FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

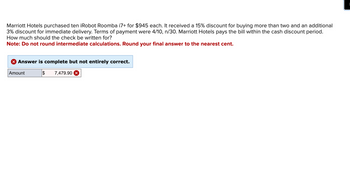

Transcribed Image Text:Marriott Hotels purchased ten iRobot Roomba i7+ for $945 each. It received a 15% discount for buying more than two and an additional

3% discount for immediate delivery. Terms of payment were 4/10, n/30. Marriott Hotels pays the bill within the cash discount period.

How much should the check be written for?

Note: Do not round intermediate calculations. Round your final answer to the nearest cent.

Answer is complete but not entirely correct.

Amount

$ 7,479.90

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An invoice dated April 22 shows a net price of $175.00 with the terms 3/10, n/30. What is the latest date the cash discount is allowed?arrow_forwardSimmons Corporation can borrow from its bank at 21 percent to take a cash discount. The terms of the cash discount are 2.5/14, net 50. Compute the cost of not taking the cash discount. Note: Use a 360-day year. Do not round intermediate calculations. Input your final answer as a percent rounded to 2 decimal places.arrow_forwardOn June 04, FDN Company sold merchandise to ABC Company and accepted a 90-day, 12% P90,000 note. After 30 days, FDN Company decided to discount the note to XYZ Bank that offers a 14% discount rate. How much is the cash received upon discounting?arrow_forward

- Dineshbhaiarrow_forwardA couch is priced at $980.00 if bought for cash. On the stores installment plan, a down payment of $100 and 24 payments of $45 each are required. What is the finance charge?arrow_forwardMax Corp. sold goods for $36,000 on July 17, 2020, and accepted a 12%, 90-day note. On August 1, the note was sold to a bank at a 15% discount rate. Required: a. Compute the proceeds. Assume a 360-day year. b. If the maker dishonored the note at maturity, prepare the entry for Max Corp. assuming $75 of bank protest fees. If an amount box does not require an entry, leave it blank.arrow_forward

- As a jewelry store manager, you want to offer credit, with interest on outstanding balances paid monthly. To carry receivables, you must borrow funds from your bank at a nominal 10%, monthly compounding. To offset your overhead, you want to charge your customers an EAR (or EFF%) that is 3% more than the bank is charging you. What APR rate should you charge your customers? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardFIGURE OUT THE NEW STATEMENT BALANCE. You have a credit card that charges 18.99% on any outstanding balances, and 25% on cash advances, plus a fee of 3% of the amount of the cash advance. The closing date on the credit card is the 1st of each month. Last month you left a balance of $1800 on your credit card. This month you took out a cash advance of $450 and made $1600 in additional purchases. You made a payment of $950. What will the total of your new balance be on your next credit card statement, taking into account finance charges?arrow_forward6. A business allows customers to pay with a credit card or with cash. If paid with cash, the customer receives a discount of 100r%, where 0arrow_forward

- Question: Presented below is the information for Skysong Company. Beginning of the year Accounts Receivable balance was $23600. Net sales (all on account) for the year were $103100. Skysong does not offer cash discounts. Collections on accounts receivable during the year were $90300. Skysong is planning to factor some accounts receivables at the end of the year. Accounts totaling $14100 will be transfered to Credit Factors, Inc with recourse. Credit Factor will retain 7% of the balances for probable adjustments and assesses a finance charge of 6%. The fair value of the recourse obligation is $1021. Prepare the journal entry to record the sale of the receivables. Compute Skysongs accounts receivable turnover for the year, assuming the receivables are sold.arrow_forwardAmerican Express and other credit card issuers must by law print the Annual Percentage Rate (APR) on their monthly statements. If the APR is stated to be 17.25%, with interest paid monthly, what is the card's EFF%? Select the correct answer. a. 18.68% b. 12.88% c. 9.98% d. 24.48% e. 15.78%arrow_forwardWhat does "2/10" mean, with respect to "credit terms of 2/10, n/30"? A. A discount of 2 percent will be allowed if the invoice is paid within 10 days of the invoice date. B. Interest of 2 percent will be charged if the invoice is paid after 10 days from the date on the invoice. C. A discount of 10 percent will be allowed if the invoice is paid within two days of the invoice date. D. Interest of 10 percent will be charged if invoice is paid after two days.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education