Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need answer

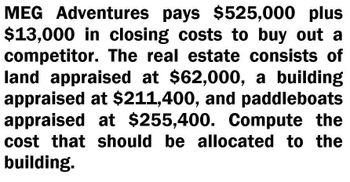

Transcribed Image Text:MEG Adventures pays $525,000 plus

$13,000 in closing costs to buy out a

competitor. The real estate consists of

land appraised at $62,000, a building

appraised at $211,400, and paddleboats

appraised at $255,400. Compute the

cost that should be allocated to the

building.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Riverboat Adventures pays $310,000 plus $15,000 in closing costs to purchase real estate. The real estate consists of land appraised at $35,000, a building appraised at $105,000, and land improvements appraised at $210,000. Compute the cost that should be allocated to the building. Multiple Choice $97,500. $105,000. $89,178. $140,000. $93,000.arrow_forwardUnilever acquires land for $86,000 cash. Additional costs are as follows: removal of shed $300, broker commission $1,530, paving of parking lot $10,000, gardening $1,500, closing costs $560, and a salvage value of lumber of shed $120. Unilever will record the acquisition cost of the land as:arrow_forwardKate Company submitted an offer to purchase a plot of land that was listed at $120,000. Kate's offer was 10% below the list price and was accepted. Kate paid $10,000 to remove an old structure in order to make the land ready for use as a building site. Title and attorney fees amounted to $3,000. Annual property taxes amounted to $5,000 per year. Based on this information, the cost of the land as shown on the balance sheet equals answer must be correctarrow_forward

- Greer Manufacturing purchases property that includes land, buildings and equipment for $5,000,000. In addition, the company pays $180,000 in legal fees, $214,000 in commissions, and $119,000 in appraisal fees. The land is estimated at 27%, the buildings are at 43%, and the equipment at 30% of the property value. Required: a. Determine the total acquisition cost of this "basket purchase". b. Allocate the total acquisition cost to the individual assets acquired. c. Prepare the journal entry to record the purchase assuming that the company paid 45% of the amounts using cash and signed a note (due in five years) for the remainder. Complete this question by entering your answers in the tabs below. Required A Required B Required C Determine the total acquisition cost of this "basket purchase". Acquisition cost toevind A Next >arrow_forwardFresh Veggies, Inc. (FVI), purchases land and a warehouse for $490,000. In addition to the purchase price, FVI makes the following expenditures related to the acquisition: broker’s commission, $29,000; title insurance, $1,900; and miscellaneous closing costs, $6,000. The warehouse is immediately demolished at a cost of $29,000 in anticipation of building a new warehouse. Determine the amount FVI should record as the cost of the land.arrow_forwardFresh Veggies, Incorporated (FVI), purchases land and a warehouse for $490,000. In addition to the purchase price, FVI makes the following expenditures related to the acquisition: broker's commission, $29,000; title insurance, $1,900; and miscellaneous closing costs, $6,000. The warehouse is immediately demolished at a cost of $29,000 in anticipation of building a new warehouse. Determine the cost of the land and record the purchase (assuming cash was paid for all expenditures). (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the purchase of the land. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general Journalarrow_forward

- Rodriguez Company pays $352, 755 for real estate with land, land improvements, and a building. Land is appraised at $207,000; land improvements are appraised at $69,000; and the building is appraised at $184,000. Allocate the total cost among the three assets. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Allocate the total cost among the three assets. Note: Round your "Apportioned Cost" answers to 2 decimal places. \table[[ \table[[Appraised], [Value]],\table[[Percent of Total], [Appraised], [Value]],\table[[x Total Cost of], [Acquisition]],\table[[Apportioned], [Cost]]]. [Land,...]. [Land improvements...]. [Building....]]arrow_forwardUtica Corporation paid 360,000 to purchase land and a building. An appraisal showed that the land is worth 100,000 and the building is worth 300,000. What cost should Utica assign to the land and to the building, respectively?arrow_forwardPlease help mearrow_forward

- A local delivery company has purchased adelivery truck for $15,000. The truck will be depreciated under MACRS as five-year property. Thetruck’s market value (salvage value) is expectedto decrease by $2,500 per year. It is expected thatthe purchase of the truck will increase its revenueby $10,000 annually. The O&M costs are expectedto be $3,000 per year. The firm is in the 40% taxbracket, and its MARR is 15%. If the company plansto keep the truck for only two years, what would bethe equivalent present worth?arrow_forwardZinski Co. paid $150,000 for a purchase that included land, building, and office furniture. An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Land, $20,000, Building, $150,000, and Office furniture, $30,000. Based on this information the cost that would be allocated to the land is_____.arrow_forwardPointer Company buys a piece of property in north Toronto that has the following costs associated with the purchase: Invoice price for land and building = $303,500 Legal fees associated with the purchase = $12,000 Unpaid property taxes assumed by Pointer as part of the purchase agreement = $28,000 Cost of having property professionally appraised = $10,350 The appraisal report shows the building has an appraised market value of $400,000 and the land has an appraised value of $100,000. Required 1: What amount should be capitalized as the value of the land on Pointer's book? $ Required 2: What amount should be capitalized as the value of the building on Pointer's book? $ Required 3: If the property acquired will be depreciated in 40 years with no residual value (assume the straight-line depreciation is used), what is the depreciation expense for the first full year of use? $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT