FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

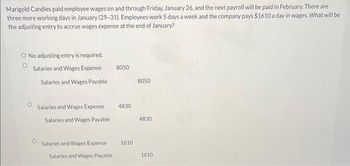

Transcribed Image Text:Marigold Candies paid employee wages on and through Friday, January 26, and the next payroll will be paid in February. There are

three more working days in January (29-31). Employees work 5 days a week and the company pays $1610 a day in wages. What will be

the adjusting entry to accrue wages expense at the end of January?

O No adjusting entry is required.

Salaries and Wages Expense

Salaries and Wages Payable

Salaries and Wages Expense

Salaries and Wages Payable

Salaries and Wages Expense

Salaries and Wages Payable

8050

4830

1610

8050

4830

1610

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sean Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. 2021 Wage-Bracket Method Tables. Round your answer to the two decimal places. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, married, 2 allowances), social security taxes, and state income tax (2%).arrow_forwardTurner Empire Co. employs 65 employees. The employees are paid every Monday for work done from the previous Monday to the end-of-business on Friday, or a 5-day work week. Each employee earns $80 per day. Required: 1. Calculate the total weekly payroll cost and the salary adjustment at March 31, 2016. 2. Prepare the adjusting entry at March 31, 2016. 3. Prepare the subsequent cash entry on April 4, 2016.arrow_forwardWage and Tax Statement Data on Employer FICA TaxEhrlich Co. began business on January 2. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and federal income tax were withheld in the required amounts. An employee who is hired in the middle of the month receives half the monthly salary for that month. All required payroll tax reports were filed, and the correct amount of payroll taxes was remitted by the company for the calendar year. Early in the following year, before the Wage and Tax Statements (Form W-2) could be prepared for distribution to employees and for filing with the Social Security Administration, the employees' earnings records were inadvertently destroyed.None of the employees resigned or were discharged during the year, and there were no changes in salary rates. The social security tax was withheld at the rate of 6.0% and Medicare tax at the rate of 1.5% on salary. Data on dates of employment, salary rates, and…arrow_forward

- Accrued Wages Skiles Company's weekly payroll amounts to $10,000 and payday is every Friday. Employees work five days per week, Monday through Friday. The appropriate journal entry was recorded at the end of the accounting period, Wednesday, August 31, 2022. Required: What journal entry is made on Friday, September 2, 2022? For those boxes in which no entry is required, leave the box blank.arrow_forwardAssume that the weekly payroll of A Inc. is $5,000. Employees work five days a week, Monday through Friday. December 31, the end of the year falls on Wednesday, but the company won't pay employees for the full week until its usual payday, Friday. What adjusting entry will A Inc., make on Wednesday, December 31? Accounts Dr. Cr. O Salaries Expense $5,000 Salaries Payable $5,000 Accounts Dr. Salaries Expense $5,000 Cash Cr. $5,000 Accounts Dr. Cr. Salaries Payable $5,000 Salaries Expense $5,000 Accounts Dr. Cr. Salaries Expense $5,000 Accumulated Salarles $5,000arrow_forwardSheffield Consulting Inc's gross salaries for the biweekly period ended August 24 were $12,500. Deductions included $743 for CPP, $235 for El, and $6,248 for income tax. The employer's payroll costs were $743 for CPP and $329 for El. Prepare journal entries to record (a) the payment of salaries on August 24; (b) the employer payroll costs on August 24, assuming they will not be remitted to the government until September; and (c) the payment to the government on September 15 of all amounts owed. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. Date Account Titles and Explanation Debit Cred (a) (b) 15 (b) (c)arrow_forward

- please assist me with workings and explanation thanksarrow_forwardGodoarrow_forwardSwifty Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below. Employee Hours Worked Hourly Rate Federal Income Tax Withholdings United Fund Ben Abel 40 $14.00 $59.00 $5.00 Rita Hager 41 16.00 64.00 5.00 Jack Never 44 13.00 60.00 8.00 Sue Perez 46 13.00 62.00 5.00 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.6%. 1. Prepare a payroll register for the weekly payroll. No employee has reached the Social Security limit of $132,900 or the FUTA/SUTA limit of $7,000 2. Journalize the payroll on March 15, 2022, and the accrual of employer payroll taxes. 3. Journalize the payment of the payroll on March 16,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education