ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Many economists believe that a more effective way to supplement the income of the poor is through a negative income tax. Under this scheme, everyone reports his or her income to the government; individuals and families earning a higher income will pay a tax based on that income, while low-income individuals and families receive a subsidy, or negative tax. Assume that the only qualification required to receive a tax credit is low income.

Transcribed Image Text:Many economists believe that a more effective way to supplement the income of the poor is through a negative income tax. Under this scheme,

everyone reports his or her income to the government; individuals and families earning a higher income will pay a tax based on that income, while

low-income individuals and families receive a subsidy, or negative tax. Assume that the only qualification required to receive a tax credit is low

income.

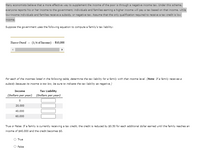

Suppose the government uses the following equation to compute a family's tax liability:

Tazes Owed =

(1/4 of Income) – $10,000

For each of the incomes listed in the following table, determine the tax liability for a family with that income level. (Note: If a family receives a

subsidy because its income is too low, be sure to indicate the tax liability as negative.)

Income

Tax Liability

(Dollars per year) (Dollars per year)

20,000

40,000

60,000

True or False: If a family is currently receiving a tax credit, the credit is reduced by $0.50 for each additional dollar earned until the family reaches an

income of $40,000 and the credit becomes $0.

True

O False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The graph illustrates the labor market in a country that does not tax labor income. Suppose the government introduces a Social Security tax of $2 an hour and it is split equally between workers and employers. The number of workers employed is. 14.00- 13.00- 12.00- 11.00- 10.00- 9.00- 8.00- Wage rate (dollars per hour) 10.00 7.00+ 600 700 $900 800 900 Quantity (workers) LS LD 1000 1100 1200 Q Q Garrow_forwardSketch two demand curves reflecting the difference in price responsiveness among different income groups: one for high-income people and one for low-income people. Show why the tax will impose a larger cost on the low-income group. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardSome states exclude necessities, such as food andclothing, from their sales tax. Other states do not.Discuss the merits of this exclusion. Consider bothefficiency and equity.arrow_forward

- In the government of a country's budget the finance minister proposed to raise the tax on cigarettes. He also proposed to increase income tax on individuals earning more than $100,000 per annum. What possible welfare objective can you think of from these proposals?arrow_forwardWhat makes the Earned Income Tax Credit (EITC) different from other poverty-fighting programs? The amount of the credit is doubled if the head of household is attending college. The tax credit is phased out gradually, rather than at a specific income cutoff point. The amount of the credit is not determined by the number of dependent children in the household. The EITC doesn't require the recipient to pay a minimum amount of income tax in order to receive the credit. It creates less of an incentive to work than other programs.arrow_forwardPoverty is measured by the number of people who fall below a certain level of income—called the poverty line—that defines the income one needs for a basic standard of living. The official definition of the poverty line traces back to Group of answer choices A)The Great Depression B)Mollie Orshansky, whose idea was to define a poverty line based on the cost of a healthy diet. C)1953 and the ability to pay for housing and food. D)The 1965 cost of providing food, housing, and transportation.arrow_forward

- One of the major problems in dealing with any welfare program is the tension between individual and social responsibility- Medicare is no different. Should adult children be responsible for the medical expenses of their parents? No. Where does individual and familiar Responsibility end and social responsibility begin?arrow_forwardFill in the blanks below. The info reported in the graphic shows that the current estimate is that ___________% of the global population now live in extreme poverty, using a measure based on a $1.90 per day wage. The figure is adjusted using the cost of living and inflation, and it also takes into account the minimum needed for daily essentials in places where poverty is prevalent. In comparison, some 1.9 billion, then about __________% of the world population, were living in extreme poverty in 1980.arrow_forwardConsider a society consisting of two people. Jacques earns an income of $100,000 per year and Kyoko earns an income of $30,000 per year. The government is considering a redistribution plan that would impose a 25% tax on Jacques's income and give the revenue to Kyoko. Without any incentive distortion, Jacques would retain $75,000 and Kyoko would end up with $55,000. However, let us assume that since Jacques will not receive all the income he earns, he decides to work less and earn an income of only $90,000, of which 25%×$90,000=$22,50025%×$90,000=$22,500 will be owed in taxes. With the redistribution plan, Jacques will take home an income of . The $22,500 that Jacques pays in taxes will be transferred by the government to Kyoko. Let us assume that since Kyoko now receives payment from the government, she will not work as many hours and will earn an income from work of only $29,000 instead of her initial $30,000. With the redistribution plan, Kyoko's total income…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education