Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

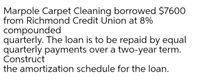

Transcribed Image Text:Marpole Carpet Cleaning borrowed $7600

from Richmond Credit Union at 8%

compounded

quarterly. The loan is to be repaid by equal

quarterly payments over a two-year term.

Construct

the amortization schedule for the loan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A property is available for sale that could normally be financed with a fully amortizing $82,000 loan at a 10 percent rate with monthly payments over a 25-year term. Payments would be $745.13 per month. The builder is offering buyers a mortgage that reduces the payments by 50 percent for the first year and 25 percent for the second year. After the second year, regular monthly payments of $745.13 would be made for the remainder of the loan term. Required: a. How much would you expect the builder to have to give the bank to buy down the payments as indicated? b. Would you recommend the property be purchased if it was selling for $5,000 more than similar properties that do not have the buydown available? Complete this question by entering your answers in the tabs below. Required A Required B How much would you expect the builder to have to give the bank to buy down the payments as indicated? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Down…arrow_forwardThe payment necessary to amortize a 4.9% loan of $86,000 compounded annually, with 4 annual payments is $24,196.70. The total of the payments is $96,786.80 with a total interest payment of $10,786.80. The borrower made larger payments of $25,000.00. Calculate (a) the time needed to pay off the loan, (b) the total amount of the payments, and (c) the amount of interest saved. a. The time needed to pay off the loan with payments of $25,000.00 is _____ years. (Round up to the nearest year.) b. The total amount of the payments is $______ (Round to the nearest cent as needed.) c. The amount of interest saved is $______. (Round to the nearest cent as needed.)arrow_forwardChuck’s Publishing, Inc. borrows $30,000 from Citicorp to finance the purchase of a new office cooling system. The loan has an interest rate of 12% and Chuck’s will be required to make annual payments for the next 3 years. Fill in the following loan amortization schedule for this transaction.arrow_forward

- A firm purchases 150 acres of land for $195,000 and agrees to remit 17 equal annual end-of-year installments of $25,831.94 each. What is the true annual interest rate on this loan?arrow_forwardThe payment necessary to amortize a 4.5% loan of $81,000 compounded annually, with 5 annual payments is $18,451.12. The total of the payments is $92,255.60 with a total interest payment of $11,255.60. The borrower made larger payments of $19,000.00. Calculate (a) the time needed to pay off the loan, (b) the total amount of the payments, and (c) the amount of interest saved. Thank you~arrow_forwardTo pay for remodeling, the company will take out a $500,000 five-year loan at 9.5% interest, compounded quarterly. The terms of the loan have been entered in the Loan Analysis worksheet. In cell B8, calculate the quarterly payment on the loan based on the loan conditions already entered. Complete the amortization schedule in cells B11 through E30. Column B contains the interest payment for each quarter, and column C contains the principal payment. Column D contains the remaining principal at the start of each month. The initial principal remaining is $500,000. The subsequent remaining principal values are reduced by the principal payment made in the previous quarter. Calculate the ending balance in cell D31. Use the IPMT function in cell B11 to calculate the interest amount paid per period. Copy this formula to cell B30. Use the PPMT function in cell C11 to calculate the principal amount paid per period. Copy this formula to cell C30. Write a formula in cell D11 to indicate the…arrow_forward

- To pay for remodeling, the company will take out a $500,000 five-year loan at 9.5% interest, compounded quarterly. The terms of the loan have been entered in the Loan Analysis worksheet. In cell B8, calculate the quarterly payment on the loan based on the loan conditions already entered. Complete the amortization schedule in cells B11 through E30. Column B contains the interest payment for each quarter, and column C contains the principal payment. Column D contains the remaining principal at the start of each month. The initial principal remaining is $500,000. The subsequent remaining principal values are reduced by the principal payment made in the previous quarter. Calculate the ending balance in cell D31. Use the IPMT function in cell B11 to calculate the interest amount paid per period. Copy this formula to cell B30. Use the PPMT function in cell C11 to calculate the principal amount paid per period. Copy this formula to cell C30. Write a formula in cell D11 to indicate the…arrow_forwardOn January 1, 2022, Anderson Company purchased a machine with a cost of $14,409.50. To complete the purchase, Anderson signs a note specifying monthly payments of $600 beginning one month from the purchase date. The interest rate is 18% compounded monthly. How many payments will Anderson make for this loan? What is the total amount of interest that Anderson will pay over the life of this loan?arrow_forwardprepare an amortization schedule showing the first four payments for each loan. Large semitrailer trucks cost $110,000 each. Ace Trucking buys such a truck and agrees to pay for it by a loan that will be amortized with 9 semiannual payments at 8% compounded semiannually.arrow_forward

- Calculate and print out the balance due, principal payment, and interest payment for each period of a new car loan. The nominal interest is 8% per year, compounded monthly. Payments are made monthly for 5 years. The original loan is for $27,000.arrow_forwardDejardines Financial has provided a $53, 217 loan to Your Finished Inc. that earns interest at a rate of 6.5% compounded monthly. The loan is to be paid back in equal payments at the end of each month over a three-year term. In addition to the amortization schedule, how much interest was paid over the life of the loan? Complete the amortization table for the 3 years of the loan.arrow_forwardAmortizationThe accountant requests a loan of $2,000 from a bank; agrees to make quarterly payments, for two years, at a rate of 24% compounded monthly. Make an amortization table.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education