FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

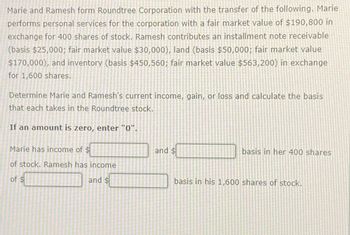

Transcribed Image Text:Marie and Ramesh form Roundtree Corporation with the transfer of the following. Marie

performs personal services for the corporation with a fair market value of $190,800 in

exchange for 400 shares of stock. Ramesh contributes an installment note receivable

(basis $25,000; fair market value $30,000), land (basis $50,000; fair market value

$170,000), and inventory (basis $450,560; fair market value $563,200) in exchange

for 1,600 shares.

Determine Marie and Ramesh's current income, gain, or loss and calculate the basis

that each takes in the Roundtree stock.

If an amount is zero, enter "0".

Marie has income of $

of stock. Ramesh has income

of $

and $

and $

basis in her 400 shares

basis in his 1,600 shares of stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aaron, Deanne, and Keon formed the Blue Bell General Partnership at the beginning of the current year. Aaron and Deanne each contributed $108,000 and Keon transferred an acre of undeveloped land to the partnership. The land had a tax basis of $72,000 and was appraised at $180,000. The land was also encumbered with a $72,000 nonrecourse mortgage for which no one was personally liable. All three partners agreed to split profits and losses equally. At the end of the first year, Blue Bell made a $6,300 principal payment on the mortgage. For the first year of operations, the partnership records disclosed the following information: Sales revenue $ 470,000 Cost of goods sold 450,000 Operating expenses 55,000 Long-term capital gains 2,100 §1231 gains 900 Charitable contributions 300 Municipal bond interest 300 Salary paid as a guaranteed payment to Deanne (not included in expenses) 3,000 a. Compute the adjusted basis of each partner’s interest in the partnership…arrow_forwardSuzy contributed assets valued at $360,000 (basis of $200,000) in exchange for her 40% interest in Suz-Anna GP (a general partnership in which both partners are active owners). Anna contributed land and a building valued at $640,000 (basis of $380,000) in exchange for the remaining 60% interest. Anna’s property was encumbered by qualified nonrecourse financing of $100,000, which was assumed by the partnership. The partnership reports the following income and expenses for the current tax year. What is the beginning and ending nonrecourse values. Beg $0 ending $40,000 What is the beginning Capital amount ? Sales $560,000 Utilities, salaries, depreciation, other operating expenses 360,000 Short-term capital gain 10,000 Tax-exempt interest income 4,000 Charitable contributions (cash) 8,000 Distribution to Suzy 10,000 Distribution to Anna 20,000 At the end of the year, Suz-Anna held recourse debt of $100,000 for partnership accounts payable…arrow_forwardPrepare your answers using excel or clearly written computations. Show your work for maximum points. 1. Marie and Ramesh form Roundtree Corporation with the transfer of the following. Marie performs personal services for the corporation with a fair market value of $80,000 in exchange for 400 shares of stock. Ramesh contributes an installment note receivable (basis $25,000; fair market value $30,000), land (basis $50,000; fair market value $170,000), and inventory (basis $100,000; fair market value $120,000) in exchange for 1,600 shares. Determine Marie and Ramesh’s current income, gain, or loss; calculate the basis that each takes in the Roundtree stock.arrow_forward

- Kesha, a sole proprietor, is engaged in a cash basis service business. In the current year, she incorporates the business to form Kiwi Corporation. She transfers assets with a basis of $500,000 (fair market value of $1,200,000), a bank loan of $450,000 (which Kiwi assumes), and $80,000 in trade payables in return for all of Kiwi’s stock. What are the tax consequences of the incorporation of the business?arrow_forwardBrett and Illain formed a new Corporation by transferring the following assets in exchange for stock:▪ Brett transferred: Property subject to a 70,000 mortgage; FMV $1,000000, Basis 500,000. In exchange, she received 200 shares of Stock and relief of the mortgage liability. ▪ Illain transferred: Inventory with a Basis of 15,000 and FMV 150,000. Required:a. What is Brett’s basis in the stock she received b. What is Brett’s recognized gain/lossarrow_forwardHi can someone help me with this please?arrow_forward

