FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

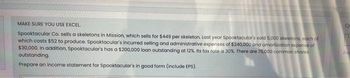

Transcribed Image Text:MAKE SURE YOU USE EXCEL

Spooktacular Co. sells a skeletons in Mission, which sells for $449 per skeleton. Last year Spooktacular's sold 5,000 skeletons, each of

which costs $52 to produce. Spooktacular's incurred selling and administrative expenses of $240,000 and amortization expense of

$30,000. In addition, Spooktacular's has a $200,000 loan outstanding at 12%. Its tax rate is 30%. There are 75,000 common shares

outstanding.

Prepare an income statement for Spooktacular's in good form (include EPS).

Qu

Fin

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blossom Inc. is a cell phone wholesaler. At the beginning of the year, it purchased 1320 units of the most recent android phone for $500 each. The selling price during the year was $700 per unit. At year end, it had 320 units on hand. Due to changes in technology, the selling price will have to be reduced by 35% in order to sell the remaining phones. What is the inventory value of the android phones at the end of the period? O $160000 O $145600 O $104000 O $56000arrow_forwardAyayai Taco Palace sells 240 gift cards at $40 per gift card and 120 of the gift cards are redeemed by year-end. Ayayai estimates that it will have 10% breakage on its gift cards. Prepare the entry for the gift card redemption and the expected breakage for the gift cards in the current year. (Ignore Cost of Goods Sold.) (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries. Round intermediate calculations to 4 decimal places, e.g. 0.2456 and final answers to O decimal places, e.g. 5,125.) Account Titles and Explanation Unearned Gift Card Revenue Sales Revenue Sales Revenue (Breakage) Debit Credit 4800 960arrow_forwardTim's Bicycle Shop sells 21-speed bicycles. For purposes of a cost-volume-profit analysis, the shop owner has divided sales into two categories, as follows: product type high quality medium quality price invoice cost 840 620 sales commission sales price 1850 920 100 40 Three-quarters of the shop's sales are medium-quality bikes. The shop's annual fixed expenses are $270,400. (In the following requirements, ignore income taxes.) a. What is the shop's break-even sales volume in dollars? Assume a constant sales mix. b. How many bicycles of each type must be sold to earn a target net income of $126,750? Assume a constant sales mix.arrow_forward

- Please help me to solve all questionarrow_forwardSchoenen Motors is a small car dealership. On average, it sells a car for $27,000, which it purchases from the manufacturer for $23,000. Each month, Schoenen Motors pays $48,200 in rent and utilities and $68,000 for salespeople's salaries. In addition to their salaries, salespeople are paid a commission of $600 for each car they sell. Schoenen Motors also spends $13,000 each month for local advertisements. Its tax rate is 40%. Read the requirements. Requirement 1. How many cars must Schoenen Motors sell each month to break even? Schoenen Motors must sell cars each month to break even Requirement 2. Schoenen Motors has a target monthly net income of $51,000. What is its targeted monthly operating income? How many cars must be sold each month to reach the target monthly net income of $51,000? The target monthly operating income is They would need to sell cars to reach the target monthly income of $51,000.arrow_forwardJulianna Abdallah owns and operates FirstCakes, a bakery that creates personalized birthday cakes for a child's first birthday. The cakes, which sell for $40 and feature an edible picture of the child, are shipped throughout the country. A typical month's results are as follows: Sales revenue $840,000 Variable expenses 630,000 Contribution margin 210,000 Fixed expenses 112,000 Operating income $ 98,000 a.What is FirstCakes' contribution margin per unit? b.What is FirstCakes' monthly breakeven point in units? c.What is FirstCakes' contribution margin ratio? d.What is FirstCakes' monthly breakeven point in sales dollars?arrow_forward

