FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

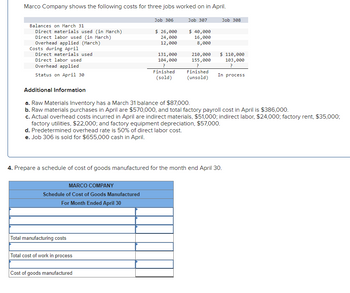

Transcribed Image Text:Marco Company shows the following costs for three jobs worked on in April.

Job 306

$ 26,000

24,000

12,000

Balances on March 31

Direct materials used (in March)

Direct labor used (in March)

Overhead applied (March)

Costs during April

Direct materials used

Direct labor used

Overhead applied

Status on April 30

MARCO COMPANY

Schedule of Cost of Goods Manufactured

For Month Ended April 30

Total manufacturing costs

131,000

104,000

?

Total cost of work in process

Finished

(sold)

Cost of goods manufactured

Job 307

$ 40,000

16,000

8,000

210,000

155,000

Finished

(unsold)

Additional Information

a. Raw Materials Inventory has a March 31 balance of $87,000.

b. Raw materials purchases in April are $570,000, and total factory payroll cost in April is $386,000.

c. Actual overhead costs incurred in April are indirect materials, $51,000; indirect labor, $24,000; factory rent, $35,000;

factory utilities, $22,000; and factory equipment depreciation, $57,000.

d. Predetermined overhead rate is 50% of direct labor cost.

e. Job 306 is sold for $655,000 cash in April.

Job 308

4. Prepare a schedule of cost of goods manufactured for the month end April 30.

$ 110,000

103,000

In process

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Direct Labor Costs August, Carrothers Company accumulated 790 hours of direct labor costs on Job 50 and 500 hours on Job 56. The total direct labor was incurred at a rate of $15 per direct labor hour for Job 50 and $13 per direct labor hour for Job During 56. Journalize the entry to record the flow of labor costs into production during August. If an amount box does not require an entry, leave it blank.arrow_forwardApplying factory overhead Instructions Chart of Accounts Factory Overhead Journal Instructions Bergan Company estimates that total factory overhead costs will be $620,000 for the year. Direct labor hours are estimated to be 80,0000. Required: a. For Bergan Company, determine the predetermined factory overhead rate using direct labor hours as the activity base. If required, round your answer to two decimal places. b. During May, Bergan Company accumulated 2,500 hours of direct labor costs on Job 200 and 3,000 hours on Job 305. Determine the amount of factory overhead applied to Jobs 200 and 305 in May. c. Prepare the journal entry on May 31 to apply factory overhead to both jobs in May according to the predetermined overhead rate, Refer to the chart accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debit or credit entries. Do not add explanations or skip a line between journal…arrow_forwardRequired information [The following information applies to the questions displayed below.) Watercraft's predetermined overhead rate is 200% of direct labor. Information on the company's production activities during May follows. a. Purchased raw materials on credit, $220,000. b. Materials requisitions record use of the following materials for the month. Job 136 Job 137 Job 138 Job 139 Job 140 Total direct materials Indirect materials $ 49,500 34,000 20,000 22,800 6,400 132,700 20,500 Total materials requisitions $ 153,200 c. Time tickets record use of the following labor for the month. These wages were paid in cash. Job 136 Job 137 $ 12,100 Job 138 Job 139 Job 140 Total direct labor Indirect labor Total labor cost 10,700 37,900 39,000 4,000 103,700 26,500 $ 130,200 d. Applied overhead to Jobs 136, 138, and 139. e. Transferred Jobs 136, 138, and 139 to Finished Goods Inventory. f. Sold Jobs 136 and 138 on credit at a total price of $540,000. g. Recorded the cost of goods sold for Jobs…arrow_forward

- Applying Factory Overhead Instructions Chart of Accounts Factory Overhead Journal Instructions Lockmiller Company estimates that total factory overhead costs will be $867,000 for the year, Direct labor hours are estimated to be 102.000 Required: a For Lockmiller Company, determine the predetermined factory overhead rate using direct labor hours as the activity base. Round your answer to the nearest cent b. During May, Lockmiler Company accumulated 1,900 hours of direct labor costs on Job 275 and 2,600 hours on Job 310 Determine the amount of factory overhead applied to Joba 275 and 310 in May c. Prepare the journal entry on May 30 to apply factory overhead to both jobs in May according to the predetermined overhead rate. Refer to the chart of accounts for the exact wording of the account titles CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit…arrow_forwardIvanhoe Company begins operations on April 1. Information from job cost sheets shows the following: Manufacturing Costs Assigned Job Number April May June Month Completed 10 $6,700 $4,600 May 11 4,400 4,200 $3,200 June 12 1,400 April 13 4,900 3,500 June 14 5,600 3,600 Not complete Each job was sold for 25% above its cost in the month following completion. (a) Calculate the balance in Work in Process Inventory at the end of each month. Work in Process Inventory April 30 $enter a dollar amount May 31 $enter a dollar amount June 30 $enter a dollar amountarrow_forwardValdosta Company is working on its costing information for January. Using normal costing, they use one overhead control account and charges overhead to production at 75% of direct labor cost. The company does not formally close the account until the end of the year. The beginning and ending inventories for the month of August are August 1 August 31 Direct Materials $62,000 $67,000 Work in Process $171,000 $145,000 Finished Goods $78,000 $85,000 Production data for the month of August follows: Direct labor $250,000 Actual manufacturing overhead $195,500 Direct materials purchased $163,000 Transportation in $2,000 Valdosta Company's manufacturing overhead control balance for the month of August is Group of answer choices $8,000 credit, overapplied $8,000 debit, underapplied $8,000 debit, overapplied $8,000 credit, underappliedarrow_forward

- AAAarrow_forwardThe April Work in Process account for Coventry Co. contained the following: Beginning balance -- $19,000 debit Direct materials -- $11,000 debit Direct labor -- $8,000 debit Overhead -- $13,000 debit Transfer to finished goods -- $3,000 credit Overhead is applied at a rate of 125% of direct labor cost. The only job in process at April 30, Job #897, has been charged with direct labor cost of $4,000. What amount of direct materials cost has been charged to Job 897? $____________arrow_forwardRobin Company has the following balances for the current month: Direct materials used $ 8,500 Direct labor $20,900 Sales salaries $10,500 $ 1,870 $ 6,070 $ 9,230 $ 4,650 Indirect labor Production manager's salary Marketing costs Factory lease What is Robin's total manufacturing overhead? Multiple Choice $17,170 $29,400 $12,590 $9,230arrow_forward

- Techuxia Corporation worked on four jobs during October: Job A256, Job A257, Job A258, and Job A260. At the end of October, the job cost sheets for these jobs contained the following data: Beginning balance Charged to the jobs during October: Direct materials Direct labor Manufacturing overhead applied Units completed Units in process at the end of October Units sold during October Job A256 $ 2,500 $ 3,900 $ 1,450 $ 2,500 100 1. Cost of goods sold for October 2. Finished goods inventory at the end of October 3. Work in process inventory at the end of October 0 80 Job A257 $1,150 $ 4,800 $ 2,300 $ 2,800 0 152 0 Job A258 $0 $ 2,700 $ 1,250 $ 1,550 850 0 170 Job A260 $0 $ 4,800 $ 1,050 $ 1,900 0 122 0 the end of October. There was no Jobs A256 and A258 were completed during October. The other two jobs were incomplete finished goods inventory on October 1. The company's total manufacturing overhead applied equals its total actual manufacturing overhead. Required: 1. What is the cost of…arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education