Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

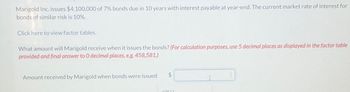

Transcribed Image Text:Marigold Inc. issues $4,100,000 of 7% bonds due in 10 years with interest payable at year-end. The current market rate of interest for

bonds of similar risk is 10%.

Click here to view factor tables.

What amount will Marigold receive when it issues the bonds? (For calculation purposes, use 5 decimal places as displayed in the factor table

provided and final answer to O decimal places, e.g. 458,581.)

Amount received by Marigold when bonds were issued

$

10822

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Sunland Railroad Co. is about to issue $286,000 of 9-year bonds paying an 11% interest rate, with interest payable annually. The discount rate for such securities is 12%. Click here to view the factor table. In this case, how much can Sunland expect to receive from the sale of these bonds? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 0 decimal places, e.g. 2,525.) Present value of bonds $ LAarrow_forwardLaura Hall Company issued $660,000 of 10%, 20-year bonds on January 1, 2025, at 102. Interest is payable semiannually on July 1 and January 1. Laura Hall Company uses the effective-interest method of amortization for bond premium or discount. Assume an effective yield of 9.7705%. Click here to view factor tables. Prepare the journal entries to record the following. (Round intermediate calculations to 6 decimal places, e.g. 1.251247 and final answer to O decimal places, eg. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) a. The issuance of the bonds. b. The payment of interest and related amortization on July 1, 2025. C The accrual of interest and the related amortization on December 31, 2025. Date Account Titles and Explanation Debit Creditarrow_forwardPharoah Corporation issues $460,000 of 9% bonds, due in 10 years, with interest payable semiannually. At the time of issue, the market rate for such bonds is 10%. Click here to view factor tables. Compute the issue price of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) Issue price of the bonds $arrow_forward

- Urmilaarrow_forwardPina Corporation issues $450,000 of 8% bonds, due in 9 years, with interest payable semiannually. At the time of issue, the market rate for such bonds is 10%. Click here to view factor tables. Compute the issue price of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places, e.g. 58,971.) Issue price of the bonds $arrow_forwardFlint Corporation issues $430,000 of 9% bonds, due in 9 years, with interest payable semiannually. At the time of issue, the market rate for such bonds is 10%. Click here to view factor tables. Compute the issue price of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places, e.g. 58,971.) Issue price of the bondsarrow_forward

- Brin Company issues bonds with a par value of $590,000. The bonds mature in 5 years and pay 9% annual Interest in semiannual payments. The annual market rate for the bonds is 12%. (Table B.1, Table B.2, Table B.3, and Table B.4) Note: Use appropriate factor(s) from the tables provided. 1. Compute the price of the bonds as of their Issue date. 2. Prepare the journal entry to record the bonds' issuance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the price of the bonds as of their issue date. Note: Round all table values to 4 decimal places, and use the rounded table values in calculations. Round intermediate calculations to the nearest dollar amount. Table Values are Based on: Cash Flow Par (maturity) value Interest (annuity) Price of bonds n= Table Value Amount Present Value $ 0 Required 1 Prepare the journal entry to record the bonds' issuance. Note: Round intermediate calculations to the nearest dollar amount. Required 2 View…arrow_forwardCurrent Attempt in Progress × Your answer is incorrect. Marin Inc. issues $2,100,000 of 7% bonds due in 10 years with interest payable at year-end. The current market rate of interest fo bonds of similar risk is 9%. Click here to view factor tables. What amount will Marin receive when it issues the bonds? (For calculation purposes, use 5 decimal places as displayed in the factor tabl provided and final answer to O decimal places, e.g. 458,581.)arrow_forwardSheffield Corporation issues $430,000 of 9% bonds, due in 10 years, with interest payable semiannually. At the time of issue, the market rate for such bonds is 10%. Click here to view factor tables. Compute the issue price of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places, e.g. 58,971) Issue price of the bonds $arrow_forward

- jayarrow_forwardGive me correct answer with explanation.arrow_forwardMetlock Inc. issues $4,200,000 of 7% bonds due in 10 years with interest payable at year-end. The current market rate of interest for bonds of similar risk is 12%. What amount will Metlock receive when it issues the bonds?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education