- Mr. Beaver and Ms. Duck decide to form a new corporation named BD Inc. Mr. Beaver transfers $20,000 cash, equipment (FMV $40,000; adjusted tax basis $41,500) and business inventory ($20,000 FMV; adjusted tax basis $12,000), and Ms. Duck drafts the legal documents and designs the accounting and information systems for BD. These services are valued at $10,000. BD issues 1000 shares of common stock to its two shareholders. a. How many shares should Mr. Beaver and Ms. Duck each receive? Beaver __________ Duck __________ b. Compute Mr. Beaver’s realized and recognized gain on his exchange of property for stock, and determine his tax basis in his BD common shares. Beaver realized gain ______________ Beaver recognized gain ___________ Beaver’s basis in BD stock _________ c. Compute Ms. Duck’s realized and recognized gain on her exchange of services for stock, and determine her tax basis in her BD common shares. Duck realized gain ______________ Duck recognized gain ___________…arrow_forwardErica and Brett decide to form their new motorcycle business as an LLC. Each will receive an equal profits (loss) interest by contributing cash, property, or both. In addition to the members' contributions, their LLC will obtain a $46,000 nonrecourse loan from First Bank at the time it is formed. Brett contributes cash of $4,200 and a building he bought as a storefront for the motorcycles. The building has an FMV of $41,000 and an adjusted basis of $26,000 and is secured by a $31,000 nonrecourse mortgage that the LLC will assume. What is Brett's outside tax basis in his LLC interest? Multiple Choice O $38,500 O $40,200 O $33,500 $35,200arrow_forwardAaron, Deanne, and Keon formed the Blue Bell General Partnership at the beginning of the current year. Aaron and Deanne each contributed $108,000 and Keon transferred an acre of undeveloped land to the partnership. The land had a tax basis of $72,000 and was appraised at $180,000. The land was also encumbered with a $72,000 nonrecourse mortgage for which no one was personally liable. All three partners agreed to split profits and losses equally. At the end of the first year, Blue Bell made a $6,300 principal payment on the mortgage. For the first year of operations, the partnership records disclosed the following information: Sales revenue $ 470,000 Cost of goods sold 450,000 Operating expenses 55,000 Long-term capital gains 2,100 §1231 gains 900 Charitable contributions 300 Municipal bond interest 300 Salary paid as a guaranteed payment to Deanne (not included in expenses) 3,000 Compute the adjusted basis of each partner’s interest in the partnership…arrow_forward

- Albert transfers land (basis of $140,000 and fair market value of $320,000) to Gold Corporation for 80% of its stock and a note payable in the amount of $80,000. Gold assumes Albert's mortgage on the land of $200,000. As a result of the transfer, 1. Albert has a recognized gain on the transfer of $140,000. 2. Albert has a recognized gain on the transfer of $80,000. 3. Albert has a recognized gain on the transfer of $60,000. 4. Gold Corporation has a basis in the land of $220,000. 5. None of the abovearrow_forwardWilliam, Xavier and Zelda formed WXZ Partnership. William contributed land with a fair market value of $50,000 (basis of $10,000) in exchange for a 50% interest (capital and profits/losses). Zelda contributed services worth $30,000 in exchange for a 40% profit interest (profit interest only; no capital interest). Xavier owns the remaining interest in the partnership. What is the amount of William's recognized gain on the contribution of land in exchange for his interest in the partnership?arrow_forward. Aaron, Deanne, and Keon formed the Blue Bell General Partnership at the beginning of the current year. Aaron and Deanne each contributed $110,000 and Keon transferred an acre of undeveloped land to the partnership. The land had a tax basis of $70,000 and was appraised at $180,000. The land was also encumbered with a $70,000 nonrecourse mortgage for which no one was personally liable. All three partners agreed to split profits and losses equally. Blue Bell made a $7,000 principal payment on the mortgage at the end of the first year. For the first year of operations, the partnership records disclosed the following information: Sales revenue $ 470,000 Cost of goods sold $ 410,000 Operating expenses $ 70,000 Long-term capital gains $ 2,400 §1231 gains $ 900 Charitable contributions $ 300 Municipal bond interest $ 300 Salary paid as a guaranteed payment to Deanne (not included in expenses) $ 3,000 What is the Qualified nonrecourse debt for Deanne and why.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education