Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

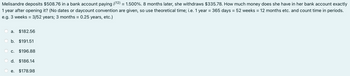

Transcribed Image Text:Melisandre deposits $508.76 in a bank account paying i(12) = 1.500%. 8 months later, she withdraws $335.78. How much money does she have in her bank account exactly

1 year after opening it? (No dates or daycount convention are given, so use theoretical time; i.e. 1 year = 365 days = 52 weeks = 12 months etc. and count time in periods.

e.g. 3 weeks = 3/52 years; 3 months = 0.25 years, etc.)

a. $182.56

b. $191.51

c. $196.88

d. $186.14

e. $178.98

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Bob wants to deposit $5000 into a bank account at the beginning of the next month and $200 per month into that same account at the end of that month and each subsequent month for the next 5 years. If the bank pays interest at the rate of 3% per year compounded monthly, how much will Bod have in his account at the end of 5 years? Assume that he makes no withdrawals during the 5 year period.arrow_forwardDr. Sisters has been secretly depositing $2,300 in her savings account every December starting in 2001. Her account earns 10 percent compounded annually. How much did she have in December 2015? (Assume a deposit is made in the last year) Make sure to carefully count the years. Use Appendix C. (Round "FV Factor" to 3 decimal places. Round the final answer to the nearest whole dollar.) Future value CIarrow_forwardFive years ago, you deposited $1,000 in a bank account. One year ago, you deposited $2,000 in the same bank account. Assuming no other deposits and no withdrawals, what will be in the account 7 years from now? Assume an interest rate of 4%. Use the $ symbol and round to the nearest dollar...no decimal places...use a comma.arrow_forward

- Morgana deposits £1000 into her bank account on the 1st of January every year with the first deposit being on 1st January 2016. The bank adds 3% interest to her deposit every 31st December. (a) Show that, after interest has been paid on 31st of December 2018, the balance in her account (assuming no withdrawals and no other deposits during this time) is 1000 × 1.033 + 1000 × 1.032 + 1000 × 1.03 (b) During which year (assuming that she continues in this fashion and her bank continues to pay 3%) will her balance exceed £50,000?arrow_forwardTen years ago, when Franco was still a college student, he deposited 10,000 in a bank. The bank's rate of interest on deposit is 2% compounded quarterly, what is the balance of Nigel's account today? No peso sign, with comma, no decimal point.arrow_forwardSuppose that before ATMs and credit cards, a person goes to the bank once at the beginning of each four-day period and withdraws from her savings account all the money she needs for four days. Assume that she spends $100 per day. Calculate the amount of money this person withdraws each time she goes to the bank.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education