FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

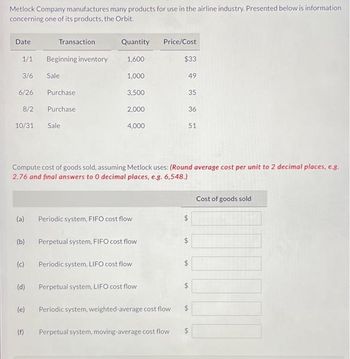

Transcribed Image Text:Metlock Company manufactures many products for use in the airline industry. Presented below is information

concerning one of its products, the Orbit.

Date

1/1

3/6

6/26

8/2

10/31 Sale

Transaction

(a)

Beginning inventory

Sale

Purchase

Purchase

Quantity

1,600

1,000

(f)

3,500

2,000

4,000

Periodic system, FIFO cost flow

(b) Perpetual system, FIFO cost flow

Compute cost of goods sold, assuming Metlock uses: (Round average cost per unit to 2 decimal places, e.g.

2.76 and final answers to 0 decimal places, e.g. 6,548.)

(c) Periodic system, LIFO cost flow

(d) Perpetual system, LIFO cost flow

Price/Cost

(e) Periodic system, weighted-average cost flow

$33

49

Perpetual system, moving-average cost flow

35

36

51

VA

$

EA

$

$

Cost of goods sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forwardAssessment #1 _Cost Classification Inventory valuation Question 1 Part 1 Gopaul Electronics designs and manufactures specialized switches for the telecommunications industry. The accounting records of the business reflect the following data at December 31, 2023: Inventory 1/1/2023 31/12/2023 Raw Materials $260,000 $230,000 Work In Progress $333,800 $218,800 Finished Goods $1,075,200 $615,000 Other information: Sales Revenue Factory supplies Direct Factory Labor Special Design Cost Raw Plant janitorial service Depreciation: Plant & Equipment Purchased Plant Utilities Plant supervisor's salary Property Taxes ¹ R & D for Graphic Designs Office Utilities Insurance on Plant & Equipment Delivery truck driver's wages Depreciation: Delivery truck Administrative Wages & Salaries Sales Commission $5,765,000 45,000 735,000 15,000 540,000 52,000 165,000 385,000 480,000 300,000 70,500 165,000 120,000 125,000 52,000 850,150 97,650 ¹ The property taxes should be shared: 60% manufacturing & 40%…arrow_forward

- 24. answer of part a is $28.9545arrow_forwardAs production takes place, all manufacturing costs are added to the: a. Finished-Goods Inventory account. O b. Manufacturing-Overhead Inventory account. O C. Production Labor account. O d. Work-in-Process Inventory account. е. Cost-of-Goods-Sold account. US PAGE NEXT PAGE MAR 18 tv MacBook Air DII F5 F6 F7 F8arrow_forwardr田 1/1 gageNOWv2 | Online teachirs X om/ilrn/takeAssignment/takeAssignmentMan.uo?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook What are the total costs to account for if a company's beginning inventory had $231,430 in materials, $186,360 in conversion costs, and added direct material costs ($4,231,378), direct labor ($2,313,394), and manufacturing overhead ($1,156,704)? Total costs $arrow_forward

- Please do not give solution in image format thankuarrow_forwardEXERCISE - INVENTORIES PROBLEM 1 CRITICS Company is a multi-product firm. Presented below is information concerning one of its products, the CarMac. TRANSACTION QUANTITY DATE 01-Jan Beginning Inventory 04-Feb Purchase 20-Feb Sale 02-Apr Purchase 04-Nov Sale 1000 2000 2500 3000 2200 PRICE/COST 12 18 30 23 33 Determine the amount of cost of goods sold and ending inventory if the company is using specific identification. (Assume that in the sale on 2/20, 1,000 units came from the beginning inventory and the rest from the 2/4 purchase. For the sale on 11/4, everything came from the 4/2 purchase.) PROBLEM 2 (Philippine CPALE adapted) On May 6, 2016, a flash flood caused damage to the merchandise stored in the warehouse of Tiwala Lang Company. You were asked to submit an estimate of the merchandise destroyed in the warehouse. The following data were established: 2015 net sales, P8,000,000 matched against cost of P5,600,000. Merchandise inventory, January 1, 2016 was P2,000,000, 90% of which…arrow_forward4arrow_forward

- rmn.3 answer must be in proper format or i will give down votearrow_forwardezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%25... A ☆ mework i Exercise 6-4 Alternative cost flow assumptions-perpetual inventory system LO2 Sport Box sells a wide variety of sporting equipment. The following is information on the purchases and sales of their top selling hockey stick. The hockey stick sells for $130. Description Mar. 1 Beginning Inventory JESTE Mar. 3 Purchase Mar. 6 Purchase Mar. 17 Sale Mar. 23 Purchase Mar. 31 Sale Units 1. FIFO 2. Moving weighted average 24 69 119 64 68 158 Unit Cost Cost of Goods Sold $ 49 $ 54 $59 $59 Required: Calculate the cost of goods sold and ending inventory under the perpetual inventory system using the following methods. (Do not round your "Unit Cost" answers. Round all other intermediate and final answers to nearest whole dollar.) Saved Ending Inventory Helparrow_forwardRa Subject: acountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education