FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

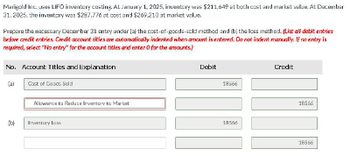

Transcribed Image Text:Marigold Inc. uses LIFO inventory costing. At January 1, 2025, inventory was $211,649 at both cost and market value. At December

31, 2025, the inventory was $287,776 at cost and $269,210 at market value.

Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method and (b) the loss method. (List all debit entries

before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No entry" for the account titles and enter 0 for the amounts.)

No. Account Titles and Explanation

(a)

(b)

Cost of Goods Sold

Allowance to Reduce Inventory to Market

Inventory Loss

Debit

18566

18566

Credit

18566

18566

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You have the following information for Carla Vista Inc. for the month ended October 31, 2025. Carla Vista uses a periodic system for inventory. Date Description Units Unit Cost or Selling Price Oct. 1 Beginning inventory 55 $26 Oct. 9 Purchase 130 28 Oct. 11 Sale 95 45 Oct. 17 Purchase 95 29 Oct. 22 Sale 55 50 Oct. 25 Purchase 65 31 Oct. 29 Sale 105 50 (a1) (a2) Calculate ending inventory, cost of goods sold, and gross profit under each of the following methods. 1. LIFO. 2. FIFO. 3. Average-cost. (Round answers to 0 decimal places, e.g. 125.) AVERAGE-COST $ LIFO FIFO Ending inventory $ $ Cost of goods sold $ SA $ $ +A Gross profit $ $ $ +A eTextbook and Media Attempts: 0 of 3 used Submit Answerarrow_forwardFischer, Inc. had the following inventory in fiscal 2019. The company uses the average cost method of accounting for inventory. Beginning Inventory, January 1, 2019: 100 units @ $10.00 Purchase of inventory, June 1, 2019: 200 units @ $12.00 Sale of inventory, November 1, 2019: 150 units What amount is reported as cost of goods sold?arrow_forwardAssume the perpetual inventory system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless stated otherwise. Journalizing purchase and sales transactions On November 4, 2018, Cain Company sold merchandise inventory on account to Tarin Wholesalers, $12,000, that cost $4,800. Terms 3/10, n/30. On November 5, 2018, Tarin Wholesalers paid shipping of $30. Tarin Wholesalers paid the balance to Cain Company on November 13, 2018. Requirements Journalize Tarin Wholesaler’s November transactions. Journalize Cain Company’s November transactions.arrow_forward

- Ayayai Company had the following account balances at year-end: Cost of Goods Sold $63,840; Inventory $14,610; Operating Expenses $30,650; Sales Revenue $121,130; Sales Discounts $1,130; and Sales Returns and Allowances $1,850. A physical count of inventory determines that merchandise inventory on hand is $13,080.arrow_forwardRiverbed Company had the following account balances at year-end: Cost of Goods Sold $62,380, Inventory $14,410, Utilities Expense $32,500, Sales Revenue $126,790, Sales Discounts $1,170, and Sales Returns and Allowances $1,700. A physical count of inventory determines that merchandise inventory on hand is $12,360. They use the perpetual inventory system. (a) Prepare the adjusting entry necessary as a result of the physical count. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount (b) Prepare closing entries. (List all debit entries before credit entries. Credit account titles are automatically…arrow_forwardLitton Industries uses a perpetual inventory system. The company began its fiscal year with inventory of $268,000. Purchases of merchandise on account during the year totaled $850,000. Merchandise costing $903,000 was sold on account for $1,430,000. Prepare the journal entries to record these transactions. (If no entry is required for a transaction/event, select "No journal entry required" In the first account fleld.) View transaction list Journal entry worksheet < 1 2 3 Record the merchandise purchased on account for $850,000. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journalarrow_forward

- wer the following independent questions and show computations supporting your answers. 1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is 2. Assume that the company uses the average cost method. The value of the ending inventory on Decemb $. 3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 isarrow_forward.arrow_forwardThe following details taken from the books of DiDi Sdn Bhd for the year ending 31 December 2020. DiDi Sdn Bhd Statement Profit or Loss for the year ending 31 December 2020 (extract) RM RM Gross profit 44,700 Add : Discount received 410 Profit on sale of van 620 1,030 45,730 Less: Expenses Motor expenses 1,940 Wages 17,200 General expenses 830 Bad debts 520 Increase in allowance for doubtful debts 200 Depreciation : van 1,800 22,490 23,240 Statement of Financial Position as at 31 December 2019 2020 RM RM RM RM Non-current Assets Vans at cost 15,400 8,200 less Depreciation (5,300) (3,100) 10,100 5,100 Current Assets Inventory 18,600 24,000 Trade accounts receivables less provision*…arrow_forward

- Nittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Inventory, December 31, prior year For the current year: Purchase, March 21 Purchase, August 1 Inventory, December 31, current year Ending inventory Cost of goods sold FIFO Units 1,960 LIFO 5,100 2,950 4,030 Required: Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods. Note: Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount. Unit Cost $5 Average Cost 7 8arrow_forwardPresented below is selected information related to Metlock, Inc. for the year ended January 31, 2022. Ending inventory per Insurance expense $ 11,150 perpetual records $ 31,180 Rent expense 21,280 Ending inventory actually Salaries and wages expense 55,630 on hand 30,480 Sales discounts 11,090 Cost of goods sold 218,770 Sales returns and allowances 15,740 Freight-out 7,290 Sales revenue 404,680 Prepare the necessary adjusting entry for inventory.arrow_forwardVermont Resources, which uses the FIFO inventory costing method, has the following account balances at August 31, 2025, prior to releasing the financial statements for the year: $ Merchandise Inventory, ending Cost of Goods Sold Net Sales Revenue 14,800 67,000 118.000 Date Aug. 31 Requirement 1. Prepare any adjusting journal entry required from the given information. (Record debits first, then credits. Select the explanation on the last line of the journal entry. For situations that do not require an entry, make sure to select "No entry required" in the first cell in the "Accounts" column and leave all other cells blank.) Accounts and Explanation X Debit Credit C Requirements 1. 2. Vermont has determined that the current replacement cost (current market value) of the August 31, 2025, ending merchandise inventory is $12,500. Read the requirements. Prepare any adjusting journal entry required from the information given. What value would Vermont report on the balance sheet at August 31,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education