FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:STaaPM x

ugth.wileyplus.com/edugen/Iti/main.uni

Indeed Monster Jobs

Degree Progra

High Energy Make

1 Hear Student Da..

Paused

d pue

S Consumer Center

* The Ultimate Guide

nancial Calculator.

IS Kimmel, Financial Accounting, 8e

Help I System Announcements

CALCULATOR

PRINTER VERSION

4BACK

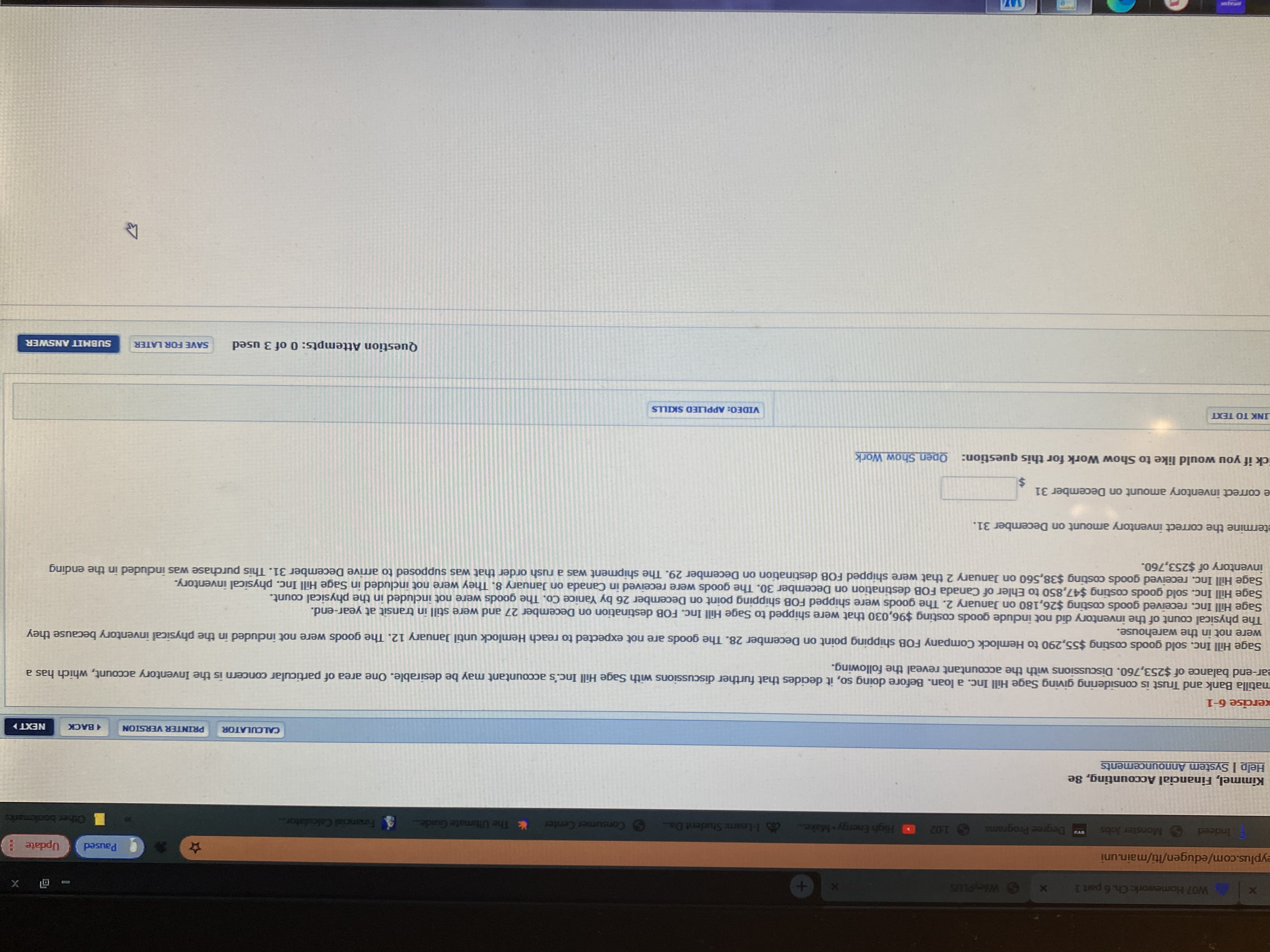

Exercise 6-1

Umatilla Bank and Trust is considering giving Sage Hill Inc. a loan. Before doing so, it decides that further discussions with Sage Hill Inc's accountant may be desirable. One area of particular concern is the Inventory account, which has

year-end balance of $253,760. Discussions with the accountant reveal the following.

1. Sage Hill Inc. sold goods costing $55,290 to Hemlock Company FOB shipping point on December 28. The goods are not expected to reach Hemlock until January 12. The goods were not induded in the physical inventory because the

were not in the warehouse.

