FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

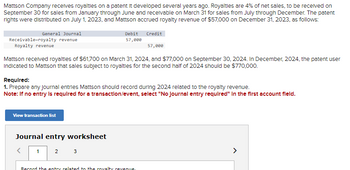

Transcribed Image Text:Mattson Company receives royalties on a patent It developed several years ago. Royalties are 4% of net sales, to be received on

September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent

rights were distributed on July 1, 2023, and Mattson accrued royalty revenue of $57,000 on December 31, 2023, as follows:

General Journal

Receivable-royalty revenue

Royalty revenue

57,000

Mattson received royalties of $61,700 on March 31, 2024, and $77,000 on September 30, 2024. In December, 2024, the patent user

Indicated to Mattson that sales subject to royalties for the second half of 2024 should be $770,000.

View transaction list

Required:

1. Prepare any Journal entries Mattson should record during 2024 related to the royalty revenue.

Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.

Journal entry worksheet

<

Debit

57,000

1

2 3

Credit

Record the entry related to the royalty revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A On January 1. 2020. Machinery Corp. enters into a contract with a customer for the sale of a machine and related one year maintenance services for a total contract price of P2000.000. Machinery Corp. regularly sells these items separately. If they were to be purchased separately, their stand-alone selling prices are as follows: P1.800.000 for the machines and P600.000 for the one-year maintenance services Machinery Corp transfers the machine, and collects the total contract price on February 1, 2020 The maintenance services start on that date. Required Analyze the five steps of model of revenue recognitionarrow_forwardScreen Co. assigns some of its patents to other enterprises under a variety of licensing agreements . In some instances, advance royalties are received when the agreements are signed, and in others, royalties are remitted within sixty days after each license year-end. The following data are included in Screen Co.'s December 31 balance sheet : 2019 2020 Royalties receivable Unearned royalties 100,000 70,000 95,000 50,000 During 2020 Screen Co. received royalties' remittances of P200,000 . How much should Screen Co. report as royalty income in its income statement for the year ended December 31, 2020?arrow_forwardOn July 01, 2021, Emerald Corporation sold a set of washing machine and a dryer for a total contract price of P200,000. The stand-alone selling prices of the washing machine and the dryer if sold separately are: 150,000 and 70,000, respectively. A 20% down payment was made and the balance is payable in six (6) equal installment payments of P28,564, inclusive of 2% interest, payable quarterly starting September 30 and December 31, 2021. How much is the total amount of interest earned in 2021?arrow_forward

- Hardevarrow_forwardBon Nebo Co. sold 11,500 annual subscriptions of Bjorn for $60 during December 20Y5. These new subscribers will receive monthly issues, beginning in January 20Y6. In addition, the business had taxable income of $436,000 during the first calendar quarter of 20Y6. The federal tax rate is 40%. A quarterly tax payment will be made on April 12, 20Y6. Prepare the “Current liabilities” section of the balance sheet for Bon Nebo Co. on March 31, 20Y6. Bon Nebo Co.Current Liabilities Section of Balance SheetMarch 31, 20Y6 Line Item Description Amount Current liabilities: Advances on magazine subscriptions $Advances on magazine subscriptions Federal income taxes payable Federal income taxes payable Total current liabilities $Total current liabilitiesarrow_forwardMAYUMI Co. sold 50,000 units at P 225 per unit during May of this year. The cost per unit is P150. The entity granted the customers right to return within 90 days if not satisfied and will receive either a full refund if cash was already paid or a full credit for the amount owed to the entity. It is estimated that 7% of the units sold will be returned within the 90-day period. The entity used the perpetual method. What amount of sales revenue should be reported for the month of May?arrow_forward

- On January 1, 2021, Glanville Company sold goods to Otter Corporation. Otter signed an installment note requiring payment of $21,500 annually for five years. The first payment was made on January 1, 2021. The prevailing rate of interest for this type of note at date of issuance was 10%. Glanville should record sales revenue in January 2021 of: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice $107,500 $81,502 $89,652 None of these answer choices are correct.arrow_forwardOn December 1, 2020, ABC Co. grants customer a license to use ABC’s patented technology over a 4-year period. The contract price is P5,000,000, payable in full at contract inceptions. During Dec. 2020, ABC Co. incurs direct contract cost of P500,000 and indirect cost of P100,000. The customer obtains control of the license on January 2, 2021. Compute for the contract revenue on 2021 assuming there is right to access?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education