3 questions.-- Please see both photos. Second time I have submitted this question. The first one that was answered , they were wrong and didn't answer it all.

Manufacturing Income Statement, Statement of Cost of Goods Manufactured

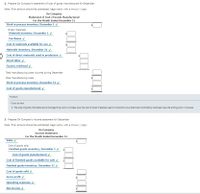

Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December:

1. Determine the amounts of the missing items, identifying them by letter. Enter all amounts as positive numbers.

2. Prepare On Company's statement of cost of goods manufactured for December.

Note: If an amount should be subtracted, begin entry with a minus (-) sign.

3. Prepare On Company's income statement for December.

Note: If an amount should be subtracted, begin entry with a minus (-) sign.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Nonearrow_forward! Required information [The following information applies to the questions displayed below.] Bergo Bay's accounting system generated the following account balances on December 31. The company's manager knows something is wrong with this list of balances because it does not show any balance for Work in Process Inventory, and the accrued factory payroll (Factory Wages Payable) has not been recorded. Cash Accounts receivable Raw materials inventory Work in process inventory. Finished goods inventory Prepaid rent Accounts payable Notes payable Common stock Retained earnings (prior year) Sales Cost of goods sold Factory overhead General and administrative expenses Totals Cash Accounts receivable Raw materials inventory Work in process inventory Debit $ 70,000 39,000 24,500 BERGO BAY COMPANY List of Account Balances December 31 0 6,000 2,000 Debit These six documents must be processed to bring the accounting records up to date. Materials requisition 10: Materials requisition 11: Materials…arrow_forwardIncome Statement for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods sold data from a manufacturing company income statement. Determine the amounts of the missing items, identifying them by letter. Finished goods inventory, June 1 $136,000 $45,300 (e)Cost of goods manufactured 963,000 (c) 209,900Cost of finished goods available for sale (a) $629,600 $1,282,600Finished goods inventory, June 30 151,600 81,600 (f)Cost of goods sold (b) (d) $1,101,900a. $fill in the blank 1b. $fill in the blank 2c. $fill in the blank 3d. $fill in the blank 4e. $fill in the blank 5f. $fill in the blank 6arrow_forward

- Income Statement for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods sold data from a manufacturing company income statement. Determine the amounts of the missing items, identifying them by letter. Finished goods inventory, June 1 $56,800 $18,700 (e) Cost of goods manufactured 301,000 (c) 65,500 Cost of finished goods available for sale (a) $177,700 $102,900 Finished goods inventory, June 30 69,400 37,300 (f) Cost of goods sold (b) (d) $94,700 a. b. C.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardManufacturing company and merchandising company work sheets are prepared using the same four steps. Select one: True False To close Income Summary at the end of the year, Retained Earnings is credited for the amount of net income. Select one: True False __________ is the consumption or exhaustion of natural resources. Please answer all questions ill give thumbs up thanksarrow_forward

- 16. At the end of the year, a company finds that it has under-applied factory overhead by $1,000. What would be the most common accounting treatment in this case? Increase Assets by $1,000 on the Balance Sheet Increase Profit by $1,000 in the Income Statement Increase Liabilities by $1,000 on the Balance Sheet Decrease Cost of Goods Sold by $1,000 in the Income Statement Increase Cost of Goods Sold by $1,000 in the Income Statement.arrow_forwardPlease do not give solution in image format thankuarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education