FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

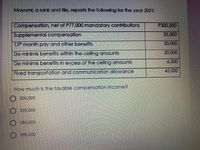

Transcribed Image Text:Mayumi, a rank and file, reports the following for the year 2021:

Compensation, net of P77,000 mandatory contributions

P300,000

Supplemental compensation

35,000

13th month pay and other benefits

50,000

De minimis benefits within the ceiling amounts

20,000

De minimis benefits in excess of the ceiling amounts

6,000

45,000

Fixed transportation and communication allowance

How much is the taxable compensation income?

O 300,000

O 335,000

380,000

386,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the gross profit margin? Higher ratio or lower ratioarrow_forwardSandhill Co. had the following selected balances at December 31, 2021: Projected benefit obligation $4,640,000 Accumulated benefit obligation 4,540,000 Fair value of plan assets 4,285,000 Accumulated OCI (PSC) 165,000 Calculate the pension asset/liability to be recorded at December 31, 2021. Pension $arrow_forwardHappy Woolly Inc. provides the following information about its postretirement benefit plan for the year 2019. (In Euros) Service cost €90,000 Contribution to the plan €56,000 Actual return on plan assets €2,000 Benefits paid € 40,000 Plan assets at January 1, 2019 €710,000 Defined postretirement benefit obligation at January 1, 2019 €760,000 Accumulated OCI (Loss) at January 1, 2019 100 (Dr-Loss) Discount (interest) rate 9% Required: Compute the postretirement benefit expense for 2019 and give your explanation!arrow_forward

- Analis has the following information and reported the for the taxable year: Basic salary 900,000; supplemental compensation 150,000; mandatory contributions 35,000; Rice allowance 30,000; Uniform allowance 10,000; 13th month pay 85,000. Compute for: a. total taxable compensation? 1,060,000; 1,025,000; 1,015,000 b.non-taxable de minimis benefit? 45,000; 30,000; 0 c.regular compensation 900,000; 1,050,000; 1,135,000arrow_forwardPresented below is pension information related to Tyre Recycling Inc., for the calendar year 2019. The corporation uses ASPE. Current service costs $ 50,000 Contributions to the plan 55,000 Actual return on plan assets 40,000 Defined benefit obligation (beginning of year) 600,000 Fair value of plan assets (beginning of year) 400,000 Interest cost on the obligation 10% The pension expense to be reportedfor 2019 is Select one: a. $110,000. b. $70,000. c. $65,000. d. $50,000. e. None of the above.arrow_forwardAsha's pension adjustment (PA) in 2020 was $3,500 and in 2021 the PA was $4,000. Asha's 2020 Notice of Assessment showed unused RRSP room of $8,000. How much can Asha contribute to an RRSP for the 2021 taxation year? A) $10,260 B) $14,760 C) $15,160 D) $27,830arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education