FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

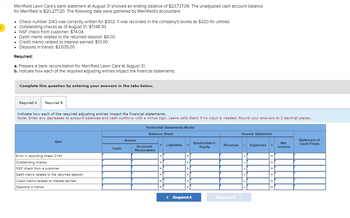

Transcribed Image Text:### Bank Reconciliation and Financial Impact Analysis for Merrifield Lawn Care

#### Overview

Merrifield Lawn Care’s bank statement at August 31 showed an ending balance of $23,737.09. The unadjusted cash account balance for Merrifield is $20,277.20. The following data were gathered by Merrifield’s accountant:

- **Check number 2143** was correctly written for $302. It was recorded in the company's books as $320 for utilities.

- **Outstanding checks** as of August 31: $7,148.93

- **NSF check from a customer**: $74.04

- **Debit memo related to the returned deposit**: $8.00

- **Credit memo related to interest earned**: $10.00

- **Deposits in transit**: $3,635.00

#### Required Tasks

**a.** Prepare a bank reconciliation for Merrifield Lawn Care at August 31.

**b.** Indicate how each of the required adjusting entries impacts the financial statements.

### Horizontal Statements Model

This model helps in understanding how the adjustments affect the Balance Sheet, Income Statement, and Statement of Cash Flows. Below is a description of the components involved:

- **Balance Sheet Components:**

- **Assets**: Includes Cash and Accounts Receivables

- **Liabilities and Stockholders’ Equity**

- **Income Statement Components:**

- **Revenue**

- **Expenses**

- **Net Income**

- **Statement of Cash Flows**

In the table, you would enter the effects of each item listed below. Note that any decrease in account balances and cash outflows should be marked with a minus sign.

#### Adjusting Entries Description:

- **Error in recording check 2143**

- **Outstanding checks**

- **NSF check from a customer**

- **Debit memo related to the returned deposit**

- **Credit memo related to interest earned**

- **Deposits in transit**

The changes should be noted under each category in the corresponding columns, ensuring that the necessary adjustments are clear and appropriately recorded. Round numbers to two decimal places where necessary.

This tool provides a structured approach to aligning book balances with bank statements, ensuring that discrepancies are resolved and financial statements accurately reflect the company's financial position.

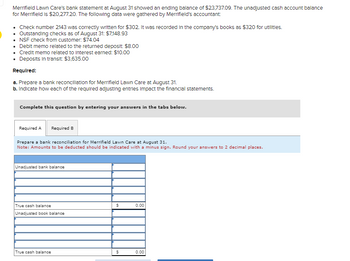

Transcribed Image Text:**Educational Resource: Bank Reconciliation for Merrifield Lawn Care**

Merrifield Lawn Care's bank statement as of August 31 showed an ending balance of $23,737.09. The unadjusted cash account balance for Merrifield is $20,277.20. The following data were gathered by Merrifield's accountant:

- Check number 2143 was correctly written for $302. It was recorded in the company's books as $320 for utilities.

- Outstanding checks as of August 31: $7,148.93

- NSF check from customer: $74.04

- Debit memo related to the returned deposit: $8.00

- Credit memo related to interest earned: $10.00

- Deposits in transit: $3,635.00

**Required:**

a. Prepare a bank reconciliation for Merrifield Lawn Care at August 31.

b. Indicate how each of the required adjusting entries impacts the financial statements.

---

**Bank Reconciliation Layout:**

1. **Prepare a bank reconciliation for Merrifield Lawn Care at August 31.**

- Note: Amounts to be deducted should be indicated with a minus sign. Round your answers to 2 decimal places.

- **Unadjusted Bank Balance:**

*This is the balance as stated on the bank statement.*

- **Adjustments to Bank Balance:**

- **Outstanding Checks:** Subtract any checks that have not yet cleared.

- **Deposits in Transit:** Add deposits made but not yet recorded by the bank.

- **True Cash Balance:**

*Calculate by adjusting the unadjusted bank balance based on the above factors.*

- **Unadjusted Book Balance:**

*This is the balance as per the company's records.*

- **Adjustments to Book Balance:**

- **NSF Checks, Debit/Credit Memos:** Adjust for bank fees, corrections, or interest not yet recorded in the books.

- **Errors in Recording:** Correct errors found in the company’s books.

