FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

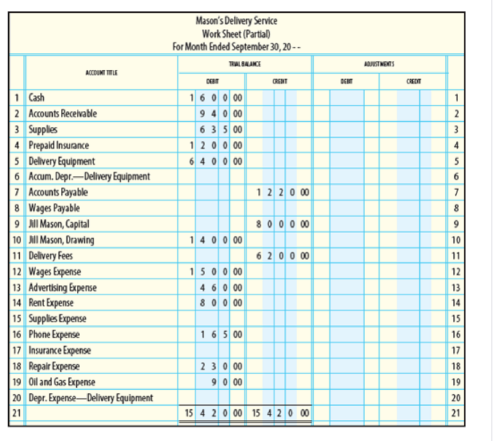

ADJUSTMENTS AND WORK SHEET SHOWING NET INCOME The

Data to complete the adjustments are as follows:

(a) Supplies inventory as of september 30 , $90.

(b) Insurance expired (used), $650,

(c)

(d) Wages earned by employees but not paid as of september 30, $350

Required

1. Enter the adjustments in the Adjustments columns of the work sheet.

2. Complete the work sheet.

Transcribed Image Text:Mason's Delivery Service

Work Sheet (Partial)

For Month Ended September 30, 20 - -

TAAKI

AITNETS

ACCDUMIE

1 Cash

600 00

940 00

6 3 5 00

1200 00

6 400 00

2 Accounts Recelvable

3 Supples

2

3

4 Prepaid Insurance

5 Delvery Equipment

6 Accum. Depr.-Delivery Equipment

7 Accounts Payable

8 Wages Payable

9 MI Mason, Capital

10 MI Mason, Drawing

11 Delivery Fees

4

5

1 2 2 0 00

8

80 0 0 00

1400 00

10

6 2 00 00

11

1500 00

4 60 00

8 00 00

12 Wages Expense

12

13 Advertsing Expense

14 Rent Expense

13

14

15 Supplies Expense

16 Phone Expense

17 Insurance Expense

18 Repair Expense

19 Ol and Gas Expense

20 Depr. Expense-Delivery Equipment

21

15

165 00

16

17

230 00

9 0 00

18

19

20

15 4 2 0 00 15 4 2| o 00

21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- INSTRUCTIONS: (1) Complete the adjustments section of the worksheet [WS]. Use the following information regarding unadjusted items. (a) On September 30, the firm received its utilities bill for the month of September amounting to P14,300. This remains to be unpaid at month-end. Record an adjustment for the utilities for the month of September. Accrued Expense (b) On September 21, the firm received a 6% 90-day note for money lent to Ling Ying Wei amounting to P400,000. The remainder of the amount pertains to a 12-month 9% promissory note received on May 1, 2021. Record an adjustment for the accrued interest from both notes for the month of September. Accrued Income (c) On September 30, an inventory of Warehouse Supplies and Office Supplies showed that items costing P127,000 and P12,000 were on hand respectively. Record an adjustment for the supplies used in September. Prepaid Expense (d) On July 1, 2021, the firm purchased a six-month insurance policy for P232,000. Record an…arrow_forwardIncluded in Blossom’s December 31 trial balance is unearned revenue of $12,600. Management reviewed the company’s progress on the underlying contracts and determined that $4,000 of revenue should be recognized. Prepare Blossom’s December 31 adjusting entryarrow_forwardThe following transactions pertain to Smith Training Company for Year 1: January 30 February 1 April 10 July 1 July 201 August 15 September 15 October 1 October 15 November 16 December 11 December 31 Adjusted records to recognize the services provided on the contract of July 1. December 31 Recorded $2,eee of accrued salaries as of December 31. December 31 Recorded the rent expense for the year. (See February 1.) December 31 Physically counted supplies; $130 was on hand at the end of the period. Income Statement Established the business when it acquired $46,000 cash from the issue of common stock. Paid rent for office space for two years, $33,000 cash.. Purchased $810 of supplies on account. Received $26,500 cash in advance for services to be provided over the next year. Paid $608 of the accounts payable from April 10. Billed a customer $9,200 for services provided during August. Completed a job and received $3,200 cash for services rendered. Paid employee salaries of $34,000 cash.…arrow_forward

- Adjusting, Closing, and Reversing Entries Prepare adjusting, closing, and payroll entries for wages using two methods. Wages paid during 20-1 are $24,080. Wages earned but not paid (accrued) as of December 31, 20-1, are $240. On January 3, 20-2, payroll of $920 is paid, which includes the $240 of wages earned but not paid in December. 1. Prepare the entries without making a reversing entry.arrow_forwardOn June 30 of the current year, Rosemount Copy Center has completed the Trial Balance columns of the work sheet. Analyze the adjustment information given here into debit and credit parts. Record the adjustments on the work sheet. Total the Adjustments columns. Adjustment Information June 30 Supplies on hand $188.00 Value of prepaid insurance 540.00 WORK SHEET For Month Ended June 30, 20-- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 1 Cash 8,715.00 1 2 Petty Cash 75.00 2 3 Accounts Receivable-Raymond O’Neil 642.00 3 4 Supplies 518.00 4 5 Prepaid Insurance 675.00 5 6 Accounts Payable-Western Supply 268.00 6 7 Akbar…arrow_forwardThe following additional accounts from Recessive Interiors' chart of accounts should be used: Wages Payable, 22; Income Summary, 33; Depreciation Expense-Equipment, 54; Supplies Expense, 55; Depreciation Expense-Trucks, 56; Insurance Expense, 57. The data needed to determine year-end adjustments are as follows: Supplies on hand at January 31 are $2,850. Insurance premiums expired during the year are $3,150. Depreciation of equipment during the year is $5,250. Depreciation of trucks during the year is $4,000. Wages accrued but not paid at January 31 are $900. Required: 1. Journalize the closing entries on of the journal. Then post to the general ledger in the attached spreadsheet. For a compound transaction, if an amount box does not require an entry, leave it blank.arrow_forward

- A payroll of $100,000 was earned for work perform by construction workers tru December 31,2010. The payroll was due to be paid on January 6,2011. Make the requred Accrual entry.arrow_forwardPlease help mearrow_forwardRequired information Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below.] The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company. Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Raw materials purchases (all direct materials) Maintenance expense-Factory equipment Factory utilities Direct labor Indirect labor Office salaries expense Rent expense-Office space Rent expense-Selling space Rent expense-Factory building Sales salaries expense Problem 14-2A (Algo) Classifying costs LO C2 Costs $ 30,000 9,000 10,000 52,000 1. Advertising expense 2. Depreciation expense-Office equipment 620,000 36,600 33,400 408,000 61,000 37,000 22,000 53,000 Required: Identify each cost as either a product cost or a period cost. If a product cost, classify it as direct materials,…arrow_forward

- Required information [The following information applies to the questions displayed below.] The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company. Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Raw materials purchases (all direct materials) Maintenance expense-Factory equipment Factory utilities Direct labor Indirect labor Office salaries expense Rent expense-Office space Rent expense-Selling space Rent expense-Factory building Sales salaries expense Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending Required: $ 45,000 24,000 25,000 $ 154,000 159,000 46,000 2,576,000 50,000 64,000 72,000 67,000 770,000 41,100 36,400 468,000 Using the following additional information for Leone Company, complete the requirements below. Raw materials inventory, beginning Raw materials inventory,…arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. amount due for employee salaries, $4,800 actual count of supplies inventory, $ 2,300 depreciation on equipment, $3,000arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education