- Rapido Quadcopters plans to sella standard quadoopter (toy drone) for $54 and a delue quadcopter for $74. Rapido purchases the standard quadcopter for $44 and the deluse quadcopter for $54. Management expects to sel wo dekove quadcopters for every three standard quadcopters The company's monthly foxed expenses are $11,200. How many of each type of quadcopter must Rapido sell monthly to breakeven? To eam $7,7007 First identity the formula to compute the sales in units at various levels of operating income using the contribubon margin approach (Abbreviations used Avg. average, and CM e contribution margin) Fied expenses Operating income Weighed-avg CM per unit Breakeven sales in units Next compute the weighted average contribution margin per unit. First identity the formula labols, then complete the calculations step by step Standard Sale price per unt Deduct Varable expense per unit Contribution margin per unit Sales mix in unts Contribution margin Weighted average contribution margin…arrow_forwardTeal Mountain Company has been a retailer of audio systems for the past 3 years. However, after a thorough survey of audio system markets, Teal Mountain decided to turn its retail store into an audio equipment factory. Production began October 1, 2022. Direct materials costs for an audio system total $77 per unit. Workers on the production lines are paid $13 per hour. An audio system takes 6 labor hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $5,070 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,700. Factory janitorial costs are $2,030 monthly. Advertising costs for the audio system will be $9,030 per month. The factory building depreciation is $6,360 per year. Property taxes on the factory building will be $8,520 per year. Assuming that Teal Mountain manufactures, on average, 1,400 audio systems per month, enter each cost item on your answer sheet, placing…arrow_forwardAmerican Investor Group is opening an office in Portland, Oregon. Fixed monthly costs are office rent ($8,800), depreciation on office furniture ($1,800), utilities ($2,500), special telephone lines ($1,500), a connection with an online brokerage service ($2,400), and the salary of a financial planner ($4,000). Variable costs include payments to the financial planner (9% of revenue), advertising (11% of revenue), supplies and postage (4% of revenue), and usage fees for the telephone lines and computerized brokerage service (6% of revenue). Read the requirements. Requirement 1. Use the contribution margin ratio approach to compute American's breakeven revenue in dollars. If the average trade leads to $750 in revenue for American, how many trades must be made to break even? Begin by showing the formula and then entering the amounts to calculate the required sales dollars for American to break even. (Abbreviation used: CM = contribution margin.) Fixed costs Target profit ) + CM ratio =…arrow_forward

- Oriole Company sells 455 units for $290 each to Sheffield Inc. for cash. Oriole allows Sheffield to return any unused product within 30 days and receive a full refund. The cost of each product is $174. To determine the transaction price, Oriole decides that the approach that is most predictive of the amount of consideration to which it will be entitled is the most likely amount. Using the most likely amount, Oriole estimates that ten (10) units will be returned, the costs of recovering the units will be immaterial, and the returned units are expected to be resold at a profit. What amount of refund liability should Oriole record at the time of sale? $1740 O $2900 $1160 O $0arrow_forwardMilliken uses a digitally controlled dyer for placing intricate patterns on manufactured carpet squares for home and commercial use. It is purchased for $400,000. Its market value will be $310,000 at the end of the 1st year and drop by $44,000 per year thereafter to a minimum of $30,000. Operating costs are $20,000 the 1st year, increasing by 7% per year. Maintenance costs are only $8,000 the 1st year but will increase by 37% each year thereafter. Milliken’s MARR is 20%. Determine the optimum replacement interval (years) for the dyerarrow_forwardThe Hurley Hat Company manufactures baseball hats. Hurley’s primary customers are sporting goods stores that supply uniforms to youth baseball teams. Following is Hurley’s income statement for 2018: In 2018, Hurley produced and sold 200,000 baseball hats. Of the Cost of Goods gold, $150,000 is fixed; 80% of the Selling and Administrative Expenses are fixed. There were no beginning inventories on January 1, 2018. The company is considering two options to increase sales. Option 1: The company is operating at 100,000 hats below full production capacity and is considering increasing advertising to increase sales to the production capacity level in 2019. The marketing director predicts that an additional $100,000 expenditure for advertising Would increase sales to 300,000 hats per year. Option 2: The sales manager has been negotiating with buyers for several national sporting goods retailers and recommends the company expand production capacity to 400,000 hats in order to secure long-term…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education