- **True Cash Balance:**

*Reconcile both balances to find the accurate cash balance.*

This example highlights the importance of thorough financial reconciliation to ensure the accuracy of financial records. Understanding factors affecting cash flow and how they align with bank records is crucial for effective financial management.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The cash account for Coastal Bike Co. at October 1, 20Y9, indicated a balance of $5,140. During October, the total cash deposited was $39,175, and checks written totaled $40,520. The bank statement indicated a balance of $8,980 on October 31, 20Y9. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: a. Checks outstanding totaled $3,260. b. A deposit of $2,450 representing receipts of October 31 had been made too late to appear on the bank statement. c. The bank had collected for Coastal Bike Co. $5,300 on a note left for collection. The face of the note was $5,000. d. A check for $460 returned with the statement had been incorrectly charged by the bank as $640. e. A check for $430 returned with the statement had been recorded by Coastal Bike Co. as $340. The check was for the payment of an obligation to Rack Pro Co. on account. f. Bank service charges for October amounted to $50. g. A check for $605…arrow_forwardThe following data were accumulated for use in reconciling the bank account for Mathers Co. For July: 1. Cash balance according to the company's record at July 31, $25,470. 2. Cash balance according to the bank statement at July 31, $26,890. 3. Checks outstanding, $5,170. 4. Deposit in transit, not record it by bank, $4,150. 5.a check for a $270 and payment of an account was erroneously recorded in the check register at $720. 6. Bank debit memo for service charges, $50. Journalize the entries that should be made up by the company, part (a )error and part ( b) service charge A. July 31 _______ _______ B. July 31 ______ _____arrow_forwardThe following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 20Y6: Cash balance according to the company’s records at August 31, $42,920. Cash balance according to the bank statement at August 31, $56,300. Checks outstanding, $25,390. Deposit in transit not recorded by bank, $13,325. A check for $150 in payment of an account was erroneously recorded in the check register as $1,500. Bank debit memo for service charges, $35. Journalize the entries that should be made by the company that (a) increase cash and (b) decrease cash. If an amount box does not require an entry, leave it blank.arrow_forward

- On December 10, you receive your bank statement showing a balance of $2,981.97. Your checkbook shows a balance of $2,782.86. Outstanding checks are $387.86 and $175.56. The account earned $122.85. Deposits in transit amount to $479.16, and there is a service charge of $8.00. Calculate the reconciled balance. O $199.11 $2,668.01 $2,897.71 O $4,024.55arrow_forwardThe cash account for Brentwood Bike Co. at May 1 indicated a balance of $12,830. During May, the total cash deposited was $64,190 and checks written totaled $59,600. The bank statement indicated a balance of $21,760 on May 31. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: Checks outstanding totaled $9,690. A deposit of $7,900, representing receipts of May 31, had been made too late to appear on the bank statement. The bank had collected for Brentwood Bike Co. $4,170 on a note left for collection. The face of the note was $3,850. A check for $490 returned with the statement had been incorrectly charged by the bank as $940. A check for $970 returned with the statement had been recorded by Brentwood Bike Co. as $790. The check was for the payment of an obligation to Adkins Co. on account. Bank service charges for May amounted to $30. A check for $960 from Jennings Co. was returned by the bank…arrow_forwardThe following data were accumulated for use in reconciling the bank account of Nakajima Co. for July: 1. Cash balance according to the company’s records at July 31, $49,910. 2. Cash balance according to the bank statement at July 31, $48,250. 3. Checks outstanding, $4,460. 4. Deposit in transit, not recorded by bank, $6,450. 5. A check for $590 issued in payment of an account was erroneously recorded in the check register as $950. 6. Bank debit memo for service charges, $30. Required: Journalize the entry or entries that should be made by the company. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. CHART OF ACCOUNTSNakajima Co.General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 131 Notes…arrow_forward

- give answer of this question pleasearrow_forwardUsing the following information: The bank statement balance is $3,093. The cash account balance is $3,305. Outstanding checks amounted to $767. Deposits in transit are $815. The bank service charge is $155. A check for $40 for supplies was recorded as $31 in the ledger. Prepare a bank reconciliation for Miller Co. for August 31. Miller Co.Bank ReconciliationAugust 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $- Select - - Select - Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $- Select - - Select - Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forwardCan you help with the image attachedarrow_forward

- The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $24,942 debit balance, but its July bank statement shows a $27,152 cash balance. b. Check Number 3031 for $1,450, Check Number 3065 for $501, and Check Number 3069 for $2,218 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accounting records as $1,260. d. The July bank statement shows the bank collected $8,000 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $12 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification…arrow_forwardThe cash account for Coastal Bike Co. at October 1, 20Y9, indicated a balance of $32,991. During October, the total cash deposited was $139,960, and checks written totaled $137,747. The bank statement indicated a balance of $43,370 on October 31, 20Y9. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: a. Checks outstanding totaled $6,476. b. A deposit of $1,779 representing receipts of October 31, had been made too late to appear on the bank statement. c. The bank had collected for Coastal Bike Co. $5,250 on a note left for collection. The face of the note was $5,000. d. A check for $580 returned with the statement had been incorrectly charged by the bank as $850. e. A check for $210 returned with the statement had been recorded by Coastal Bike Co. as $120. The check was for the payment of an obligation to Rack Pro Co. on account. f. Bank service charges for October amounted to $28. g. A check for…arrow_forwardThe beginning checkbook balance of Shamma Co. was $5,559.10. The bank statement showed a bank balance of $7,888.44. The bookkeeper of Shamma Co. noticed a $111.10 deposit in transit along with check numbers 90 and 97 for $499.88 and $1,256.45, respectively, as outstanding. The bank statement credited Shamma's account for $750.99 for a note collected. The bank statement revealed a check printing charge of $66.88. The reconciled balance is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education