Concept explainers

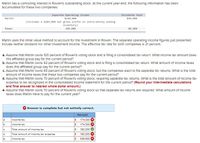

Martin has a controlling interest in Rowen's outstanding stock. At the current year-end, the following information has been accumulated for these two companies:

| Separate Operating Income | Dividends Paid | |

| Martin | $540,000 | $90,000 |

| (includes a $189,000 net gross profit in intra-entity ending inventory) | ||

| Rowen | 380,000 | 80,000 |

Martin uses the initial value method to account for the investment in Rowen. The separate operating income figures just presented include neither dividend nor other investment income. The effective tax rate for both companies is 21 percent.

-

Assume that Martin owns 100 percent of Rowen's voting stock and is filing a consolidated tax return. What income tax amount does this affiliated group pay for the current period?

-

Assume that Martin owns 92 percent of Rowen's voting stock and is filing a consolidated tax return. What amount of income taxes does this affiliated group pay for the current period?

-

Assume that Martin owns 65 percent of Rowen's voting stock, but the companies elect to file separate tax returns. What is the total amount of income taxes that these two companies pay for the current period?

-

Assume that Martin owns 70 percent of Rowen's voting stock, requiring separate tax returns. What is the total amount of income tax expense to be recognized in the consolidated income statement for the current period? (Round your intermediate calculations and final answer to nearest whole dollar amount.)

-

Assume that Martin owns 70 percent of Rowen's voting stock so that separate tax returns are required. What amount of income taxes does Martin have to pay for the current year?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Subject - account Please help me. Thankyou.arrow_forwardWaite, Incorporated owns 85% of Knight Corporation. The consolidated income statement for a year reports $60,000 Noncontrolling Interest in Knight's Net Income. Knight paid dividends in the amount of $90,000 for the year. What are the effects of these transactions in the consolidated statement of cash flows for the year? Multiple Choice Increase in the operating section of $76,500 Increase in the operating section of $76,500, and decrease in the financing section of $13,500 No effects. Decrease in the financing section of $13.500 M A Sep 16 5:00arrow_forwardGarrison holds a controlling interest in Robertson’s outstanding stock. For the current year, the following information has been gathered about these two companies: Garrison RobertsonSeparate $300,000 $200,000operating income (includes $50,000 intra-entity gross profit in ending inventory)Dividends paid ...32,000 50,000Tax rate . . . . . . . . . 40% 40% Garrison uses the initial value method to account for the investment in Robertson. Garrison’s separate operating income figure does not include dividend income for the current year.a. Assume that Garrison owns 80 percent of Robertson’s voting stock. On a consolidated tax return, what amount of income tax is paid?b. Assume that Garrison owns 80 percent of Robertson’s voting stock. On separate tax returns, what total amount of income tax is paid?c. Assume that Garrison owns 70 percent of Robertson’s voting stock. What total amount of income…arrow_forward

- Sykora Company owns 80% of Walton Company. Information reported by Sykora and Walton as of the current year end follows. Assume Walton issues 60,000 additional shares of previously authorized but unissued common stock solely to outside investors (none to Sykora) for $14 cash per share. Indicate the financial statement effects of this stock issuance on Sykora using the financial statement effects template. I need help figuring out Noncash assets and Contributed Capital. Please don't provide solution in an image based answers thanksarrow_forwardAn investor company owns 40% of the outstanding common stock of an investee company, which allows the investor to exercise significant influence over the investee. The Equity Investment was reported at $1,050,000 as of the end of the previous year. During the year, the investor received dividends of $110,000 from the investee. The investee reports the following income statement for the year: Revenues Expenses $2,700,000 1,800,000 900,000 100,000 Comprehensive income $1,000,000 a. How much equity income should the investor report in its net income (i.e., as part of the current year income statement)? Net income Other comprehensive income $0 b. What amount should the investor report for the Equity Investment in its balance sheet at the end of the year? $0arrow_forwardMozart Co. owns 35% of Melody Inc. Melody pays $50,000 in cash dividends to its shareholders for the period. Mozart's entry to record the Melody dividend includes a? O Debit to Cash for $50,000 O Credit to Cash for $17,500 Credit to Investment Revenue for $50,000 O Credit to Equity Method Investments for $17,500arrow_forward

- Martin has a controlling interest in Rowen’s outstanding stock. At the current year-end, the following information has been accumulated for these two companies: Separate Operating Income Dividends Paid Martin $500,000 $90,000 (includes a $90,000 net gross profit in intra-entity ending inventory) Rowen 240,000 80,000 Martin uses the initial value method to account for the investment in Rowen. The separate operating income figures just presented include neither dividend nor other investment income. The effective tax rate for both companies is 21 percent. Assume that Martin owns 70 percent of Rowen’s voting stock, requiring separate tax returns. What is the total amount of income tax expense to be recognized in the consolidated income statement for the current period? (Round your intermediate calculations and final answer to nearest whole dollar amount.) Assume that Martin owns 70 percent of Rowen’s voting stock so that separate tax returns are required.…arrow_forwardHow would I go about finding the income and dividends. I am not sure weather I'm supposed to subtract $24,000 from $78,000?arrow_forwardOn January 2, 20Y4, Whitworth Company acquired 40% of the outstanding stock of Aloof Company for $340,000. For the year ended December 31, 20Y4, Aloof Company earned income of $180,000 and paid dividends of $10,000. On January 31 20Y5, Whitworth Company sold all of its investment in Aloof Company stock for $405,000. Journalize the entries for Whitworth Company for the purchase of the stock, the share of Aloof income, the dividends received from Aloof Company, and the sale of the Aloof Company stock. If an amount box does not require an entry, leave it blank. Jan. 2, 20Y4 - Purchase Dec. 31, 20Y4 - Income Dec. 31, 20Y4 - Dividends Jan. 31, 20Y5 - Salearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education