2. The physical count of the inventory did not indude goods costing $96,030 that were shipped to Sage Hill Inc. FOB destination on December 27 and were still in transit at year-end.

3. Sage Hill Inc. received goods costing $26,180 on January 2. The goods were shipped FOB shipping point on December 26 by Yanice Co. The goods were not included in the physical count.

4. Sage Hill Inc. sold goods costing $47,850 to Ehler of Canada FOB destination on December 30. The goods were received in Canada on January 8. They were not included in Sage Hill Inc. physical inventory.

5. Sage Hill Inc. received goods costng $38,560 on January 2 that were shipped FOB destination on December 29. The shipment was a rush order that was supposed to arrve December 31. This purchase was induded in the ending

inventory of $253,760.

Determine the correct inventory amount on December 31.

The correct inventory amount on December 31

%24

Click if you would like to Show Work for this question: Open Show Work

VIDEO: APPLIED SKILLS

LINK TO TEXT

Question Attempts: 0 of 3 used

SAVE FOR LATER

SUBMIT ANSWER

Transcribed Image Text:matilla Bank and Trust is considering giving Sage Hill Inc. a loan. Before doing so, it decides that further discussions with Sage Hill Inc.'s accountant may be desirable. One area of particular concern is the Inventory account, which has a

ear-end balance of $253,760. Discussions with the accountant reveal the following.

Sage Hill Inc. sold goods costing $55,290 to Hemlock Company FOB shipping point on December 28. The goods are not expected to reach Hemlock until January 12. The goods were not induded in the physical inventory because they

were not in the warehouse.

The physical count of the inventory did not indlude goods costing $96,030 that were shipped to Sage Hill Inc. FOB destination on December 27 and were still in transit at year-end.

Sage Hill Inc. received goods costing $26,180 on January 2. The goods were shipped FOB shipping point on December 26 by Yanice Co. The goods were not included in the physical count.

Sage Hill Inc. sold goods costing $47,850 to Ehler of Canada FOB destination on December 30. The goods were received in Canada on January 8. They were not included in Sage Hill Inc. physical inventory.

Sage Hill Inc. received goods costing $38,560 on January 2 that were shipped FOB destination on December 29. The shipment was a rush order that was supposed to arrive December 31. This purchase was induded in the ending

inventory of $253,760.

etermine the correct inventory amount on December 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- AB Co made a credit sale to DE Co for $200,000 on July 19x9. It is known that at the end of 19x9 there was an outstanding receivable of $47,000. Managementestimates that $25,000 will be uncollectible.In July 19x9 the collections department stated that a receivable of $5,000 was written off frombookkeeping because it is impossible to receive payment from DE Co. Unexpectedly monthOctober 19x9 DE Co pays its outstanding debt. Requested:Prepare the adjusting entries and the journals needed to record the above transactions properlythe backup method as well as the direct deletion method!arrow_forwardFarley Bains, an auditor with Nolls CPAS, is performing a review of Teal Mountain Inc.'s Inventory account. Teal Mountain Inc. did not have a good year, and top management is under pressure to boost reported income. According to its records, the inventory balance at year-end was $808,200. However, the following information was not considered when determining that amount. Prepare a schedule to determine the correct inventory amount. (Show amounts that reduce inventory with a negative sign or parenthesis e.g. -45 or parentheses e.g. (45).) 808,200 Ending inventory-as reported $4 1. Included in the company's count were goods with a cost of $224,170 that the company is holding on consignment. The goods belong to Nader Corporation. (224,170) 2. The physical count did not include goods purchased by Teal Mountain Inc. with a cost of $38,530 that were shipped FOB shipping point on December 28 and did not arrive at Teal Mountain Inc.'s warehouse until January 3. 38,530 3. Included in the…arrow_forwardJackson balanced his Debtors Control Account on 30 September 2005 and it showed a debit balance of $16,300. He checked this balance with the individual debtors' balance in the Debtors Ledger which shows a debit balance of $14,750. When he examined the records, the following errors were found: (i) Goods costing $1,200 had been sold to Summer on credit but the transaction was totally omitted from the books. (ii) Spring was allowed cash discount of $50. This amount was entered correctly in the Cash Book but was recorded on the wrong side of his account. (iii) The Sales Returns Journal showed that a credit note for $200 had been sent to Winter but it had not been posted to Winter's account. (iv) Bad debts written off $1,500 had been recorded in the Sales Ledger but no entry was made in the General Ledger. (v) Autumn's debit balance of $350 had been omitted from the Debtors Ledger balance. You are required to prepare: (a) an adjusted Debtors Control Account; (b) a statement to reconcile the…arrow_forward

