FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

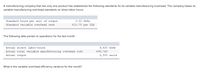

Transcribed Image Text:A manufacturing company that has only one product has established the following standards for its variable manufacturing overhead. The company bases its

variable manufacturing overhead standards on direct labor-hours.

Standard hours per unit of output

3.00 DLH3

Standard variable overhead rate

$10.75 per DLH

The following data pertain to operations for the last month:

Actual direct labor-hours

9,600 DLHS

Actual total variable manufacturing overhead cost

Actual output

$95,760

2,500 units

What is the variable overhead efficiency variance for the month?

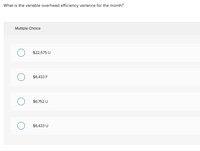

Transcribed Image Text:What is the variable overhead efficiency variance for the month?

Multiple Cholce

$22,575 U

$6,433 F

$6,752 U

$6,433 U

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturing company that has only one product has established the following standards for its variable manufacturing overhead. The company bases its variable manufacturing overhead standards on direct labor-hours. Standard hours per unit of output 3.90 direct labor-hours Standard variable overhead rate $11.25 per direct labor-hour The following data pertain to operations for the last month: Actual direct labor-hours 8,800 direct labor-hours Actual total variable manufacturing overhead cost $ 95,850 Actual output 2,200 units What is the variable overhead rate variance for the month?arrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $9.00 per pound $ 36.00 Direct labor: 3 hours at $12 per hour 36.00 Variable overhead: 3 hours at $8 per hour 24.00 Total standard variable cost per unit $ 96.00 The company also established the following cost formulas for its selling expenses: Fixed Cost per Month Variable Cost per Unit Sold Advertising $ 230,000 Sales salaries and commissions $ 160,000 $ 15.00 Shipping expenses $ 6.00 The planning budget for March was based on producing and selling 28,000 units. However, during March the company actually produced and sold 33,000 units and incurred the following costs: Purchased 165,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used in production. Direct-laborers worked 58,000 hours at a rate of…arrow_forwardRex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $157,850 4,100 $ Machine Hours 324,622 14,114 2$ Inspections 119,000 3,400arrow_forward

- Preble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 12.00 Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Fixed Cost Variable Cost per Month per Unit Sold. Advertising Sales salaries and commissions Shipping expenses $ 19.00 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. c. Total variable manufacturing overhead for the month was $390,600. d.…arrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 5 pounds at $8.00 per pound Direct labor: 2 hours at $14 per hour Variable overhead: 2 hours at $5 per hour Total standard variable cost per unit $ 40.00 28.00 10.00 $ 78.00 The company also established the following cost formulas for its selling expenses: Advertising Sales salaries and commissions Shipping expenses Variable Cost per Unit Sold Fixed Cost per Month $ 200,000 $ 100,000 $ 12.00 $ 3.00 S The planning budget for March was based on producing and selling 25,000 units. However, during March the company actually produced and sòld 30,000 units and incurred the following costs: a. Purchased 160,000 pounds of raw materials at a cost of $7.50 per pound. All of this material was used in production. b. Direct-laborers worked 55,000 hours at a rate of $15.00 per hour. c. Total variable…arrow_forward- ok k int ences w 3 E Overhead information for Cran-Mar Company for October follows: Total factory overhead cost incurred Budgeted fixed factory overhead cost Total standard overhead rate per machine hour (MH) D Standard variable factory overhead rate per MH Standard MHS allowed for the units manufactured here to search Required: 1. What is the standard fixed factory overhead rate per machine hour (MH)? 2. What is the denominator activity level that was used to establish the fixed factory overhead application rate? 3. Two-way analysis (breakdown) of the total factory overhead cost variance: calculate the following factory overhead cost variances for October and indicate whether each variance is favorable (F) or unfavorable (U). a. Total flexible-budget variance. b. Production volume variance. c. Total overhead cost variance. 4. Calculate the production volume variance and indicate whether the variance is favorable (F) or unfavorable (U). Complete this question by entering your answers…arrow_forward

- Manufacturing overhead data for the production of Product H by Kingbird Company, assuming the company uses a standard cost system, are as follows. Overhead incurred for 46,100 actual direct labor hours worked $281,880 Overhead rate (variable $5; fixed $1) at normal capacity of 58,300 direct labor hours $6 Standard hours allowed for work done $47,180 Compute the total overhead variancearrow_forwardHanshabenarrow_forwardBullseye Company manufactures dartboards. Its standard cost information follows: Direct materials (cork board) Direct labor Standard Quantity 0.50 square feet 0.90 hour Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($21,750/87,000) Bullseye has the following actual results for the month of September: Number of units produced and sold Number of square feet of corkboard purchased and used Cost of corkboard used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 0.90 hour Standard Price (Rate) $ 1.30 per square feet $5.00 per hour $0.50 per hour 74,000 43,000 $ 47,200 80,000 $ 98,000 $ 103,880 $ 33,000 Standard Unit Cost $ 0.65 4.50 0.45 0.25 Required: 1. Calculate the fixed overhead spending variance for Bullseye. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). 2. Calculate the fixed overhead volume variance…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education