FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

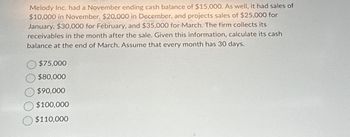

Transcribed Image Text:Melody Inc. had a November ending cash balance of $15,000. As well, it had sales of

$10,000 in November, $20,000 in December, and projects sales of $25,000 for

January, $30,000 for February, and $35,000 for March. The firm collects its

receivables in the month after the sale. Given this information, calculate its cash

balance at the end of March. Assume that every month has 30 days.

$75,000

$80,000

$90,000

$100,000

$110,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Halifax Shoes has 39% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $61,125 in June, $88,627 in July, and $70,376 in August? Round to the nearest penny, two decimal places.arrow_forwardFrom past experience, the company has learned that 20% of a month’s sales are collected in the month of sale, another 75% are collected in the month following sale, and the remaining 5% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $270,000, and March sales totaled $300,000. Required: 1. Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. 2. What is the accounts receivable balance on June 30th?arrow_forwardBaker Industries has a 45 day accounts receivable period. The estimated quarterly sales for this year, starting with the first quarter, are $1,200, $1,400, $1,900 and $3,200, respectively. How much does the firm expect to collect in the third quarter? Assume that a year has 360 days. A)$1,300 B)$1,650 C)$1,400arrow_forward

- Chatsworth Company Month Expected Sales July $40,000 August $50.000 September $30,000arrow_forwardHalifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $73,000 in June, $63,000 in July, and $95,000 in August?arrow_forwardNeon Inc.’s forecast sales for July is $72,000. It has $15,000 in accounts receivable at the end of June. 30% of its total sales are expected to be cash sales. Of the remaining 70%, 80% are expected to be collected in the month of the sale and the remaining 20% in the month following the sale. Determine the amount of accounts receivable at the end of July. Group of answer choices $79,200 $61,920 $10,080 $40,320arrow_forward

- Kent Corner Shoppe is a local convenience store with the following information: October sales were $250,000. Sales are projected to go up by 12% in November and another 30% in December and then return to the October level in January. 20% of sales are made in cash, while the remaining 80% are paid by credit or debit cards. The credit card companies and banks (debit card issuers) charge a 2% transaction fee and deposit the net amount (sales price less the transaction fee) in the store’s bank account daily. Kent Corner Shoppe’s gross profit is 25% of its sales revenue. For the next several months, the store wants to maintain an ending merchandise inventory equal to $15,000+15%$15,000+15% of the next month’s cost of goods sold. The September 30 inventory was $43,125. Expected monthly operating expenses include: Wages of store workers are $9,200 per month Utilities expense of $1,000 in November and $1,500 in December Property tax expense of $2,000 per month Property and liability…arrow_forwardMillen’s managers have made the following additional assumptions and estimates Estimated sales for July and August are $310,000 and $330,000, respectively. Each month’s sales are 20% cash sales and 80% credit sales. Each month’s credit sales are collected 30% in the month of sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July. Each month’s ending inventory must equal 20% of the cost of next month’s sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July. Monthly selling and administrative expenses are always $70,000. Each month $10,000 of this total amount is depreciation expense and the remaining $60,000 relates to expenses that are paid in the month they are incurred. The company does not plan to buy or sell any plant and equipment…arrow_forwardHalifax Shoes has 33% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $85,447 in June, $65,772 in July, and $85,928 in August? Round to the nearest penny, two decimal placesarrow_forward

- Valley's managers have made the following additional assumptions and estimates: Estimated sales for July and August are $345,000 and $315,000 respectively Each month's sales are 20% cash sales and 80% credit sales. Each month's credit sales are collected 30% in the month of the sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July Each month's ending inventory must equal 20% of the cost of the next month's sales. The Cost of Goods Sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July Monthly selling and administrative expenses are always $75,000. Each month $10,000 of this total amount is depreciation expense and the remaining $65,000 relates to expenses that are paid in the month they are incurred The company does not plan to buy or…arrow_forwardDavis and Davis have expected sales of $490, $465, $450, and $570 for the months of January through April, respectively. The accounts receivable period is 28 days. What is the accounts receivable balance at the end of March? Assume a year has 360 days. a. $450 b. $420 c. $440 d. $426arrow_forwardGreene Sisters has a DSO of 20 days. The company's average daily sales are $30,000. What is the level of its accounts receivable? Assume there are 365 days in a year. Round your answer to the nearest dollar.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education