FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

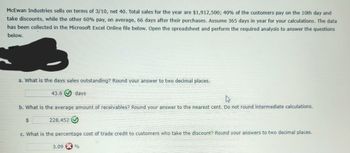

Transcribed Image Text:**McEwan Industries Transaction Analysis**

McEwan Industries sells on terms of 3/10, net 40. Total sales for the year amount to $1,912,500. Of the customers, 40% pay on the 10th day and take discounts, while the remaining 60% pay, on average, 66 days after their purchases. Assume a 365-day year for your calculations. The data has been collected in a Microsoft Excel Online file. Use the spreadsheet to perform the required analysis for the following questions.

**Questions and Answers:**

a. **What is the days sales outstanding?**

Round your answer to two decimal places.

**Answer:** 43.6 days ✅

b. **What is the average amount of receivables?**

Round your answer to the nearest cent. Do not round intermediate calculations.

**Answer:** $228,452 ✅

c. **What is the percentage cost of trade credit to customers who take the discount?**

Round your answers to two decimal places.

**Answer:** 3.09% ❌

This analysis helps understand the efficiency of receivables collection and the cost implications of offering early payment discounts.

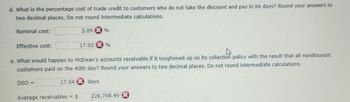

Transcribed Image Text:**d. What is the percentage cost of trade credit to customers who do not take the discount and pay in 66 days? Round your answers to two decimal places. Do not round intermediate calculations.**

- Nominal cost: 3.09%

- Effective cost: 17.02%

**e. What would happen to McEwan’s accounts receivable if it toughened up on its collection policy with the result that all nondiscount customers paid on the 40th day? Round your answers to two decimal places. Do not round intermediate calculations.**

- DSO = 17.54 days

- Average receivables = $228,768.49

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During computation, you may round your integer data to two decimal places and your percentages and present value factors to four decimal places.arrow_forwardCook Security Systems has a $37,500 line of credit, which charges an annual percentage rate of prime rate plus 4%. The starting balance on October 1 was $9,900. On October 4 they made a payment of $1,400. On October 13 the business borrowed $2,900, and on October 19 they borrowed $4,200. If the current prime rate is 6%, what is the new balance (in $)? (Round your answer to the nearest cent.)arrow_forwardA large retailer obtains merchandise under the credit terms of 2/15, net 30, but routinely takes 50 days to pay its bills. (Because the retailer is an important customer, suppliers allow the firm to stretch its credit terms.) What is the retailer's effective cost of trade credit? Assume a 365-day year. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- If a company pays you .69 cents in US dollars per 1,000 views and you have to make $30,000 US dollars by the end of the month. How many views do you need to make $30,000? Please explain and include all used formulas and calculations.arrow_forwardCook Security Systems has a $37,500 line of credit, which charges an annual percentage rate of prime rate plus 4%. The starting balance on October 1 was $9,300. On October 4 they made a payment of $1,800. On October 13 the business borrowed $2,500, and on October 19 they borrowed $4,400. If the current prime rate is 6%, what is the new balance (in $)? (Round your answer to the nearest cent.) $arrow_forwardRead the problem and answer the questions below. Write your answers in the worksheet 1. There are 1,000 iron bars in stock, and 1,500 are due in form orders that were placed previously. The company sells iron bars at the rate of 100 per day and observed that it takes an average pf 20 days for an order to be received. Because usage and lead times are known with certainty and because the company has determined that an order must be placed now, the desired safety stock quantity must be equal to 2. Heir Company has a plant that manufactures PSP. One of its is PSP 5. Expected demand is 5,200 of this video player in April 2021. Heir estimates the ordering cost per purchase order to be P2500. The carrying cost for one unit of PSP in stock is P50. What is the EOQ for PSP 5? 3. GameSports operates a boutique featuring sports merchandise. It uses EOQ model in making inventory decision. It is now considering inventory decisions for its UAAP jerseys product line. This is highly popular item. Data…arrow_forward

- NEED ALL QUESTIONS. .....arrow_forwardLibscomb Technologies' annual sales are $6,997,444 and all sales are made on credit, it purchases $3,879,449 of materials each year (and this is its cost of goods sold). Libscomb also has $530,851 of inventory, $490,754 of accounts receivable, and $417,441 of accounts payable. Assume a 365 day year. What is Libscomb’s Receivables Turnover?arrow_forwardTorrid Romance Publishers has total receivables of $3,040, which represents 20 days’ sales. Total assets are $73,000. The firm’s operating profit margin is 5%. Find the firm's ROA and asset turnover ratio. (Use 365 days in a year. Do not round intermediate calculations. Round your final answers to 2 decimal places.)arrow_forward

- Libscomb Technologies' annual sales are $5,790,872 and all sales are made on credit, it purchases $3,221,342 of materials each year (and this is its cost of goods sold). Libscomb also has $539,653 of inventory, $498,477 of accounts receivable, and $416,602 of accounts payable. Assume a 365 day year. What is Libscomb’s Inventory Period (in days)?arrow_forwardYour company received a $7 million order on the last day of the year. You filled the order with $3 million worth of inventory. The customer picks up the order the same day and pays $2 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $5 million within 40 days. Suppose your firm’s tax rate is 0% (ignore taxes). Based on this information, complete the table below: Account Account Increase/Decrease/ No effect Value of effect ($) Revenues Earnings Receivables Inventory Casharrow_forwardYour company received a $7 million order on the last day of the year. You filled the order with $3 million worth of inventory. The customer picks up the order the same day and pays $2 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $5 million within 40 days. Suppose your firm's tax rate is 0% (ignore taxes). Based on this information, complete the table below: Value of Account Increase/Decrease/ No effect effect ($) Revenues Earnings Receivables Inventory Casharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education