FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

a2

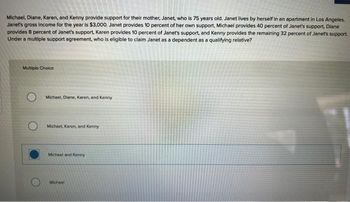

Transcribed Image Text:Michael, Diane, Karen, and Kenny provide support for their mother, Janet, who is 75 years old. Janet lives by herself in an apartment in Los Angeles.

Janet's gross income for the year is $3,000. Janet provides 10 percent of her own support, Michael provides 40 percent of Janet's support, Diane

provides 8 percent of Janet's support, Karen provides 10 percent of Janet's support, and Kenny provides the remaining 32 percent of Janet's support.

Under a multiple support agreement, who is eligible to claim Janet as a dependent as a qualifying relative?

Multiple Choice

Michael, Diane, Karen, and Kenny

Michael, Karen, and Kenny

Michael and Kenny

Michael

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- The following information pertains to Sage Hill Solar Panels, Inc. Sold $144,000 of solar panels to Oriole Company with terms 2/15, n/30. Sage Hill uses the gross method to record cash discounts. Sage Hill estimates allowances of $1,500 will be honored on this sale. July 1 Sold $88,000 of solar panels to Cheyenne Corp. with terms of 3/10, n/60. Sage Hill expects no allowances related to 12 this sale. 18 Cheyenne Corp. paid Sage Hill for its July 12 purchase. Oriole calls to indicate that the panels purchased on July 1 work well, but the color is not quite right. Sage Hill grants a credit of $2,000 as compensation. 20 29 Oriole Company paid Sage Hill for its July 1 purchase. 31 Sage Hill expects allowances of $4,380 to be grated in the future related to solar panel sales in July. Prepare the necessary journal entries for Sage Hill. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the…arrow_forwardPlease answer G part with explanationarrow_forwardII- Chapter 4 Saved Excerpts from Hulkster Company's December 31, 2021 and 2020, financial statements are presented below: 2021 2020 ACcounts receivable Merchandise inventory Net sales Cost of goods sold $78,000 47,000 $55,000 73,000 300, 000 127, 000 305,900 152, 000 424,000 244,000 Total assets 463,000 Total shareholders' equity 278,000 61,000 Net income 47,000 Hulkster's 2021 receivables turnover is: (Round your answer to 2 decimal places.) Multiple Choice 1.95. 11 of 15 Next > < Prevarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education