FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1. What amount of profit on the sale should be recorded for the year ended December 31, 2021?

2. What amount of interest revenue should be recorded for the year ended December 31, 2021?

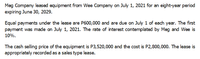

Transcribed Image Text:Meg Company leased equipment from Wee Company on July 1, 2021 for an eight-year period

expiring June 30, 2029.

Equal payments under the lease are P600,000 and are due on July 1 of each year. The first

payment was made on July 1, 2021. The rate of interest contemplated by Meg and Wee is

10%.

The cash selling price of the equipment is P3,520,000 and the cost is P2,800,000. The lease is

appropriately recorded as a sales type lease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the gross profit under each planarrow_forwardUnder the revenue recognition principle, when is revenue recorded?arrow_forwardExercise 13-3 (Algo) Computing and analyzing trend percents LO P1 Sales Cost of goods sold. Accounts receivable 2021 $ 424,322 214,661 20,580 Numerator: 2020 $ 279,159 141, 180 16,303 2019 $ 218,948 112,924 15,042 Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. Trend Percent for Net Sales: 2021: 2020: 2019: 2018: 2017: Is the trend percent for Net Sales favorable or unfavorable? 2018 $ 153,648 78,724 8,973 Denominator: 2017 $ 116,400 58,200 7,973 11 Trend percent % % ge % % %arrow_forward

- 15. Related to insurance, what is a deductible and how does it work?arrow_forwarddescribe general principles of revenue recognition and accrual accounting, specifi c revenue recognition applications (including accounting for long-term contracts, installment sales, barter transactions, gross and net reporting of revenue), and implications of revenue recognition principles for fi nancial analysisarrow_forwardWhich accounting principle guides the application of the installment method for reporting income? a ) Matching principle b) Revenue recognition principle c) Consistency principle d) Materiality principlearrow_forward

- What is the formula for calculating sales tax? A. Amount of Purchase x Sales Tax Rate = Sales Tax B. Cost of Goods Sold x Sales Tax Rate = Sales Tax C. Amount of Revenue x Sales Tax Rate = Sales Taxarrow_forwardPlease do not give solution in image format thankuarrow_forwardIf a company understates its inventory, what are the effects on cost of goods sold and net income for the current year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education