FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

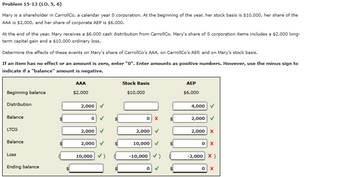

Transcribed Image Text:Problem 15-13 (LO. 5, 6)

Mary is a shareholder in CarrollCo, a calendar year S corporation. At the beginning of the year, her stock basis is $10,000, her share of the

AAA is $2,000, and her share of corporate AEP is $6,000.

At the end of the year, Mary receives a $6,000 cash distribution from CarrollCo. Mary's share of S corporation items includes a $2,000 long-

term capital gain and a $10,000 ordinary loss.

Determine the effects of these events on Mary's share of CarrollCo's AAA, on CarrollCo's AEP, and on Mary's stock basis.

If an item has no effect or an amount is zero, enter "0". Enter amounts as positive numbers. However, use the minus sign to

indicate if a "balance" amount is negative.

Beginning balance

Distribution

Balance

LTCG

Balance

Loss

Ending balance

AAA

$2,000

2,000

0

2,000

2,000

10,000 ✓)

Stock Basis

$10,000

0 X

2,000

10,000

-10,000 ✓)

0

AEP

$6,000

4,000

2,000

2,000 X

0 X

-2,000 X )

0

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cameron owns all the stock of Connor Corporation, an S corporation. Cameon's basis for the 1,000 shares is $355,000. On June 25 of the current year (assume a non-leap year), Cameron gifts 100 shares of stock to his younger brother Chase, who has been working in the business for one year. Conner Corporation reports $350,000 of ordinary income for the current year. Requirement: What amount of income is allocated to Comeron? To Chase? (Use a 365-day year for computations. Do not round intermediary calculations. Only round the amount you enter in the input field to the nearest dollar.) Question content area bottom Part 1 Ordinary income allocated Cameron Chasearrow_forwardGarth is a shareholder in a calendar year S corporation. At the beginning of 2020, his stock basis is $ 20,000, his share of the AAA is $ 4,000, and his share of corporate AEP is $ 12,000. He receives a $17,000 distribution, and his share of S corporation items includes a $ 12,000 long- term capital gain and a $( 7,000) operating loss (i.e. a non-separately stated loss) . Determine the ending balance that Garth has in his stock basis, AEP and AAAarrow_forwardHernando is a shareholder in a S corporation. At the beginning of the year, he purchased 1500 shares of the corporation for $35000. He then received a schedule K-1 for the same year reporting his share of the ordinary business income $10000. The only other item reported on schedule k-1 was $2000 cash distribution. What is Hernando year-end adbjusted basisarrow_forward

- For the current year, Sarah has salary of 50,000. In addition, she has the following capital transactions: Long-term capital gain (15%) 12,000 Short-term capital gain 8,000 Long-term capital loss (28%) (4,000) Short-term capital loss (10,000) What is her taxable income for the year? She has a short-term capital loss carry-over of 5,000 from the previous year. The standard deduction amount for her is 12,000arrow_forwardEllie and Linda are equal owners in Otter Enterprises, a calendar year business. Ellie has a basis in Otter Enterprises of $80,000 at the beginning of the year. Linda has a basis in Otter Enterprises of $60,000 at the beginning of the year. Assume that Otter Enterprises has no debt. Otter Enterprises has $320,000 of gross income and $210,000 of operating expenses. In addition, Otter has a long-term capital gain of $15,000 and makes distributions to Ellie and Linda of $25,000 each. Required: Discuss the impact of this information on the taxable income of Otter, Ellie, and Linda if Otter is:arrow_forwardJoel is a shareholder in an S corporation. He purchased 200 shares of the corporation at the beginning of the year for $25,000. His Schedule K-1 (Form 1120-S) for the same year reported ordinary business income of $1,300 in Part Ill, box 1 and $1,500 of net long-term capital gain in Part III, box 8a. What is Joel's year-end adjusted basis in the corporation? $25,000 $26,300 $26,500 $27,800 harrow_forward

- After several years of profitable operations, Javell, the sole shareholder of JBD Inc., a C corporation, sold 22 percent of her JBD stock to ZNO Inc., a C corporation in a similar industry. During the current year, JBD reports $1,200,000 of after-tax income. JBD distributes all of its after-tax earnings to its two shareholders in proportion to their shareholdings. How much tax will ZNO pay on the dividend it receives from JBD? What is ZNO's tax rate on the dividend income (after considering the DRD)? [Hint. See IRC $243.] (Round the "Tax rate on dividend income" to 2 decimal places.) ZNO's tax on dividend received ZNO's tax rate on dividend income % www.oboocessarrow_forwardHope Corporation has a single class of common stock outstanding. Joe owns 400 shares, which he purchased for $40 per share two years ago. On April 10 of the current year, Hope distributes to its common shareholders one right to purchase for $55 one common share for each common share owned. At the time of the distribution, each common share is worth $85, and each right is worth $40. On September 10, Joe sells 200 rights for $5,000 and exercises the remaining 200 rights. On November 10, he sells for $90 each 167 of the shares acquired through exercise of the rights. Read the requirements. Amount of gain or loss 10880 Character of gain or loss long-term capital gain Requirement c. What are the amount and character of gain or loss Joe recognizes upon exercising the rights? (Enter a 0 for a zero amount. If the amount is zero, select "n/a" in the character column.) Joe Amount of gain or Character of gain or loss loss Requirement d. What are the amount and character of gain or loss Joe…arrow_forwardOn January 2, Chaz transfers cash of $165,800 to a newly formed corporation for 100% of the stock. In its initial year, the corporation has net income of $41,450. The income is credited to the earnings and profits account of the corporation. The corporation distributes $12,435 to Chaz. If an amount is zero, enter "0". a. How do Chaz and the corporation treat the $12,435 distribution? Chaz has a of $ and the corporation has a deduction of $ b. Assume, instead, that Chaz transfers to the corporation cash of $82,900 for stock and cash of $82,900 for a note of the same amount. The note is payable in equal annual installments of $8,290 and bears interest at the rate of 6%. No distributions are made during the year to Chaz. However, at the end of the year, the corporation pays an amount to meet the loan obligation (i.e., the annual $8,290 principal payment plus the interest due). Determine the total amount of the payment and its tax treatment to Chaz and the corporation. The corporate…arrow_forward

- Cerulean Corporation has two equal shareholders, Eloise and Olivia. Eloise acquired her Cerulean stock three years ago by transferring property worth $700,000, basis of $300,000, for 70 shares of the stock. Olivia acquired 70 shares in Cerulean Corporation two years ago by transferring property worth $660,000, basis of $110,000. Cerulean Corporation’s accumulated E & P as of January 1 of the current year is $350,000. On March 1 of the current year, the corporation distributed to Eloise property worth $120,000, basis to Cerulean of $50,000. Itdistributed cash of $220,000 to Olivia. On July 1 of the current year, Olivia sold her stock to Magnus for $820,000. On December 1 of the current year, Cerulean distributed cash of $90,000 each to Magnus and Eloise. What are the tax issues?arrow_forwardAt the beginning of the current year, Laura owns 100% of the stock of ABC Corporation. On 7/1/20, Lisa sold her stock to Mark. At the beginning of 2020, ABC Corporation had accumulated E&P of $400,000 and its current E&P for 2020 is $400,000 (prior to any distributions). ABC distributed $500,000 cash on February 15th to Laura and distributed another $500,000 cash to Mark on November 1st. How much dividend income does Mark recognize from ABC this year?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education