FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Good day, I want to ask for help for numbers 55-58 thanks

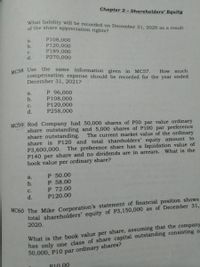

Transcribed Image Text:Chapter 2 - Shareholders' Equity

What liability will be recorded on December 31, 2020 as a result'

of the share appreciation rights?

P108,000

P120,000

P189,000

P270,000

a.

b.

С.

d.

MC58 Use the

same information given in MC57. How. much

compensation expense should be recorded for the year ended

December 31, 2021?

P 96,000

P108,000

P120,000

P258,000

a.

b.

с.

d.

MC59 Rod Company had 50,000 shares of P50 par value ordinary

share outstanding and 5,000 shares of P100 par preference

share outstanding.

share is P120 and total shareholders' equity amount to

P3,600,000. The preference share has a liquidation value of

P140 per share and no dividends are in arrears. What is the

book value per ordinary share?

The current market value of the ordinary

a.

P 50.00

b.

P 58.00

P 72.00

P120.00

с.

d.

total shareholders’ equity of P3,150,000 as of December 31,

2020.

MC60 The Mike Corporation's statement of financial position shows

What is the book value per share, assuming that the company

has only one class of share capital outstanding consisting o

50,000, P10 par ordinary shares?

P10.00

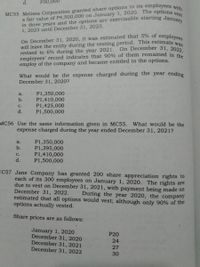

Transcribed Image Text:in three years and the options are exercisable starting January

On December 31, 2020, it was estimated that 5% of employees

d.

P30,000

MC55 Melissa Corporation granted share options to its employees viie

1, 2023 until December 31, 2023.

will leave the entity during the vesting period. This estimate w

revised to 6% during the year 2021.

employees' record indicates that 90% of them remained in th

employ of the company and became entitled to the options.

On December 31, 2022,

What would be the expense charged during the year ending

December 31, 2020?

P1,350,000

P1,410,000

P1,425,000

P1,500,000

a.

b.

с.

d.

MC56 Use the same information given in MC55. What would be the

expense charged during the year ended December 31, 2021?

P1,350,000

P1,395,000

P1,410,000

P1,500,000

a.

b.

с.

d.

1C57 Jane Company has granted 200 share appreciation rights to

each of its 300 employees on January 1, 2020. The rights are

due to vest on December 31, 2021, with payment being made on

December 31, 2022.

estimated that all options would vest; although only 90% of the

options actually vested.

During the year 2020, the company

Share prices are as follows:

January 1, 2020

December 31, 2020

December 31, 2021

December 31, 2022

P20

24

27

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. List 3 of the most common methods for a young adult/teen to obtain a credit card. Which of these methods are you most likely to use in the future?arrow_forwardI need help with 6 and 10arrow_forwardeducation.wiley.com Ch 1: Ho... WP NWP AS... С Maria Q.. b Search.. The Acc... Cengag... financia... WileyPL... financia... BB Financi.. Accoun... X - Cha... e Ch 1: Homework Question 4 of 5 - / 20 View Policies Current Attempt in Progress Van Occupanther is the bookkeeper for Roscoe Company. Van has been trying to get the balance sheet of Roscoe Company to balance. Roscoe's balance sheet is as follows. ROSCOE COMPANY Balance Sheet December 31, 2022 Assets Liabilities Cash $ 9,400 Accounts payable $25,000 Supplies 7,100 Accounts receivable (19,500) Equipment 45,000 Common stock 40,000 Dividends 9,200 Retained earnings 25,200 Total assets $70,700 Total liabilities and stockholders' equity $70,700 Prepare a correct balance sheet. (List Assets in order of liquidity.) ROSCOE COMPANY Balance Sheet 田 IIarrow_forward

- Question is attached in the screenshot thanks for the help greatly appreciated 13y14yko1yko15kyo1yk15oky1o5kyokxfdokarrow_forwardcan someone help me set this up? I have 11 of the slots down pack, i cant figure out the remaining ( its 16 slots) .arrow_forward3. Zach had surgery, which was his third claim of the year. He had a bill of $5000. Considering the prior visits, what is Zach's portion of this bill, and what is the responsibility of the insurance carrier? 4. How much is Zach responsible for so far this year considering his first three visits?arrow_forward

- If the amount Katie owes is close to her credit limit, it will negatively affect her credit score. 9 True False Previous Page 2 W # 3 e Next Page C $ A + 4 r % 5 rt acer Oll 6 y & 7 O C * 8 00 a i 9 O 0 Page 13 of 14 4 P 55.arrow_forwardHi - I need this rounded in 4 decimal places, like I stated in the question. Thanks!arrow_forwardWould you provide me with an answer to this question please?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education