FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

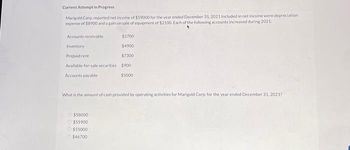

Transcribed Image Text:Current Attempt in Progress

Marigold Corp. reported net income of $59000 for the year ended December 31, 2021 Included in net income were depreciation.

expense of $8900 and again on sale of equipment of $2100. Each of the following accounts increased during 2021

Accounts receivable

$2700

Inventory

$4900

Prepaid rent

$7300

Available-for-sale securities $900

$5000

Accounts payable

What is the amount of cash provided by operating activities for Marigold Corp. for the year ended December 31, 2021?

Ⓒ$58000

Ⓒ$55900

$55000

$46700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ELS Corporation reported gross receipts for 2017-2019 for scenarios A, B, and C as follows: Year Scenario A Scenario B Scenario C 2017 $25,000,000 $24,000,000 $26,500,000 2018 $26,000,000 $26,000,000 $26,000,000 2019 $26,900,000 $28,500,000 $25,500,000 a) Is ELS allowed to use the cash method of accounting in 2020 under Scenario A? b) Is ELS allowed to use the cash method of accounting in 2020 under Scenario B? c) Is ELS allowed to use the cash method of accounting in 2020 under Scenario C?arrow_forwardRavenna Company is a merchandiser using the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 89,000 $ 106,750 Accounts receivable 71,500 77,000 Inventory 96,000 87,500 Total current assets 256,500 271,250 Property, plant, and equipment 255,000 245,000 Less accumulated depreciation 85,000 61,250 Net property, plant, and equipment 170,000 183,750 Total assets $ 426,500 $ 455,000 Accounts payable $ 56,000 $ 99,500 Income taxes payable 43,500 57,000 Bonds payable 105,000 87,500 Common stock 122,500 105,000 Retained earnings 99,500 106,000 Total liabilities and stockholders’ equity $ 426,500 $ 455,000 During the year, Ravenna paid a $10,500 cash dividend and sold a piece of equipment for $5,250 that originally cost $12,000 and had accumulated depreciation of $8,000. The company did not retire any bonds or…arrow_forwardCrane Company reported net income of $148,500. For 2020, depreciation was $45,100, and the company reported a gain on sale of investments of $12,100. Accounts receivable increased $25,100 and accounts payable decreased $23,100.Compute net cash provided by operating activities using the indirect method. Net cash provided by operating activitiesarrow_forward

- Use the indirect method to determine Anka Company’s net cash provided or used for operating activities using the below information: Net income $15,200 Depreciation expense 10,000 Cash payment on long-term note payable 8,000 Gain on sale of equipment 3,000 Increase in inventory 1,500 Increase in accounts payable 2,850 Group of answer choices $15,550 $42,400 ($4,450) $23,550arrow_forwardUse the following information from Dubuque Company's financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018: 2018 Income Statement Balance Sheets Sales Cost of Goods Sold Operating Expenses, other than depreciation expense Depreciation Expense Gain on Sale of Plant Assets $ 299,000 (135,000) (27,000) (17,000) 16,500 136,500 Net Income Dec. 31, 2018 $45,300 1,600 22,500 900 Accounts Receivable Inventory Accounts Payable Accrued Liabilities Accounts Receivable Inventory Accounts Payable Accrued Liabilities Dec. 31, 2017 $43,400 1,800 21,250 1,150 PLEASE NOTE: Use the account and term names exactly, as shown above and the accounts will be listed in the same order as shown in the textbook examples. All dollar amounts will be rounded to whole dollars using "$" and commas as needed (i.e. $12,345) and decreases will be shown with parentheses - $(12,345).arrow_forwardUsing the financial statements and notes provided below, prepare a cash flow analysis for the Penelope Company for 2019. Penelope Company Income Statement For the Year Ended December 31, 2019 $2,467,000 1,285,000 1,182,000 Revenues Cost of Goods Sold Gross Margin Operating Expenses: Selling Expenses Administrative Expenses Depreciation Total Operating Expenses Operating Income 230,000 94,000 15,000 339,000 843,000 Other Items: Loss on Sale of Patent (11,000) (42,000) (53,000) 790,000 316,000 $474,000 Interest Expense Other Items Net Income Before Taxes Тахes Net Income After Taxes A review of the notes to the financial statements revealed the following information: 1. Dividends of $210,000 were declared and paid during the year. 2. Selling Expenses include charges of $10,000 for the amortization of trademarks. 3. During 2019 the company sold the only patent that had been reflected on its balance sheet at the beginning of the year. Hint: Consider the beginning balance in the Patent…arrow_forward

