Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

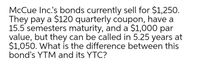

Transcribed Image Text:McCue Inc's bonds currently sell for $1,25O.

They pay a $120 quarterly coupon, have a

15.5 semesters maturity, and a $1,000 par

value, but they can be called in 5.25 years at

$1,050. What is the difference between this

bond's YTM and its YTC?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nikita Enterprises has bonds on the market making annual payments, with 17 years to maturity, a par value of $1,000, and selling for $956. At this price, the bonds yield 9.1 percent. What must the coupon rate be on the bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. Coupon rate 8.69 %arrow_forwardDraiman Corporation has bonds on the market with 14.5 years to maturity, a YTM of 10.2 percent, a par value of $1,000, and a current price of $953. The bonds make semiannual payments. What must the coupon rate be on the bonds? (Hint: The coupon rate is always quoted as an annual rate! The coupon rate is calculated by adding up the total amount of payments in a year made by a bond, then dividing it by the face value of the bond.) Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Coupon rate %arrow_forwardMcConnell Corporation has bonds on the market with 19 years to maturity, a YTM of 6.4 percent, a par value of $1,000, and a current price of $1,266.50. The bonds make semiannual payments. What must the coupon rate be on these bonds?arrow_forward

- Drongo Corporation's 4-year bonds currently yield 7.7 percent and have an inflation premium of 3.7%. The real risk-free rate of interest, r*, is 2.6 percent and is assumed to be constant. The maturity risk premium (MRP) is estimated to be 0.1% (t-1), where t is equal to the time to maturity. The default risk and liquidity premiums for this company's bonds total 1.1 percent and are believed to be the same for all bonds issued by this company. If the average inflation rate is expected to be 4 percent for years 5 and 6, what is the yield on a 6-year bond for Drongo Corporation? 8.00% O 8.50% 9.00% 9.50% 10.00%arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) The Saleemi Corporation's $1,000 bonds pay 9 percent interest annually and have 15 years until maturity. You can purchase the bond for $1,125. a. What is the yield to maturity on this bond? b. Should you purchase the bond if the yield to maturity on a comparable-risk bond is 6 percent? a. The yield to maturity on the Saleemi bonds is %. (Round to two decimal places.)arrow_forwardRaghubhaiarrow_forward

- Blue Jazz, Inc., has 5.4 percent coupon bonds on the market that have 20 years left to maturity. The bonds make annual payments. If the YTM on these bonds is 5.2 percent, the current price of the bond $______. Round it two decimial places, and do not include the $ sign, e.g., 935.67. Your Answer: Answerarrow_forwardLotsaDough's bonds have a 20-year maturity, 8% coupon (paid annually), $1000 par (face) value, and are priced at $952.68. What is LotsaDough's cost of debt (ignoring taxes)? Group of answer choices 7.0% 7.5% 8.0% 8.5%arrow_forwardValdez Corporation has bonds on the market with 11.5 years to maturity, a YTM of 7.2 percent, a par value of $1,000, and a current price of $1,054. The bonds make semiannual payments. What must the coupon rate be on these bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Coupon rate %arrow_forward

- Ezzell Enterprises' noncallable bonds currently sell for $1,218.00. They have a 5-year maturity, semi-annual coupon rate of 12.00%, and a par value of $1000. What is the bond's capital gain or loss yield?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72.arrow_forwardMcCurdy Co.'s Class Q bonds have a 12-year maturity, $1,000 par value, and a 10% coupon paid semiannually (5% each 6 months), and those bonds sell at their par value. McCurdy's Class P bonds have the same risk, maturity, and par value, but the p bonds pay a 10% annual coupon. Neither bond is callable. At what price should the annual payment bond sell? Select the correct answer. Oa. $992.23 b. $989.21 O c. $986.19 Od. $980.15 e. $983.17arrow_forwardKebt Corporation's Class Semi bonds have a 15-year maturity and a 7.25% coupon paid semiannually (3.625% each 6 months), and those bonds sell at their $1,000 par value. The firm's Class Ann bonds have the same risk, maturity, nominal interest rate, and par value, but these bonds pay interest annually. Neither bond is callable. At what price should the annual payment bond sell? Do not round your intermediate calculations. a. $988.31 b. $1,000.00 c. $1,035.90 d. $678.87 e. $992.53arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education