Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

Pls help ASAP for both

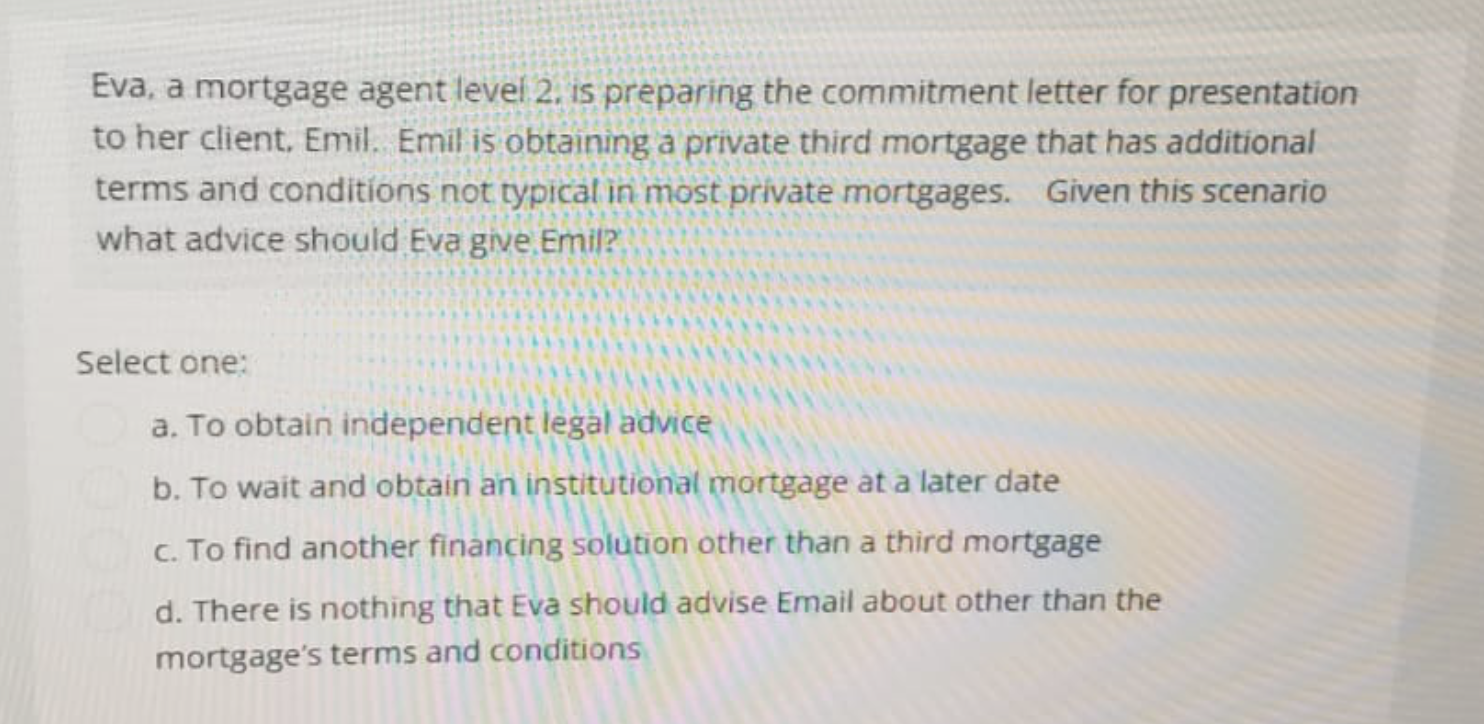

Transcribed Image Text:Eva, a mortgage agent level 2, is preparing the commitment letter for presentation

to her client, Emil. Emil is obtaining a private third mortgage that has additional

terms and conditions not typical in most private mortgages. Given this scenario

what advice should Eva give. Emil?

Select one:

a. To obtain independent legal advice

b. To wait and obtain an institutional mortgage at a later date

c. To find another financing solution other than a third mortgage

d. There is nothing that Eva should advise Email about other than the

mortgage's terms and conditions

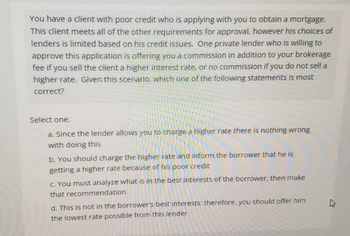

Transcribed Image Text:You have a client with poor credit who is applying with you to obtain a mortgage.

This client meets all of the other requirements for approval, however his choices of

lenders is limited based on his credit issues. One private lender who is willing to

approve this application is offering you a commission in addition to your brokerage

fee if you sell the client a higher interest rate, or no commission if you do not sell a

higher rate. Given this scenario, which one of the following statements is most

correct?

Select one:

a. Since the lender allows you to charge a higher rate there is nothing wrong

with doing this

b. You should charge the higher rate and inform the borrower that he is

getting a higher rate because of his poor credit

c. You must analyze what is in the best interests of the borrower, then make

that recommendation

d. This is not in the borrower's best interests; therefore, you should offer him

the lowest rate possible from this lender

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Wal Mart, although they are not a manufacturing company, uses sophisticated computer software to forecast sales and order products to be stocked in their stores so that they do not run out of the things shoppers are looking for. What kind of software system does Wal Mart likely use? Group of answer choices a) Inventory control b) Just-in-time ordering c) E-procurement d) Materials Requirement Planning (MRP)arrow_forward14.26. Calculate the available-to-promise row in the following matrix: Period On Hand = 100 1 2 3 4 5 6 Forecast 50 100 50 100 50 100 Customer Orders 50 125 75 175 45 15 Master Production 200 200 Schedule Available-to-Promisearrow_forwardwrite a request for proposal for new EMR systemarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON