounded monthly. How much will she have to save per month to meet these objectives? She wishes to make her first deposit from now and the last deposit on the day she retires.arrow_forwardMike and Emily each have invested $100, 000 in an investment account. No other contributions will be made to their investment account. Both have the sarne goal; they each want their account to reach $3,000,000 at which time each will retire. Mike has his money invested in risk free securities with an expected return of 12% compounded monthly. Emily has her money invested in a stock fund with an expected return of 15% compounded quarterly. How many years after Emily retires will Mike retire?arrow_forward

- Louis is 29 years old today. He is a conservative person, and is thinking about his retirement when he reaches the age of 72. He decides to invest $8,000 at regular annual intervals for 20 years, starting from today. The fund that he is investing in will give him a return of 7.7% per annum. He will then leave the money in the account to grow further until he retires when he is 72 years old. How much will Louis have in the fund when he turns 72? a. $2,262,482 b. $2,100,726 c. $ 2,325,007 d. $2,150.79 No excel pleasearrow_forwardYour great-uncle Claude is 82 years old. Over the years, he has accumulated savings of $180,000. He estimates that he will live another 18 years at the most and wants to spend his savings by then. (If he lives longer than that, he figures you will be happy to take care of him.) Uncle Claude places his $180,000 into an account earning 9 percent annually and sets it up in such a way that he will be making 18 equal annual withdrawals—the first one occurring one year from now—such that his account balance will be zero at the end of 18 years. How much will he be able to withdraw each year?arrow_forward20arrow_forward

- Ella and Aaron Martin together earn approximately $92,000 a year after taxes. Through an inheritance and some wise investing, they also have an investment portfolio with a value of almost $200,000. a. how much of annual income do you reccoment they hold in liquid savings as reserves? why? b. How much of their investment portfolio do you reccoment they hold in savings and other short term vehicles? Explain. c. How much, in total, should they hold in short term liquid assets? Determine the right amount of short term, liquid assets. (Explain.) (Explain.) How much in total in liquid assets:arrow_forwardTwins Natalie and Kaitlyn are both age 27. They both live in Warren, Ohio. Beginning at age 27, Natalie invests $2,000 per year for ten years and then never sets aside another penny. Kaitlyn waits ten years and then invests $2,000 per year for the next 30 years. Assuming they both earn 7 percent, how much will each twin have at age 67.arrow_forwardTwo friends, Alysha and Betty, are planning for their retirement. Both are 20 years old and plan on retiring in 40 years with $1,000,000 each. Betty plans on making annual deposits beginning in one year (total of 40 deposits) while Alysha plans on waiting and then depositing twice as much as Betty deposits. If both can earn 4.20 percent per year, how long can Alysha wait before she has to start making her deposits? (Round answer to 2 decimal places, e.g. 125. Do not round your intermediate calculations.) Alysha can wait for yearsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education