CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

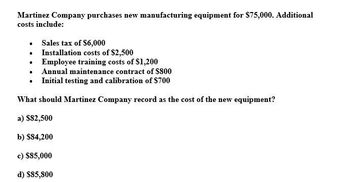

Transcribed Image Text:Martinez Company purchases new manufacturing equipment for $75,000. Additional

costs include:

⚫ Sales tax of $6,000

⚫

Installation costs of $2,500

⚫ Employee training costs of $1,200

.

Annual maintenance contract of $800

⚫ Initial testing and calibration of $700

What should Martinez Company record as the cost of the new equipment?

a) $82,500

b) $84,200

c) $85,000

d) $85,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Utica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?arrow_forwardSteele Corp. purchases equipment for $30,000. Regarding the purchase, Steele paid shipping of $1,200, paid installation fees of $2,750, pays annual maintenance cost of $250, and received a 10% discount on sales price. Determine the acquisition cost of the equipment.arrow_forwardRonson recently purchased a new boat to help ship product overseas. The following information is related to that purchase: purchase price $4,500,000 cost to bring boat to production facility $15,000 yearly insurance cost $12,000 pays annual maintenance cost of $22,000 received a 10% discount on sales price Determine the acquisition cost of the boat and record the journal entry needed.arrow_forward

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for 120,000 miles. Montello uses the units-of-production depreciation method and in year one it expects to use the truck for 23,000 miles. Calculate the annual depreciation expense.arrow_forwardHi expert please give me answer general accounting questionarrow_forwardDumb Company constructed its own factory building. The company had a P1,000,000 two-year 12% loan specifically obtained to finance the asset construction. The construction began on January 1, 2021 and the building was completed on December 30, 2022. Expenditures on the building were made as follows: January 1, 2021 P800,000April 30, 2021 300,000November 1, 2021 600,000March 1, 2022 600,000September 30, 2022 400,000Dumb has the following outstanding loans from general borrowings: 10% note issued prior to construction of new building; term, 10 years 1,500,000 12% note issued prior to construction of new building; term, 15 years 2,500,000 13) How much is total initial cost of the building? 14) How much is the finance cost that should be recognized in profit or loss for the year 2022?arrow_forward

- Nelson Company purchased equipment and incurred the following costs: Cash price = $55,000 Sales taxes = $4,400 Insurance during transit = $400 Site preparation, installation, and testing= $2,300What amount should be used as the cost basis of the equipment?arrow_forwardTullis Construction enters into a long-term fixed price contract to build an office tower for $10,300,000. In the first year of the contract Tullis incurs $2,200,000 of cost and the engineers determined that the remaining costs to complete the project are $5,800,000. Tullis billed $3,600,000 in year 1 and collected $3,500,000 by the end of the year. How much gross profit should Tullis recognize in Year 1 assuming the use of the percentage-of-completion method? (Round any intermediary percentages to the nearest hundredth percent, and round your final answer to the nearest dollar) A. $2,832,500 B. $0 C. $5,032,500 D. $632,500 13arrow_forwardTullis Construction enters into a long - term fixed price contract to build an office tower for $10,800,000. In the first year of the contract Tullis incurs $3,000,000 of cost and the engineers determined that the remaining costs to complete the project are $5,000,000. Tullis billed $3,700,000 in year 1 and collected $3,500,000 by the end of the year How much gross profit should Tullis recognize in Year 1 assuming the use of the percentage - of - completion method? (Round any intermediary percentages to the nearest hundredth percent, and round your final answer to the nearest dollar) O A. SO O B. S7,050,000 OC. $1,050,000 O D. $4,050,000arrow_forward

- teele Corp. purchases equipment for $25,000. Regarding the purchase, Steele recorded the following transactions: • Paid shipping of $1,000• Paid installation fees of $2,000• Pays annual maintenance cost of $200• Received a 5% discount on $25,000 sales price Determine the acquisition cost of the equipment.arrow_forwardThe table given below lists the relevant cost items for a specific system purchase. The operating expenses for the new system are $10,000 per year, and the useful life of the system is expected to be five years. The salvage value for depreciation purposes is equal to 25% of the hardware cost. Cost Item Cost Hardware $160,000 Training $15,000 Installation $15,000 a) What is the Book Value (BV) of the device at the end of year three if the Straight Line (SL) depreciation method is used? b) Suppose that after depreciating the device for two years with the SL method, the firm decides to switch to the double declining balance depreciation method for the remainder of the device's life (the remaining three years). What is the device's BV at the end of four years?arrow_forwardOrion Flour Mills purchased a new machine and made the following expenditures: Purchase price $ 66,000 Sales tax 5,550 Shipment of machine 910 Insurance on the machine for the first year 610 Installation of machine 1,820 The machine, including sales tax, was purchased on account, with payment due in 30 days. The other expenditures listed above were paid in cash. Required: Record the above expenditures for the new machine. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT