FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

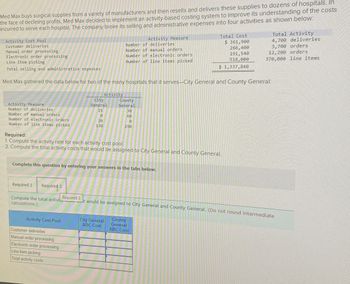

Transcribed Image Text:Med Max buys surgical supplies from a variety of manufacturers and then resells and delivers these supplies to dozens of hospitals. In

the face of declining profits, Med Max decided to implement an activity-based costing system to improve its understanding of the costs

incurred to serve each hospital. The company broke its selling and administrative expenses into four activities as shown below:

Activity Cost Pool

Customer deliveries

Manual order processing

Electronic order processing

Line item picking

Total selling and administrative expenses

Activity Measure

Number of deliveries

Number of manual orders

Number of electronic orders

Number of line items picked

Total Activity

4,700 deliveries

3,700 orders

Total Cost

$ 361,900

266,400

191,540

518,000

370,000 line items

$ 1,337,840

12,200 orders

Med Max gathered the data below for two of the many hospitals that it serves-City General and County General:

Activity Measure

Number of deliveries

Number of manual orders

Number of electronic orders

Number of line items picked

Required:

Activity

City

General

County

General

15

30

0

60

20

130

0

290

1. Compute the activity rate for each activity cost pool.

2. Compute the total activity costs that would be assigned to City General and County General.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 2

Compute the total activity

calculations.)

It would be assigned to City General and County General. (Do not round intermediate

Activity Cost Pool

City General

ABC Cost

County

General

ABC Cost

Customer deliveries

Manual order processing

Electronic order processing

Line item picking

Total activity costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- dont provide handwriting solution ...arrow_forwardKyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2022. During that time, he earned $60,000 of self-employment income. On April 1, 2022, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $202,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? Note: Round your intermediate calculations to the nearest whole dollar amount.arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $20 per direct labor-hour $ 184 per order $ 252 per custom design $ 424 per customer Management wants to calculate the profitability of a particular customer, Big Sky Outfitters, which ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider Standard Model Custom Design 14 3 2 3 29.50 $ 1,900 $ 456 3 33.00 $ 2,420 $ 576 The company's direct labor rate is $20 per hour. Required: Using the company's activity-based costing system,…arrow_forward

- Assume a service company has implemented an activity-based costing system with five activities as shown below: Activity Cost Pool (Activity Measure) Total Cost Total Activity Customer deliveries (Number of deliveries) $ 400,000 8,000 deliveries Manual order processing (Number of manual orders) $ 280,000 5,000 manual orders Electronic order processing (Number of electronic orders) $ 150,000 15,000 electronic orders Line item picking (Number of line items picked) $ 450,000 375,000 line items Other organization-sustaining costs (None) $ 300,000 The company serves numerous customers, two of which include Hospital A and Hospital B. The activity demands pertaining to these two customers are as follows: Activity Measure Activity Hospital A Hospital B Number of deliveries 10 25 Number of manual orders 0 31 Number of electronic orders 15 0 Number of line items picked 120 250 How much cost would be assigned from the Manual Order Processing activity to…arrow_forwardLouis Clark, the new administrator for the surgical clinic, was trying to figure out how to allocate is indirect expenses. His staff were complaining that the current method of taking a percentage of revenues was unfair. He decided to try to allocate utilities expense based on square footage of each department, to allocate administration expense based on direct costs, and to allocate laboratory expense based on tests. Using the information in Exhibit 12.11 below, calculate the total indirect costs (utilities, administration, and laboratory) allocated to the Day-Op Suite; Cystoscopy; and Endoscopy. Exhibit 12-11 A B C Square Feet Dept. Costs Lab Tests Utilities $400,000 Administration 4,000 $700,000 Laboratory 2,000 $750,000 Day-Op suite…arrow_forwardPahros Company buys surgical supplies from a variety of manufacturers and the resells and delivers these supplies to hundreds of hospitals. Cleanwater sets its prices for all hospitals by marking up its cost of goods sold to those hospitals by 5%. For years the company believed that 5% mark-up covered its selling and administrative expenses and provided reasonable profit. However, in the face of declining profits, the company decided to implement activity-based costing system to help improve its understanding of customer profitability. The company broke its selling and administrative expenses into five activities as shown below: Activity Cost Pool Activity Driver Total Cost Total Activity Customer Deliveries Number of Deliveries $ 500,000 5,000 deliveries Manual order processing Number of manual orders $ 248,000 4,000 orders Electronic order processing Number of electronic orders $ 200,000 12,500 orders Line item picking Number of Line item picked $ 450,000 450,000 line…arrow_forward

- Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. Marley's ManufacturingIncome StatementMonth Ending August 31, 2018arrow_forwardDetermine the total costs that each operating segment would be accountable for if the step method is used to allocate support costs; assume support departments are ranked according to their original cost. (Round intermediate calculations to 4 decimal places, e.g. 15.2516 and final answers to 2 decimal places, e.g. 15.25.) Total costs $ Operating Segments Institutional Taythank and Media. 776887.5 Retail 468712.5arrow_forwardLucky Clothing creates and sells t-shirts that can be customized. The cost of sales order processing and shipping is calculated using activity-based costing at Lucky Clothing. The sales order processing activity has a $9 per sales order activity rate, and the shipping activity has a $18 per shipment activity rate. Lucky Clothing sold a total of 25,300 personalized t-shirts, including 4,000 orders and 1,300 shipping. The total activity cost is calculated through: Sales order activity costs = Number of orders * sales order activity rate = 4000*9 = $36,000Shipping Activity costs = Number of shipping * Shipping Activity rate= 1300*18 = $23400Total activity costs = Sales order activity costs + Shipping Activity costsWhile the per-unit sales order processing and shipping activity cost for customizable t-shirts is solved as follows:Per unit sales order processing costs = Sales order processing costs/ Number of t shirts = $36000 + $23400 = $59400 Per unit sales order processing costs = Sales…arrow_forward

- Purchasing department cost drivers, activity-based costing, simple regression analysis. Perfect Fit operates a chain of 10 retail department stores. Each department store makes its own purchasing decisions. Carl Hart, assistant to the president of Perfect Fit, is interested in better understanding the drivers of purchasing department costs. For many years, Perfect Fit has allocated purchasing department costs to products on the basis of the dollar value of merchandise purchased. A $100 item is allocated 10 times as many overhead costs associated with the purchasing department as a $10 item. Hart recently attended a seminar titled “Cost Drivers in the Retail Industry.” In a presentation at the seminar, Kaliko Fabrics, a leading competitor that has implemented activity-based costing, reported number of purchase orders and number of suppliers to be the two most important cost drivers of purchasing department costs. The dollar value of merchandise purchased in each purchase order was not…arrow_forwardNote that data typically changes for each new question, even when the same company or product name is used. Tyler's Deli sells sandwiches to grocery stores in bulk. The company identified the following information for its activity-based costing system for the year. Activity Allocation Base Estimated Overhead Cost > Purchasing Number of purchase orders $150,000 Processing Direct labor hours 360,000 Sales Number of sales orders 90,000 The estimated activity level for each type of sandwich and in total is as follows: Turkey Pastrami Total Number of purchase orders 10,000 15,000 25,000 Direct labor hours 30,000 70,000 100,000 Number of sales orders 1,000 4,000 5,000 How much total overhead cost should be assigned to one order for 500 Pastrami sandwiches, if the order requires 4 purchase orders and 100 direct labor hours?arrow_forwardMangiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education