- Tomm Wholesalers sells construction equipment to small home builders. The following pertains to Tomm’s credit and cash sales for the month of December 31, 2020. Tomm generally considers 3% of credit sales to be uncollectible and it uses the allowance method. Cash Sales $38,000 Credit Sales $275,000 Prepare the appropriate bad debt journal entry for the month of December. Do not prepare any other journal entries for this problem.arrow_forwardRaj Department store has one cash register. On a recent day, the cash register tape reported sales in the amount of $12,675 12. Actual cash in the register (after deducting and removing the opening change of $100) was $12,649.81, which was deposited in the firm's account.arrow_forwardKing Enterprises is a book wholesaler. King hired a new accounting clerk on January 1 of thecurrent year. The new clerk does not understand accrual accounting and recorded the transactions below based on when cash receipts and disbursements changed hands rather than when the transac-tion occurred. King uses a perpetual inventory system, and its accounting policy calls for inventory purchases to be recorded net of any discounts offered.Jan. 10 Paid Aztec Enterprises $9,800 for books that it received on December 15. (Thispurchase was recorded as a debit to Inventory and a credit to Accounts Payable onDecember 15 of last year, but the accounting clerk ignores that fact.)Dec. 27 Received books from McSaw Inc. for $20,000; terms 2/10, n/30.Dec. 30 Sold books to Booksellers Unlimited for $30,000; terms 1/10, n/30. The cost of thesebooks to King was $24,500.Instructionsa. As a result of the accounting clerk’s errors, compute the amount by which the followingaccounts are overstated or…arrow_forward

- I am having trouble with this problem. The beginning-of-the-period cash balance for the Travis Company was a $7,200 debit. Cash sales for the month were $3,600 and sales on account were $4,800. The company paid $1,500 cash for current-period purchases and also paid $1,800 cash for amounts due from last month.What is the ending debit or credit balance in the Cash account?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardA series of unrelated situations follow for several companies that use ASPE: (a) Larkspur Inc.’s unadjusted trial balance at December 31, 2020, included the following accounts: Debit Credit Allowance for doubtful accounts $8,000 Sales revenue $2,065,000 Sales returns and allowances 61,300 Sales discounts 3,900 Larkspur estimates its bad debt expense to be 1.5% of net sales. Determine its bad debt expense for 2020. (Round answer to 0 decimal places, e.g. 58,971.) Bad debt expense $Enter your answer in accordance to the question statement Save for Later Last saved 23 hours ago. Saved work will be auto-submitted on the due date. Attempts: 0 of 1 used Submit Answer (b) The parts of this question must be completed in order. This part will be available when you complete the part above. (c) The parts of this question must be completed in order. This part will be available when…arrow_forward

- can you please help me answer these questions... Aardvark Company sells merchandise only on credit. For the year ended December 31, 2019, the following data are available: Sales (all on credit) $1,200,000 Accounts Receivable, January 1, 2019 225,000 Allowance for doubtful accounts, January 1, 2019 (credit) 15,000 Cash collections during 2019 1,050,000 Accounts written off as uncollected (default) during 2019 10,000 Determine the balance of Accounts Receivable at December 31, 2019. Assume that the company estimates bad debts at 2% of credit sales. What amount will the company record as bad debt expense for 2019? What journal entry would Aardvark prepare to record bad debt expense for 2019 (related to part 2)? Assume that the company estimates bad debts based on the aging method, and the aging schedule estimates that $30,100 of the year-end accounts receivable will be uncollected. What amount will the company record as bad debt expense for 2019? What…arrow_forwardIn December 2013, JB Masterpiece Merchandise Inc. had a significant portion of its inventory stolen. The company determined the cost of inventory remaining to be $32,400. The following information was taken from the records of the company: Purchases... Purchase returns and allowances. Sales.. **** Sales returns and allowances. Salaries.... Rent. Insurance Utilities.. ..... Jan. 1, 2013 to Date of Theft $141,670 . 7,250 05: (15 Mark) 275,600 3,400 . 10,100 . 5,340 .. 1,030 .. 1,115 4,925 1,890 .. 74,620 Advertising. Depreciation expense Beginning inventory Required: Estimate the cost of the stolen inventory. 2012 $156,430 6.580 283,300 2,900 12,900 7,120 1.340 1,435 3,741 2,106 69,780arrow_forwardatel Service Company does make a few sales on account but is mostly a cash business. Consequently, it uses the direct write-off method to account for uncollectible accounts. During Year 1, Patel Service Company earned $37,700 of cash revenue and $9,425 of revenue on account. Cash operating expenses were $26,624. After numerous attempts to collect a $265 account receivable from Sam Stephens, the account was determined to be uncollectible in Year 1. Required: Show the effects of (1) cash revenue, (2) revenue on account, (3) cash expenses, and (4) write off of the uncollectible account on the financial statements using a horizontal statements model. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use "NC" for net change in cash. Leave blank to indicate that an element is not affected by the event. What amount of net income did Patel Service Company report on the Year 1 income statement?…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education