Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

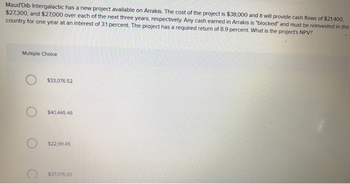

Transcribed Image Text:Maud'Dib Intergalactic has a new project available on Arrakis. The cost of the project is $38,000 and it will provide cash flows of $21,400,

$27,300, and $27,000 over each of the next three years, respectively. Any cash earned in Arrakis is "blocked" and must be reinvested in the

country for one year at an interest of 3.1 percent. The project has a required return of 8.9 percent. What is the project's NPV?

Multiple Choice

O

O

$33,076.52

$40.445.46

$22,191.45

$37,075.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Assume the company has the following two projects available. Year Cash Flow (A) 0 -$56,000 1 2 3 4 22,500 29,600 24,500 10,500 Cash Flow (B) -$ 101,000 a. Project A Project B b. Project acceptance 24,500 29,500 29,500 239,000 a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Which, if either, of the projects should the company accept? years yearsarrow_forwardealthy Food Ltd is considering to invest in one of the two following projects to buy new machinery. Each option will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 7%. The cash flows of the projects are provided below. Machinery 1 Machinery 2 Cost $396,000 $415,000 Future Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 123,000 194,000 205,000 215,000 228,000 196, 000 204,000 212,000 217,000 233,000 Required: Identify which option of machinery should the company accept based on the simple payback period method if the firm maintains a policy that every investment project should recover the initial investment within 2 years.arrow_forwardThe Kookaburra Golf Resort is redoing its golf course at a cost of $2,744,320. It expects to generate cash flows of $1,223,445, $2,007,812, and $3,147,890 over the next three years. If the appropriate discount rate for the company is 13 percent, what is the NPV of this project? a. $7,581,072 b. $2,092,432 c. $4,836,752 d. $3,112,459arrow_forward

- Maud'Dib Intergalactic has a new project available on Arrakis. The cost of the project is $36,000 and it will provide cash flows of $19,800, $25, 300, and $24, 200 over each of the next three years, respectively. Any cash earned in Arrakis is "blocked" and must be reinvested in the country for one year at an interest of 3.5 percent. The project has a required return of 8.5 percent. What is the project's NPV? Multiple Choice $19, 982.00 $22, 686.44 $31, 694.85 $28,575.27 $34, 576.20arrow_forwardTwo projects, Alpha and Beta, are being considered using the payback method. Each has an initial cost of $100,000. The annual cash flows for each project are listed below. a) What is the pay back period in years for Alpha? (round to two decimal places) b) What is the pay back period in years for Beta? (round to two decimal places) Year Project Alpha Project Beta 1 25,000 15,000 2 25,000 25,000 3 25,000 45,000 4 25,000 30,000 5 25,000 20,000 25,000 15,000arrow_forwardBluefield Inc. is considering a project that will require an initial investment of $20,000 and is expected to generate future cash flows of $5,000 for years 1 through 3 and $2,500 for years 4 through 6. The project’s payback period is: A. 6 years B. 5 years C. 4 years D. 67 yearsarrow_forward

- The Square Box is considering two independent projects, both of which have an initial cost of $18,000. The cash inflows of Project A are $3,000, $7,000, and $10,000 over the next three years, respectively. The cash inflows for Project B are $3,000, $7,000, and $15,000 over the next three years, respectively. The required return is 12 percent and the required discounted payback period is 3 years. Based on discounted payback, which project(s), if either, should be accepted? Group of answer choices Project A should be rejected and Project B should be accepted. Both projects should be accepted. Project A should be accepted and Project B should be rejected. Both projects should be rejected. You should be indifferent to accepting either or both projects.arrow_forwardSouthern Pole is developing a special vehicle for Antarctic exploration. The development requires investments of $100,000 today, $200,000 in 1 year from today and $300,000 in 2 years from today. Net returns for the project are expected to be $96,000 at the end of year over the next 15 years. If the company requires a rate of return of 12% compounded annually-find the NPV of the project. (Chapter 16.2)arrow_forwardNOVA Company is considering a long-term investment project called STUDY. STUDY will require an investment of $125,190. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $79,000, and annual cash outflows would increase by $40,000. Compute the cash payback period. O 3.21 years O 1.23 years O 1.58 years O 4 yearsarrow_forward

- Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Assume the company has the following two projects available. Year Cash Flow (A) -$ 59,000 Cash Flow (B) 01234 24,000 31,400 26,000 12,000 -$ 104,000 26,000 31,000 28,000 236,000 a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Which, if either, of the projects should the company accept? a. Project A years Project B years b. Project acceptance Accept Project A and reject Project Barrow_forwardMaud Dib Intergalactic has a new project available on Arrakis. The cost of the project is $36,000 and it will provide cash flows of $19,800, $25,300, and $24,200 over each of the next three years, respectively. Any cash earned in Arrakis is "blocked" and must be reinvested in the country for one year at an interest of 3.5 percent. The project has a required return of 8.5 percent. What is the project's NPV?arrow_forwardGiant Machinery Ltd is considering to invest in one of the two following Projects to buy a new equipment. Each project will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 9%. The cash flows of the projects are provided below. Project 1Cost $175,000 Project 2 Cost $185,000 Future Cash Flows For Project 1 Year 1 Year 2 Year 3 Year 4 Year 5 is 76,000 83,000 67,000 65,000 55,000 respectively. For Project 2 it is 87,000 78,000 69,000 65,000 57,000 for Year 1 Year 2 Year 3 Year 4 Year 5 resp. Required: a) Identify which project should the company accept based on NPV method. (Note: Please round up the result of each calculation of PV to 2 decimal places only for simplification) b) Identify which project should the company accept based on simple pay back method if the payback criteria is maximum 2 years. c) Which project Giant Machinery should choose if two methods are in conflictarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education