FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

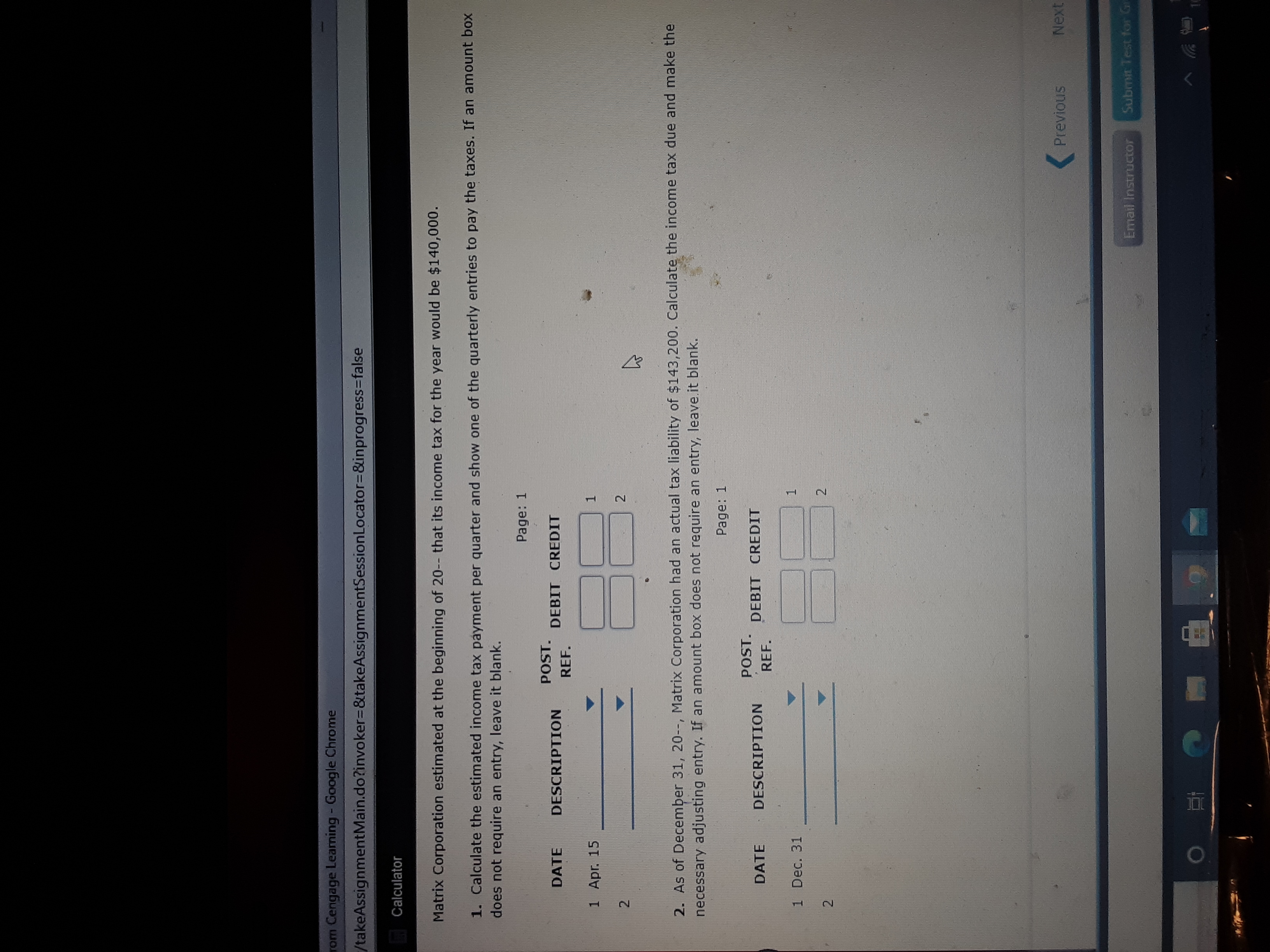

Transcribed Image Text:### Income Tax Calculation Assignment

**Overview:**

Matrix Corporation estimated at the beginning of the year that its income tax for the year would be $140,000.

#### Task 1:

Calculate the estimated income tax payment per quarter and show one of the quarterly entries to pay the taxes. If an amount box does not require an entry, leave it blank.

- **Entry Table:**

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT |

|--------|-------------|------------|-------|--------|

| 1 Apr. 15 | | | | |

| 2 | | | | |

#### Task 2:

As of December 31, the actual tax liability was $143,200. Calculate the income tax due and make the necessary adjusting entry. If an amount box does not require an entry, leave it blank.

