EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

kindly help me with this General accounting question

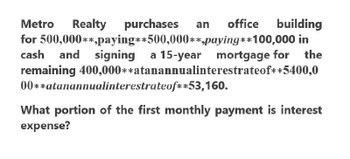

Transcribed Image Text:Metro Realty purchases

an office building

for 500,000**,paying**500,000**,paying**100,000 in

and signing a 15-year mortgage for the

400,000**atanannualinterestrateof**5400,0

cash

remaining

00**atanannualinterestrateof**53,160.

What portion of the first monthly payment is interest

expense?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 18 .Use the following amortization chart: Selling price of home Down payment Principal (loan) Rate of interest Years Payment per $1,000 Monthly mortgage payment $ 90,000 $ 5,000 $ 85,000 5 1/2% 30 $ 5.67789 $ 482.62 What is the total cost of interest? Note: Do not round intermediate calculations. Round your answer to the nearest cent. Total cost of interest:???arrow_forward1 Find the total monthly payment, including taxes and insurance, for the following loan. Annual Annual Amount of Loan Term of Loan Taxes Insurance Interest Rate 1 6-% $149,500 10 years $2830 $655 Click the icon to view the real estate amortization table. Complete the table below. Amount of Loan $149,500 0 Interest Rate 1 6-% 2 Term of Loan W Annual Taxes $2830 F Monthly Payment Annual Insurance $655 10 years (Simplify your answer. Round to the nearest cent as needed.) Monthly Payment $arrow_forwardThe following loan is a simple interest amortized loan with monthly payments. $155,000, 9- 9-%, 30 years 2 (a) Find the monthly payment. (Give your answer to the nearest cent.) Payment $ (b) Find the total.interest for the given simple interest amortized loan. (Give your answer to the nearest cent.) Total interest | Enter a number.arrow_forward

- Help pleasearrow_forwardPlease helparrow_forwardComplete the following amortization chart by using Table 15.1. Note: Round your "Payment per $1,000" answer to 5 decimal places and other answers to the nearest cent. Selling price of home: $198,000 Down payment: $60,000 Principal (loan): 138,000 Rate of interest: 6.5% Years: 25 Payment per $1,000: ??? Monthly mortgage payment:???? TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) Rate Interest Only 10 Year 15 Year 20 Year 25 Year 30 Year 40 Year 2.000 0.16667 9.20135 6.43509 5.05883 4.23854 3.69619 3.02826 2.125 0.17708 9.25743 6.49281 5.11825 4.29966 3.75902 3.09444 2.250 0.18750 9.31374 6.55085 5.17808 4.36131 3.82246 3.16142 2.375 0.19792 9.37026 6.60921 5.23834 4.42348 3.88653 3.22921 2.500 0.20833 9.42699 6.66789 5.29903 4.48617 3.95121 3.29778 2.625 0.21875 9.48394 6.72689 5.36014 4.54938 4.01651 3.36714 2.750 0.22917 9.54110 6.78622 5.42166 4.61311 4.08241 3.43728 2.875 0.23958 9.59848 6.84586 5.48361 4.67735 4.14892 3.50818 3.000…arrow_forward

- JG Asset Services is recommending that you invest $1,050 in a 5-year certificate of deposit (CD) that pays 3.5% interest, compounded annually. How much will you have when the CD matures? a. $1,247.07 b. $1,274.67 c. $1,283.87 d. $1,265.47 e. $1,256.27arrow_forwardYou obtain a $265,000, 15-year fixed-rate mortgage. The annual interest rate is 6.25 percent. In addition to the principal and interest paid, you must pay $275 a month into an escrow account for insurance and taxes. What is the total monthly payment (to the nearest dollar)? a. $2,272 b. $1,632 c. $2,547 d. $1,907 e. $2,311arrow_forwardHow much will you pay on a 25 year, $400,000 mortgage if you make monthly payment at the beginning of month? Interest is 3.5% compounded annually. O a. $1,968 O b. $1,973 OC. $1,979 O d. $1,997 O e. $1,991arrow_forward

- Investigate the effect of the term on simple interest amortized auto loans by finding the monthly payment and the total interest for a loan of $13,000 at 8 and 7/8% interest if the term is the following. (Round all answers to the nearest cent.) (a) 3 years. Payment $ Total interest $ (b) 4 years. Payment $ Total interest $ 4615 (c) 5 years. Payment Total interest Enter a number. XX XX XXarrow_forward6. Assume an elderly couple owns a $140,000 home that is free and clear of mortgage debt. A reverse annuity mortgage (RAM) lender has agreed to a $100,000 RAM. The loan term is 12 years, the contract is 9.25%, and payments will be made at the end of each month. a. What is the monthly payment on this RAM? b. Fill in the following partial loan amortization table: Month 1 2 3 4 5 Beginning Balance Monthly Payment Interest Ending Balance C. What will be the loan balance at the end of the 12-year term? d. What portion of the loan balance at the end of year 12 represents principal? What portion represents interest?arrow_forwardThe following loan is a simple interest amortized loan with monthly payments. $7000, 7%, 4 years (a) Find the monthly payment. (Give your answer to the nearest cent.) Payment $189.58 (b) Find the total interest for the given simple interest amortized loan. (Give your answer to the nearest cent.) Total interest $ 2100 Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT