Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

What are some factors Maria should consider when deciding to get the loan or the lease?

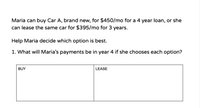

Transcribed Image Text:Maria can buy Car A, brand new, for $450/mo for a 4 year loan, or she

can lease the same car for $395/mo for 3 years.

Help Maria decide which option is best.

1. What will Maria's payments be in year 4 if she chooses each option?

BUY

LEASE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Identify housing alternatives, assess the rental option, and perform a rent to buy analysisarrow_forwardwhat financial arguments could you use to justify your proposed recommendations to segregate FLTs and the worker?arrow_forwardWhich are the other Approaches to Investing in Distressed Properties?arrow_forward

- A mortgagee is entitled to certain consideration in the event of a loss to property when indicated as the mortgagee on an insurance policy. Which one (1) of the following is the consideration? OA) The mortgagee is entitled to the proceeds of the insurance to the extent of its financial interest in the property. OB) The mortgagee is entitled to the full proceeds of the insurance. OC) The insured and the mortgagee are permitted to consider the loss and decide between them how much each will receive. OD) The insurer pays the entire loss to the insured who is required to satisfy the mortgagee.arrow_forwardWhat were your feelings about your need for life insurance before you read this chapter? What are they now? What is the difference between Term and whole life insurance? Which one do you prefer? and why?arrow_forwardHow does renter’s insurance differ from other home insurance policies?arrow_forward

- Discuss the common misconceptions of retirement planning.arrow_forwardWhich are the subjects that should always be included in a printed form of mortgage instrument is used or an attorney draws up a special form?arrow_forwardWhat are the problems with return on premium life insurance? What type of individual would purchase decreasing term insurance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education