- ences Hampton Company reports the following information for its recent calendar year. Income Statement Data Sales Expenses: Cost of goods sold Salaries expense Depreciation expense Net income $ 160,000 Accounts receivable increase Inventory decrease Salaries payable increase 100,000 24,000 12,000 $ 24,000 Selected Year-End Balance Sheet Data Required: Prepare the operating activities section of the statement of cash flows using the indirect method. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Cash flows from operating activities-indirect method Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities $ 10,000 16,000 1,000arrow_forwardSalud Company reports the following information. Selected Annual Income Statement Data Net income Depreciation expense Gain on sale of machinery Selected Year-End Balance Sheet Data $ 415,000 Accounts receivable increase 90,500 Prepaid expenses decrease 20,900 Accounts payable increase Wages payable decrease $ 45,200 12,900 6,400 3,100 Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Cash flows from operating activities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilitiesarrow_forwardPrepare the Cash Flow Statement for Dell Technologies Inc. for January 29th 2021 using the Direct Method. DELL TECHNOLOGIES INC. CONSOLIDATED STATEMENTS OF INCOME (LOSS) 29TH JANUARY 2021 (in millions) Net Revenue 94,224 Cost of Net Revenue (64,807) Gross Margin 29,417 Operating Expenses: Selling, General & Admin 18,998 Depreciation Expense 5,275 Total Operating Expenses (24,273) Operating Profit 5,144 Interest Expense (1,474) Pretax Income 3,670 Income Tax Expense (165) Net Profit 3,505 DELL TECHNOLOGIES INC. CONSOLIDATED STATEMENTS OF FINANCIAL…arrow_forward

- Selected financial info for Strand Corp is below: Cash Accounts receivable (net) Inventory Land Equipment Accumulated depreciation TOTAL Accounts payable Notes payable- current Notes payable- non-current Common stock Retained earnings TOTAL 2022 2021 $63,000 $42,000 $151,200 $84,000 $201,600 $168,000 $21,000 $58,800 $789,600 $504,000 ($115,600) ($84,000) $1,110,800 $772,800 $86,000 $50,400 $29,400 $67,200 $302,400 $168,000 $487,200 $420,000 $205,800 $67,200 $1,110,800 $772,800 Additional info for 2022: 1) Net Income was $235,200 2) Depreciation expense was recorded 3) Land was sold at its original cost. No other assets were sold 4) Cash dividends were paid 5) Equipment was purchased for cash REQUIRED: A) Prepare a formal Statement of Cash Flows for 2022 B) Prepare a calculation for Free Cash Flowarrow_forwardRodriguez Company completed its income statement and comparative balance sheet for the current year and provided the following information: Income Statement for Current Year Service revenue Expenses Salaries Depreciation Amortization of copyrights Other expenses Net loss Partial Balance Sheet Accounts receivable Salaries payable Other accrued liabilities $ 42,000 8,200 220 10,200 Current Year $ 9,300 13,000 1,500 Cash flows from operating activities: RODRIGUEZ COMPANY Statement of Cash Flows (Partial) $ 53,000 60,620 $ (7,620) Prior Year $ 16,600 In addition, Rodriguez bought a small service machine for $7,000. Required: 1.Present the operating activities section of the statement of cash flows for Rodriguez Company using the indirect method. Note: List loss amount and cash outflows as negative amounts. 2,000 5,200arrow_forwardReporting Net Cash Flow from Operating Activities The following information is available for Bernard Corporation for 2019: Net income $199,000 Decrease in accounts receivable 6,400 Increase in inventory 18,300 Decrease in prepaid rent 2,100 Increase in salaries payable 4,410 Decrease in income taxes payable 4,270 Increase in notes payable (due 2023) 50,000 Depreciation expense 44,700 Loss on disposal of equipment 11,000 Required: Compute the net cash flows from operating activities using the indirect method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education