Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

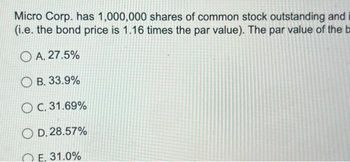

Micro Corp. has 1,000,000 shares of common stock outstanding and i (i.e. the bond price is 1.16 times the par value). The par value of the b

A. 27.5%

B. 33.9%

C. 31.69%

D. 28.57% E. 31.0%

Transcribed Image Text:Micro Corp. has 1,000,000 shares of common stock outstanding and

(i.e. the bond price is 1.16 times the par value). The par value of the b

OA. 27.5%

B. 33.9%

OC. 31.69%

OD. 28.57%

E. 31.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Give typing answer with explanation and conclusionarrow_forwardA firm has 750 bonds outstanding that are selling for $989 each, 2,500 shares of preferred stock with a market price of $47 per share, and 30,000 shares of common stock valued at $56 per share. What weight should be assigned to the common stock when computing the firm's weighted average cost of capital? a. 54.00% b. 55.45% c. 66.16% d. 62.08% e. 47.11%arrow_forwardFormat A & B Dinklage Corp. has 8 million shares of common stock outstanding. The current share price is $60, and the book value per share is $7. The company also has two bond issues outstanding. The first bond issue has a face value of $85 million, a xxx coupon, and sells for 97 percent of par. The second issue has a face value of $50 million, an 8 percent coupon, and sells for 108 percent of par. The first issue matures in 21 years, the second in 6 years. Suppose the most recent dividend was $3.90 and the dividend growth rate is 6 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 35 percent, What is the company's WACC?arrow_forward

- Bill's Boards has 6.3 million shares of common stock outstanding, 5.3 million shares of preferred stock outstanding, and 33.00 thousand bonds. If the common shares are selling for $29.40 per share, the preferred share are selling for $18.30 per share, and the bonds are selling for 95.87 percent of par, what would be the weight used for common stock in the computation of Bill's WACC? 33.33% 66.67% 54.16% 59.02%arrow_forwardA 16. Subject:- financearrow_forwardCMS Corporation's balance sheet as of today is as follows: Long-term debt (bonds, at par) Preferred stock Common stock ($10 par) Retained earnings Total debt and equity $10,000,000 2.000.000 10,000,000 4.000.000 $26.000,000 The bonds have a 6.6% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 12%, so the bonds now sell below par. What is the current market value of the firm's debt? Select the correct answer. Oa. $6,900,480 Ob.$6,901,361 Oc$6,899,600 d. $6,903,121 Oe. $6,902,241arrow_forward

- Report inc as a shipping company with securities listed on the American stock exchange. The company has the following capital structure : Equity Common shares ($1 per share nominal value) Reserves $m $m 40 85. 125 Debt 5.5% unsecured bond ($100 per bond nominal value 55 20 year secured bank loan. 25 5%preference shares ($1 per share nominal value). 30 Total equity and debt 110 235 The common share have a beta of…arrow_forward2. Book Co. has 1.5 million shares of common equity with a par (book) value of $1.15, retained earnings of $29.9 million, and its shares have a market value of $50.88 per share. It also has debt with a par value of $18.2 million that is trading at 102% of par. a. What is the market value of its equity? b. What is the market value of its debt? c. What weights should it use in computing its WACC? **round to two decimal places**arrow_forwardAssume JUP has debt with a book value of $22 million, trading at 120% of par value. The firm has book equity of $25 million, and 2 million shares trading at $18 per share. What weights should JUP use in calculating its WACC? ..... A. 33.85% for debt, 66.15% for equity B. 29.62% for debt, 70.38% for equity C. 42.31% for debt, 57.69% for equity D. 38.08% for debt, 61.92% for equityarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education