FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

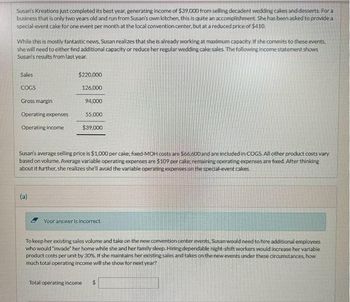

Transcribed Image Text:Susan's Kreations just completed its best year, generating income of $39,000 from selling decadent wedding cakes and desserts. For a

business that is only two years old and run from Susan's own kitchen, this is quite an accomplishment. She has been asked to provide a

special-event cake for one event per month at the local convention center, but at a reduced price of $410.

While this is mostly fantastic news, Susan realizes that she is already working at maximum capacity. If she commits to these events,

she will need to either find additional capacity or reduce her regular wedding cake sales. The following income statement shows

Susan's results from last year.

Sales

COGS

Gross margin

Operating expenses

Operating income

$220,000

(a)

126,000

94,000

55.000

$39,000

Susan's average selling price is $1,000 per cake; fixed-MOH costs are $66,600 and are included in COGS. All other product costs vary

based on volume. Average variable operating expenses are $109 per cake remaining operating expenses are fixed. After thinking

about it further, she realizes she'll avoid the variable operating expenses on the special-event cakes.

Your answer is incorrect.

To keep her existing sales volume and take on the new convention center events, Susan would need to hire additional employees

who would "invade" her home while she and her family sleep. Hiring dependable night-shift workers would increase her variable

product costs per unit by 30%. If she maintains her existing sales and takes on the new events under these circumstances, how

much total operating income will she show for next year?

Total operating income

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SERVICE REVMENUE $ 281,000 120,000 161,000 Sales revenue, net Cost of goods sold Gross profit OPERATING EXPENSES Selling expenses Wages expense - selling Fuel expense- selling Depreciation expense - selling Total selling expenses General and administrative expenses 15,000 20,000 45,000 80,000 Rent expense - administrative Office supplies expense - administrative 12,000 15,000 27,000 107,000 54,000 Total general and administrative expenses Total operating expenses Total income from operations OTHER EXPENSES Interest expense 2,000 52,000 13,000 %24 Total incorme before tax Incorme tax expense Net income 39,000 Eamings Per Share (EPS) 24 0.65 What is Carson's Bakery net profit margin? O 13.87% O 57.29% O 38.07% O 33.54%arrow_forwarda company has sales of 763000 and cost of goods sold of 306,000 its gross profit equals (457,000) 763,000 306,000 457,000 1069,000arrow_forwardUse the following information (in thousands): Service Revenue ¥1,600,000 Income from continuing operations 200,000 Net Income 180,000 Income from operations 440,000 Selling & administrative expenses 1,000,000 Income before income tax 400,000 Determine the amount of other income and expense. ¥40,000 ¥160,000 ¥200,000 ¥20,000arrow_forward

- Question :8 A A company has net sales of $125,000, cost of goods sold of $50,000, operating expenses of $35,000, and selling expenses of $11,000. What is the gross profit? A. $75,000 B. $40,000 C. $29,000 D. $50,000arrow_forwardA B C D E Sales revenue $40,400 $75,400 $573,700 $34,800 $54,100 Cost of goods sold 19,200 50,500 273,600 19,400 30,500 Operating expenses 9,800 39,800 230,700 11,800 17,900 Total expenses 29,000 90,300 504,300 31,200 48,400 Operating profit (loss) $11,400 $(14,900) $69,400 $3,600 $5,700 Identifiable assets $34,500 $80,000 $501,100 $64,700 $50,400 Sales of segments B and C included intersegment sales of $20,000 and $101,000, respectively. (a) Determine which of the segments are reportable based on the: 1. Revenue test. 2 Operating profit (loss) test. 3. Identifiable assets test. Reportable Segmentarrow_forwardGross profit margin 2400 how is the estimate operating costarrow_forward

- Suresh Company reports the following segment (department) income results for the year. Department N Department 0 Department P $36,000 $ 57,000 $ 43,000 Sales Expenses Avoidable. Unavoidable Total expenses Income (loss) Department M $ 64,000 otal increase in income 10,300 52,200 62,500 $1,500 37,000 13,200 50,200 $ (14,200) $ 30,000 22,700 4,300 27,000 $ 30,000 14,500 30,000 44,500 $ (1,500) Department T $ 29,000 38,700 10,500 49,200 $ (20,200) Total $ 229,000 123,200 110,200 Compute the total increase in income if the departments with sales less than avoidable costs, as identified in part a, are eliminated 233,400 $ (4,400)arrow_forwardQ5 Revenues Cost of Goods Sold Gross Profit Selling, General and Admin Depreciation EBIT Income tax (35%) Incremental Earnings Capital Purchases Changes to NWC Year 0 Year 1 -280,0 00 Year 2 140,00 440,00 0 0 -70,00 220,00 0 0 Year 3 Year 4 440,00 350.00 0 0 220,00 175,00 0 0 70,000 220,00 220,00 0 0 -6400 6400 6400 175,00 0 6400 75.00 75.000 75,000 75,000 0 -11,40 138,60 138.60 93,600 0 0 0 3990 -48,51 48,51 0 32,76 0 0 -7410 90,090 90,090 60,840 -5.000 -5,000 -5,000 -5,000 A garage is installing a new "bubble-wash" car wash. It will promote the car wash as a fun activity for the family, and it is expected that the novelty of this approach will boost sales in the medium term. If the cost of capital is 10%, what is the net present value (NPV) of this project? Show all calculationsarrow_forwardSales Revenue Cost of Goods Sold Income from Operations Selling and Administrative Expenses Budgeted Income Statement For the Year Ending December 31, 2022 Income from Operations Interest Expense Income before Income Taxes Interest Expense Not Income (Loss) $ 326,400 (166,380) i 160,020 88,500 i 71,520 (4,130 67,390 (13,478 53912arrow_forward

- PLZZ EXPLAINarrow_forward12arrow_forwardFrom the following information, compute percent change in operating income for the current year. Sales for the previous year $210,000 Contribution margin 181,000 Fixed costs 125,000 Operating income 36,000 Assume that sales for the current year increased by 17%. a.86% b.92% c.74% d.96%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education