- **Entry Table:**

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT |

|----------|-------------|------------|-------|--------|

| 1 Dec. 31 | | | | |

| 2 | | | | |

Be sure to input the calculated amounts and make necessary adjustments accurately.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bon Nebo Co. sold 19,000 annual subscriptions of Bjorn for $51 during December 20Y5. These new subscribers will receive monthly issues, beginning in January 20Y6. In addition, the business had taxable income of $612,000 during the first calendar quarter of 20Y6. The federal tax rate is 40%. A quarterly tax payment will be made on April 12, 20Y6. Prepare the “Current liabilities” section of the balance sheet for Bon Nebo Co. on March 31, 20Y6.arrow_forwardVishalarrow_forwardBon Nebo Co. sold 30,000 annual subscriptions of Bjorn for $105 during December 20Y5. These new subscribers will receive monthly issues, beginning in January 20Y6. In addition, the business had taxable income of $970,000 during the first calendar quarter of 20Y6. The federal tax rate is 40%. A quarterly tax payment will be made on April 12, 20Y6. Prepare the “Current liabilities” section of the balance sheet for Bon Nebo Co. on March 31, 20Y6. Current liabilities: Advances on magazine subscriptions Federal income taxes payable Total current liabilitiesarrow_forward

- E 6arrow_forwardThe Sirap Co had sales for the year at $150000. Only $105000 was collected in cash, The remaining $45000 should be collected in cash next year. The income is not taxable until it is collected in cash. The only expense for the business in income tax and the rate is 25% for this year and in all future years. how do you Make all journal entries necessary to record income tax for the year. ?arrow_forwardFor each of the following situations, indicate the amount shown as current or long-term liability on the balance sheet of Anchor, Inc., at December 31: a. Anchor's general ledger shows a credit balance of $125,000 in Long-Term Notes Payable. Of the amount, a $25,000 installment becomes due on June 30 of the following year. b. Anchor estimates its unpaid income tax liability for the current year is $34,000; it plans to pay this amount in March of the following year. c. On December 31, Anchor received a $15,000 invoice for merchandise shipped on December 28. The merchandise has not yet been received. The merchandise was shipped F.O.B. shipping point. d. During the year, Anchor collected $10,500 of state sales tax. At year-end, it has not yet remitted $1,400 of these taxes to the state department of revenue. e. On December 31, Anchor's bank approved a $5,000, 90-day loan. Anchor plans to sign the note and receive the money on January 2 of the following year. Current Liability Long-Term…arrow_forward

- Sheffield Corporation rings up cash sales and sales taxes separately on its cash register. On April 10, the register totals are pre-tax sales of sales $5,300 plus GST of $265 and PST of $424. 1. 2. Brenda Corporation receives its annual property tax bill in the amount of $8,700 on May 31. (1) During the month of March, Martinez Corporation's employees earned gross salaries of $65,100. Withholdings deducted from employee earnings related to these salaries were $2.750 for CPP, $964 for El, $7,300 for income taxes. (ii) Martinez's 3. employer portions were $2,750 for CPP and $1,350 for El for the month. Prepare the journal entries to record the above transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) Sr no. Account Titles and Explanation Debit Credit 1. 2. 3 (i). 3 (ii).arrow_forwardYou have calculated the adjusted profit for the company to be $2,000,000. Capital Allowance was $20,000. The tax rate is 25%.Estimated tax paid during the year is $750,000. Employment Tax Credit available (which is nonrefundable)is $700,000. The tax refundable for this company is.a. $950,000b. $500,000c. $250,000d. $200,000arrow_forwardIn January, gross earnings in Coronado Company totaled $74,000. All earnings are subject to 7.65% FICA taxes, 5.40% state unemployment taxes, and 0.80% federal unemployment taxes.Prepare the entry to record January payroll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Jan. 31 Click if you would like to Show Work for this question: Open Show Workarrow_forward

- Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages. Faruga Company had FUTA taxable payrolls for the four quarters of $38,400; $29,600; $16,500; and $8,900, respectively. What was the amount of Faruga’s first required deposit of FUTA taxes? Round your answer to two decimal places.arrow_forwardTimes-Roman Publishing Company reports the following amounts In its first three years of operation: ($ in thousands) Pretax accounting income Taxable income Req 2 and 3 The difference between pretax accounting Income and taxable income is due to subscription revenue for one-year magazine subscriptions being reported for tax purposes in the year received, but reported in the Income statement in later years when the performance obligation is satisfied. The Income tax rate is 25% each year. Times-Roman anticipates profitable operations in the future. Required: 1. What is the balance sheet account that gives rise to a temporary difference in this situation? 2. For each year, Indicate the cumulative amount of the temporary difference at year-end. 3. Determine the balance in the related deferred tax account at the end of each year. Is It a deferred tax asset or a deferred tax liability? Complete this question by entering your answers in the tabs below. 2624 $ 210 250 Cumulative temporary…arrow_forwardThe following information is available for Hunt Company after its first year of operations: Income before taxes $250,000 Federal income tax payable $104,000 Deferred income tax (4,000) Income tax expense 100,000 Net income $150,000 Hunt estimates its annual warranty expense as a percentage of sales. The amount charged to warranty expense on its books was £95,000. Assuming a 40% income tax rate, what amount was actually paid this year for warranty claims?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education