FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

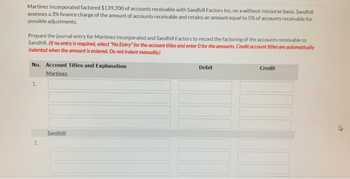

Transcribed Image Text:Martinez Incorporated factored $139,200 of accounts receivable with Sandhill Factors Inc. on a without-recourse basis. Sandhill

assesses a 3% finance charge of the amount of accounts receivable and retains an amount equal to 5% of accounts receivable for

possible adjustments.

Prepare the journal entry for Martinez Incorporated and Sandhill Factors to record the factoring of the accounts receivable to

Sandhill. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically

Indented when the amount is entered. Do not indent manually)

No. Account Titles and Explanation

Martinez

1.

2.

Sandhill

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, Amil Corp. lent $37,000 to Windsor Ltd., accepting Windsor's $49,247, three-year, zero-interest-bearing note. The implied interest is 10%.(a) Prepare Amil's journal entries for the initial transaction, recognition of interest each year assuming use of the effective interest method, and the collection of $49,247 at maturity. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit (To record initial transaction) (To record interest income in the first year) (To record interest income in the second year) (To record interest income in the third year) (To record collection at maturity)arrow_forwardWhispering Incorporated factored $126,900 of accounts receivable with Metlock Factors Inc. on a without-recourse basis. Metlock assesses a 2% finance charge of the amount of accounts receivable and retains an amount equal to 5% of accounts receivable for possible adjustments. Prepare the journal entry for Whispering Incorporated and Metlock Factors to record the factoring of the accounts receivable to Metlock. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)arrow_forwardAt the beginning of 2021, Brad’s Heating & Air (BHA) has a balance of $26,000 in accounts receivable. Because BHA is a privately owned company, the company has used only the direct write-off method to account for uncollectible accounts. However, at the end of 2021, BHA wishes to obtain a loan at the local bank, which requires the preparation of proper financial statements. This means that BHA now will need to use the allowance method. The following transactions occur during 2021 and 2022.1. During 2021, install air conditioning systems on account, $190,000.2. During 2021, collect $185,000 from customers on account.3. At the end of 2021, estimate that uncollectible accounts total 15% of ending accounts receivable.4. In 2022, customers’ accounts totaling $8,000 are written off as uncollectible.Required:1. Record each transaction using the allowance method.2. Record each transaction using the direct write-off method.3. Calculate the difference in net income (before taxes) in 2021 and…arrow_forward

- The ledger of Teal Mountain Inc. at the end of the current year shows Accounts Receivable $74,000; Credit Sales $810,000; and Sales Returns and Allowances $36,000. If Teal Mountain uses the direct write-off method to account for uncollectible accounts, journalize the entry if on December 31 Teal Mountain determines that Matisse Company's $750 balance is uncollectible. (a) If Allowance for Doubtful Accounts has a credit balance of $1,400 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 11% of accounts receivable. (b) If Allowance for Doubtful Accounts has a debit balance of $600 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 9% of accounts receivable. (c) Prepare journal entries to record the above transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) Dec.…arrow_forwardFrom inception of operations to December 31, 2020, Flounder Corporation provided for uncollectible accounts receivable under the allowance method. The provisions are recorded, based on analyses of customers with different risk characteristics. Bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account, and no-year-end adjustments to the allowance account were made. Flounder’s usual credit terms are n/30 days. The balance in allowance for doubtful accounts was $119,600 (cr.) on January 1, 2020. During 2020, credit sales totaled $8,280,000, the provision for doubtful accounts was determined to be $165,600, $82,800 of bad debts were written off, and recoveries of accounts previously written off amounted to $13,800. Flounder installed a computer system in November 2020, and an aging of accounts receivable was prepared for the first time as of December 31, 2020. A summary of aging is as follows:…arrow_forwarda)Present the journal entries for the transactions above. (b)Journalise the adjusting entry. Show workings. (c)Determine the net realizable value of the accounts receivable as at 31 Dec. (d)Is the Allowance Method of accounting for doubtful debt better compared to the direct write-off method? Explain.arrow_forward

- Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $10,000 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet 1 2 3 Record write-off of Leer Company account. Note: Enter debits before credits. Date March 11 General Journal Debit Credit Record entry Clear entry View general journal >arrow_forwardthank uarrow_forwardWood Incorporated factored €150,000 of accounts receivable with Engram Factors Inc., Without guarantee. Engram assesses a 2% finance charge of the amount of accounts receivable Retains an amount equal to 6% of accounts receivable for possible adjustments. Prepare the journal entry for Wood Incorporated and Engram Factors to record the factoring of the accounts receivable to Engram.arrow_forward

- Looking for answers. Please include all the calculations for my reference. Thanks in advance.arrow_forwardOn October 1, 2020, Ayayai, Inc. assigns $1,263,100 of its accounts receivable to Pina National Bank as collateral for a $718,300 note. The bank assesses a finance charge of 3% of the receivables assigned and interest on the note of 9%.Prepare the October 1 journal entries for both Ayayai and Pina. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)arrow_forwardGive me correct answer with explanationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education