Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

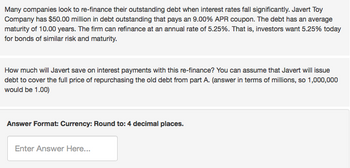

Transcribed Image Text:Many companies look to re-finance their outstanding debt when interest rates fall significantly. Javert Toy

Company has $50.00 million in debt outstanding that pays an 9.00% APR coupon. The debt has an average

maturity of 10.00 years. The firm can refinance at an annual rate of 5.25%. That is, investors want 5.25% today

for bonds of similar risk and maturity.

How much will Javert save on interest payments with this re-finance? You can assume that Javert will issue

debt to cover the full price of repurchasing the old debt from part A. (answer in terms of millions, so 1,000,000

would be 1.00)

Answer Format: Currency: Round to: 4 decimal places.

Enter Answer Here...

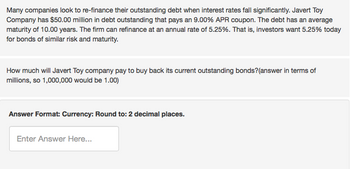

Transcribed Image Text:Many companies look to re-finance their outstanding debt when interest rates fall significantly. Javert Toy

Company has $50.00 million in debt outstanding that pays an 9.00% APR coupon. The debt has an average

maturity of 10.00 years. The firm can refinance at an annual rate of 5.25%. That is, investors want 5.25% today

for bonds of similar risk and maturity.

How much will Javert Toy company pay to buy back its current outstanding bonds? (answer in terms of

millions, so 1,000,000 would be 1.00)

Answer Format: Currency: Round to: 2 decimal places.

Enter Answer Here...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your company wants to raise $8.5 million by issuing 10-year zero-coupon bonds. If the yield to maturity on the bonds will be 5% (annual compounded KAPR), what total face value amount of bonds must you issue? ve this 6 F V The total face value amount of bonds that you must issue is $. (Round to the nearest cent.) View an example Get more help. G B.B % 5 T G 1 B A 6 Y H ☐ MacBook Pro N & 7 U J * 8 M Ⓒ K ( 9 H 15 X 1 option Clear all + = Check answer delete returarrow_forwardYour company wants to raise $8.0 million by issuing 30-year zero-coupon bonds. If the yield to maturity on the bonds will be 5% (annual compounded APR), what total face value amount of bonds must you issue?arrow_forwardA corporation is planning to sell its 90 - day commercial paper to investors offering a 10.2 percent yield. If the liquidity premium is estimated to be 0.2 percent, and there is a 0.4 percent tax adjustment. Also, the three month real annualized rate is 5.6 percent and expected inflation is 1.1 percent. What is the appropriate default premium?arrow_forward

- Builtrite needs to raise $2,000,000 for a plant improvement. It plans to sell $1000 par value bonds with a 10% coupon rate arde a 15 year maturity. Investors require a 9% rate of return. Calculate the market value of the bonds, what is the net price of the bonds if flotation costs are 5% of the market price?arrow_forwardThe required rate on this company's debt has now risen to 16 percent. The firm has a bond issue outstanding with 24 years to maturity and a coupon rate of 9.8 percent, with interest being paid semiannually. What is the current yield?arrow_forwardKroBank issues a zero coupon bond and it has to pay the face value of the bond of $100 M due in exactly five years. Assuming interest rates are currently at 8% p.a., which of the following is the best investment option for the bank to ensure it has enough funds to meet the liability in five years: Invest $100M today in coupon-paying bonds paying 8% p.a. annual coupons with maturity of 7 years (duration is 5.62 years), sell the bonds in year 5. Invest $100M today in coupon-paying bonds paying 8% p.a. annual coupons with maturity of 6 years (duration is 4.99 years), sell the bonds in year 5. Invest $100 M today in coupon-paying bonds paying 8% p.a. annual coupons with maturity of 5 years (duration is 4.31 years). Invest $100 M today in coupon-paying bonds paying 8% p.a. annual coupons with maturity of 8 years (duration is 6.21 years), sell the bonds in year 5.arrow_forward

- Third Mortgage Investors makes money by purchasing mortgage backed securities (MBS), stripping them into interest only (IO) and principal only (PO) components, and selling the components for more than it paid for the original security. Suppose the company purchases a $100,000 Face value MBS carrying a coupon of 9 percent and a maturity of 30 years. Assume for the purpose of the following analysis, the MBS will make payments on an “ANNUAL BASIS.” What is the remaining principal balance on the MBS if it survives 1-year? 3-years? 5 years? 8 years?arrow_forwardMany companies look to re-finance their outstanding debt when interest rates fall significantly. Javert Toy Company has $50.00 million in debt outstanding that pays an 8.75% APR coupon. The debt has an average maturity of 10.00 years. The firm can refinance at an annual rate of 5.25%. That is, investors want 5.25% today for bonds of similar risk and maturity. How much will Javert save on interest payments with this re-finance? You can assume that Javert will issue debt to cover the full price of repurchasing the old debt from part A. (answer in terms of millions, so 1,000,000 would be 1.00) Submit Answer format: Currency: Round to: 4 decimal places.arrow_forwardA twenty-year government bond with a face value of 120$ makes annual coupon payments of 1% and offers a yield of 8% annually compounded.Suppose that one year later the bond yields at 5%. Showing your calculations,a) What return has bondholders earned over the 12-month period? Instead, suppose now that one year later the bond yields at 5.5%.b) What return has bondholders earned over the 12-month period?arrow_forward

- X Co. want to raise $100 million of 5-year debt in the Euro-market where interest is paid annually. It can obtain a 5-yr floating rate note with an interest rate of 1-year LIBOR + 2%. The 1-year LIBOR rate is currently 5%. To hedge the interest rate risk X Co. plans to enter into a collar with a cap rate of 6% and a floor rate of 4%. The notional principal of both the cap and floor is $100 million. The cap premium is 1.4% of the notional principal and the floor premium is 0.5% of the notional premium. What is the worst case all-in-rate that X Co. will pay in total? Answer options: 5.8% 5.2% 9.2% 8.2% 7.2%arrow_forwardA mortgage pass-through security (PT) has a par value of $100,000, a 4% coupon paid monthly, and is based on 30 year mortgages. The current market rate for similar bonds is 3.5%, and prepayments currently equal $100 per month. Assume rates immediately rise to 4.5%, and prepayments drop to $40 as a result. The PT will now be paid off in month 310. What is the price of the PT today? Group of answer choices: $98,323.2214 $184,274.6844 $94,737.4877 $102,365.1248arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education