FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Midshipmen Company borrows $16,500 from Falcon Company on July 1, 2021. Midshipmen repays the amount borrowed and pays interest of 12% (1%/month) on June 30, 2022.

Required:

-

1.&2. Record the necessary entries in the

Journal Entry Worksheet below. -

3. Calculate the 2021 year-end adjusted balances of Interest Payable and Interest Expense (assuming the balance of Interest Payable at the beginning of the year is $0).

Transcribed Image Text:Journal entry worksheet

1

Record the borrowing for Midshipmen on July 1, 2021.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

July 01, 2021

Record entry

Clear entry

View general journal

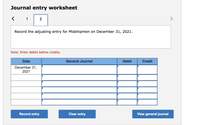

Transcribed Image Text:Journal entry worksheet

1

2

>

Record the adjusting entry for Midshipmen on December 31, 2021.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

December 31,

2021

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Brooks Inc. issued a $220,000, six-month, 6% note to purchase equipment on August 1, 2022. Brooks Inc's fiscal year end is September 30. The journal entry to record unpaid, accrued interest as of September 30, 2022 is: Interest expense 6,600 Interest payable 6,600 Interest expense 13,200 Interest payable 13,200 Interest expense 2,200 Interest payable 2,200arrow_forwardOn October 1, 2019, Muscat Company borrowed OMR 8,000 cash by signing a note payable due in one year at 8% interest. Interest is due when the principal is paid. If financial statements are to be prepared on December 31, the company should make the following adjusting entry: Select one: O a. Interest Expense 160 Interest Payable 160 O b. Interest Expense . 8,000 Interest Payable 8,000 O c. Interest Expense. .640 Interest Payable 640 O d. None of the answers are correct O e. Cash 8,000 Notes Payable 8,000arrow_forwardRequired Information [The following Information applies to the questions displayed below.] Agrico Incorporated accepted a 10-month, 11% (annual rate), $5,650 note from one of its customers on July 15, 2022; Interest is payable with the principal at maturity. a-2. Prepare the Journal entry to record the Interest earned by Agrico during its year ended December 31, 2022. Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Do not round your Intermediate calculation. Round your answers to 2 decimal places. View transaction list View journal entry worksheet No A Event 1 Accumulated depreciation General Journal Debit Creditarrow_forward

- Sunland Company borrowed $760,000 on December 31, 2019, by issuing an $760,000, 9% mortgage note payable. The terms call for annual installment payments of $118,423 on December 31. (a) Your answer is correct. Prepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to 0 decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Dec. 31, 2019 ec. 31, 2020 Account Titles and Explanation Cash Mortgage Payable Interest Expense Mortgage Payable Cash Debit 760,000 68400 50023 Credit 760,000 118423arrow_forwardMidshipmen Company borrows $18,000 from Falcon Company on July 1, 2024. Midshipmen repays the amount borrowed and pays interest of 12% (1%/month) on June 30, 2025. Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below for Midshipmen Company. 3. Calculate the 2024 year-end adjusted balances of Interest Payable and Interest Expense (assuming the balance of Interest Payable at the beginning of the year is $0).arrow_forwardSs.236.arrow_forward

- On April 1, 2019, Flamengo Co. signed a one-year, 8% interest-bearing note payable for $50,000. Assuming that Flamengo Co. maintains its books on a calendar year basis, how much interest expense should be reported in the 2020 income statement? a.$1,000. B.$2,000. C.$4,000. D.$3,000. Which of the alternatives results from the accrual of interest: A.Increase in liabilities and decrease in stockholders' equity. B.Increase in assets and stockholders' equity. C.Increase in assets and liabilities. D.Increase in liabilities and increase in stockholders' equity. Unfortunately, Flamengo Co. is involved in a lawsuit. When would the lawsuit be recorded as a liability on the balance sheet? A.When the loss is probable and the amount can be reasonably estimated. B.When the loss probability is reasonably possible and the amount can be reasonably estimated. C.When the loss is probable regardless of whether the loss can be reasonably estimated. D.When the loss…arrow_forward4. Determine the ending balance of AccountsReceivable as of December 31, 2019. 5. What is the net realizable value of thereceivables at the end of 2019? 6. The company has a notes receivable ofRp24,000 at January 15, 2019 for 3 months at10% interest rate. Prepare journal entry as ofApril 15, 2019, on its due date.arrow_forwardPART - E Toner Limited (“Toner") borrows $180,000 on 1 July 2020 from Lighthouse Bank and signs a $180,000, 5%, 1-year promissory note. Assuming yearly accounting periods and a financial year end balance date of 31 December. Required: (i) Prepare the general journal entries to record the issuance of the promissory note. (ii) Prepare the general journal entries to record the adjusting journal entries as at 31 December 2020. (iii) Prepare the general journal entries to record the repayment on 1 July of 2021.arrow_forward

- E4-29 Mattson Loan Company completed these transactions: 2019 Apr. Dec. 2020 Apr. 1 Loaned $20,000 to Charlene Baker on a one-year, 5% note. 31 Accrued interest revenue on the Baker note. 1 Collected the maturity value of the note from Baker (principal plus interest). Show what Mattson would report for these transactions on its 2019 and 2020 balance sheets and income statements. Mattson's accounting year ends on December 31.arrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forwardOn November 1, 2021, Aviation Training Corp. borrows $44,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 6% note payable. Interest is payable at maturity. Aviation’s year-end is December 31. Required: 1.-3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Record the adjusting entry for interest. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education