Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

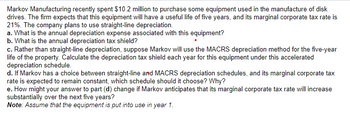

Transcribed Image Text:Markov Manufacturing recently spent $10.2 million to purchase some equipment used in the manufacture of disk

drives. The firm expects that this equipment will have a useful life of five years, and its marginal corporate tax rate is

21%. The company plans to use straight-line depreciation.

a. What is the annual depreciation expense associated with this equipment?

b. What is the annual depreciation tax shield?

c. Rather than straight-line depreciation, suppose Markov will use the MACRS depreciation method for the five-year

life of the property. Calculate the depreciation tax shield each year for this equipment under this accelerated

depreciation schedule.

d. If Markov has a choice between straight-line and MACRS depreciation schedules, and its marginal corporate tax

rate is expected to remain constant, which schedule should it choose? Why?

e. How might your answer to part (d) change if Markov anticipates that its marginal corporate tax rate will increase

substantially over the next five years?

Note: Assume that the equipment is put into use in year 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Kopperud Electronics has an investment opportunity to produce a new HDTV. Therequired investment on January 1 of this year is $150 million. The depreciation value forthis company, expressed in nominal terms, is calculated by depreciating the investmentto zero using the straight-line method over four years. The investment has no resale valueafter completion of the project. The firm has a 22 percent tax rate. The price of theproduct will be $471 per unit, in real terms, and will not change over the life of theproject. Labor costs for Year 1 will be $16.05 per hour, in real terms, and will increase at1 percent per year in real terms. Energy costs for Year 1 will be $4.38 per physical unit,in real terms, and will increase at 2 percent per year in real terms. The inflation rate is4 percent per year. Revenues are received and costs are paid at year-end. Refer to thefollowing table for the production schedule:The real discount rate for the project is 7 percent. Calculate the NPV of this…arrow_forwardMarston Co is a manufacturing company that wishes to evaluate an investment in new production machinery. The machinery would enable the company to satisfy increasing demand for existing products and the investment is not expected to lead to any change in the existing level of business risk of Marston Co. The machinery will cost $4.5 million, payable at the start of the first year of operation and is not expected to have any scrap value. Annual before tax net cash flow of $850,000 per year would be generated by the investment in each of the five years of its expected operating life. These net cash inflows are before taking account of expected inflation of 4% per year. Initial investment of $480,000 in working capital would also be required, followed by incremental annual investment to maintain the purchasing power of working capital. Marston Co has in issue seven million shares with a market value of $4.30 per share. The equity beta for the company is 1.4. The yield on short term…arrow_forwardYour Company is considering a new project that will require $2,000,000 of new equipment at the start of the project. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of $250,000 using straight-line depreciation. The cost of capital is 12%, and the firm's tax rate is 21%. Estimate the present value of the tax benefits from depreciation. Multiple Choice A. $68,250 B. $207,646 C. $175,000 D. $988,789arrow_forward

- What is the NPV assuming a 12% rate of return. (ignore Tax) Bramble Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Depreciation is $10, 230 per year for the old equipment. The straight-line depreciation method would be used for the new equipment over an eight-year period with salvage value of $4,600. Calculate NPV assuming a 12% rate of return Bramble Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Cost Old Equipment Accumulated depreciation Remaining life Current salvage value Salvage value in 8 years Annual cash operating costs $81,840 Cost $41,000 8 years $11,200 $0 $35,700 New Equipment Estimated useful life Salvage value in 8 years Annual cash operating costs $38,000 8 years $4,600 $30,700 Depreciation is $10,230 per…arrow_forwardProblem 1: American Company is considering a new product whose data are shown below. The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero-salvage value, and no change in net operating working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. However, this project would compete with other American products and would reduce their pre-tax annual cash flows. What is the project's NPV? IRR? Briefly discuss the results. 10.0% -$5,000 $80,000 WACC Pre-tax cash flow reduction for other products (cannibalization) Investment cost (depreciable basis) Annual sales revenues Annual operating costs (excl. depreciation) Tax rate $67,500 -$25,000 35.0%arrow_forwardTaxes are costs, and, therefore, changes in tax rates can affect consumer prices, project lives, and the value of existing firms. Evaluate the change in taxation on the valuation of the following project: Assumptions: Tax depreciation is straight-line over three years. Pre-tax salvage value is 25 in Year 3 and 50 if the asset is scrapped in Year 2. Tax on salvage value is 40% of the difference between salvage value and book value of the investment. The cost of capital is 20%. 4. Would it now make sense to terminate the project after two rather than three years? 5. How would your answers change if the corporate income tax were abolished entirely? NOTE: The three initial question was sent before these last two. please clarify the answer as much as possible in the Excel spreadsheet. The table to the question is attchedThank youarrow_forward

- what is the present value of the tax shield for the following project? the initial investment is $300,000. the project will last for 6 years, at which time the asset will be sold for $90,000. the asset will be depreciated on a declining balance basis at a rate of 20 percent. the firm's marginal tax rate is 40 percent. the firm's required rate of return is 8 percent a) 16,204.36 b) 82,539.68 c) 98,744.04 d) 66,335.32arrow_forward(a) New manufacturing equipment costs $225,000, salvage value is $25,000, and average annual earnings of $20,000 after taxes is expected. Find the average annual rate of return. If the earnings are doubled, then what is the rate?(b) Investment for new equipment is $100,000, and the salvage value is $10,000. Average yearly earnings from this equipment are $15,000 after taxes. What is the non-time-value-ofmoney return? When is the payback?arrow_forwardYour firm is considering investing in a new capital project that requires an initial investment of $8,000,000. This equipment will be depreciated by the straight-line over four years down to a value of zero. The machinery also has an operation life of four years. At the end of that life, you estimate it will have a salvage value of $120,000. Any gain or loss on the resell will be taxed at the firm's marginal tax rate. During the four-year life, the project should generate annual cash flows of $225,000 per year. The firm has a marginal tax rate of 22%, and it requires a return of 8.50% on projects of such risk. What is the Net Present Value of this project?arrow_forward

- A corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 25%. If the firm wants 15% return on investment after taxes, how much can it afford to pay for this machine? Click the icon to view the MACRS depreciation schedules Click the icon to view the interest factors for discrete compounding when /- 15% per year. If the firm wants 15% return on investment after taxes, it can afford to pay thousand for this machine. (Round to one decimal place.)arrow_forwardNguyen Company has an opportunity to purchase an asset that will cost company $59,000. The asset is expected to add $23,000 per year to the company’s net income. Assuming the asset has a five-year useful life and zero salvage value, the unadjusted rate of return based on the average investment will be ?arrow_forwardJ.B. Enterprises is considering the purchase of new equipment with a cost of $1,000,000. If the equipment is purchased, the incremental net cash flows are expected to be $300,000 per year for five years. These net cash flows already reflect the of the equipment and the company’s 40% tax rate. However, there are liability risks associated with the use of this product. The board of directors estimates a “cost of worry” of $25,000 per year. Calculate the net present value of this project incorporating the cost of worry if the company’s cost of capital is 10%. a. $42,466 b. $340,909 c. $375,000 d. $61,420arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education