FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

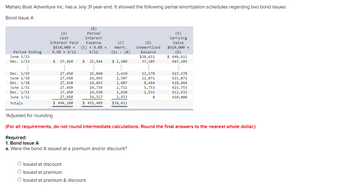

Transcribed Image Text:Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues:

Bond Issue A

Period Ending

June 1/23

Dec. 1/23

$610,000 x

9.0% x 6/12

(A)

Cash

Interest Paid

(B)

Period

Interest

Expense

(E) x 8.0% x

(c)

Amort.

(D)

Unamortized

6/12

(A) - (B)

Balance

$38,611

$ 27,450

$ 25,944

$ 1,506

37,105

(E)

Carrying

Value

$610,000 +

(D)

$ 648,611

647,105

Dec. 1/29

27,450

25,040

2,410

13,578

623,578

June 1/30

27,450

24,943

2,507

11,071

621,071

Dec. 1/30

27,450

24,843

2,607

8,464

618,464

June 1/31

27,450

24,739

2,711

5,753

615,753

Dec. 1/31

27,450

24,630

2,820

2,933

612,933

June 1/32

Totals

27,450

24,517

2,933

Ө

610,000

$ 494,100

$ 455,489

$38,611

"Adjusted for rounding

(For all requirements, do not round intermediate calculations. Round the final answers to the nearest whole dollar.)

Required:

1. Bond Issue A

a. Were the bond A issued at a premium and/or discount?

Issued at discount

O Issued at premium

◇ Issued at premium & discount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the first day of the fiscal year, a company issues an $994,000, 7%, 5-year bond that pays semiannual interest of $34,790 ($994,000 x 7% x 1/2), receiving cash of $934,400. Journalize the entry for the first interest payment and the amortization of the related bond discount using the straight-line method. If an amount box does not require an entry, leave it blank. Previousarrow_forwardOn January 1, Year 1, Hackman Corporation issued $600,000 face value 6% bonds dated January 1, Year 1, for $621,430. The bonds pay interest semiannually on June 30 and December 31 and are due December 31, Year 5. Hackman uses the straight-line amortization method. Required: Record the issuance of the bonds and the first two interest payments. Record the issuance of the bonds on January 1 and the first two interest payments on June 30 and December 3arrow_forwardOn January 1, $853,000, 5-year, 10% bonds were issued for $827,410. Interest is paid semiannually on January 1 and July 1. If the issuing corporation uses the straight-line method to amortize a discount on bonds payable, the semiannual amortization amount is a. $42,650 Ob. $2,559 Oc. $25,590 d. $5,118 Woxtarrow_forward

- Franklin corporation issues $84,000, 8%, 5-year bonds on January 1, for $87,780. Interest is paid semiannually on January 1 and July 1. If Franklin uses the straight-line method of amortization of bond premium, the amount of bond interest expense to b recognized on July 1 is O a. $3,738 O b. $6,720 Oc. $3.360 d. $2,982arrow_forwardOn January 1, $853,000, 5-year, 10% bonds were issued for $827,410. Interest is paid semiannually on January 1 and July 1. If the issuing corporation uses the straight-line method to amortize a discount on bonds payable, the semiannual amortization amount is a. $42,650 O Ob. $2,559 Oc. $25,590 Od. $5,118arrow_forwardOn 31 December 20X7, a company has the following bond on the statement of financial position: Bond payable, 7%, interest due semi-annually on 31 Dec. and 30 June; maturity date, 30 June 20X11 Premium on bonds payable $5,600,000 47,040 $5,647,040arrow_forward

- 1arrow_forwardOn the first day of the fiscal year, a company issues an $565,000, 9%, 5-year bond that pays semiannual interest of $25,425 ($565,000 x 9% x 1/2), receiving cash of $531,100. Journalize the entry to record the first interest payment and the amortization of the related bond discount using the straight-line method. If an amount box does not require an entry, leave it blank. Interest Expense Discount on Bonds Payable Casharrow_forwardOn January 1, $877,000, five-year, 10% bonds, were issued for $850,690. Interest is paid semiannually on January 1 and July 1. If the issuing corporation uses the straight-line method to amortize the discount on bonds payable, the semiannual amortization amount is a.$43,850 b.$26,310 c.$2,631 d.$5,262arrow_forward

- On the first day of the fiscal year, a company issues a $674,000, 7%, 10-year bond that pays semiannual interest of $23,590 ($674,000 x 7% x 1/2), receiving cash of $707,700. Journalize the entry for the first interest payment and amortization of premium using the straight-line method. If an amount box does not require an entry, leave it blank.arrow_forwardOn the first day of the fiscal year, a company issues a $896,000, 7%, 10-year bond that pays semiannual interest of $31,360 ($896,000 x 7% x 1/2), receiving cash of $940,800. Journalize the entry for the first interest payment and amortization of premium using the straight-line method. If an amount box does not require an entry, leave it blank.arrow_forwardDiaz Company issued bonds with a face value of $180,000 on January 1, Year 1. The bonds had a stated interest rate of 7 percent and a five-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 98. The straight- line method is used for amortization. Required a. Use a financial statements model to demonstrate how (1) the January 1, Year 1, bond issue and (2) the December 31, Year 1, recognition of interest expense, including the amortization of the discount and the cash payment, affect the company's financial statements. b. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 1. c. Determine the amount of interest expense reported on the Year 1 income statement. d. Determine the carrying value (face value less discount or plus premium) of the bond liability as of December 31, Year 2 e. Determine the amount of interest expense reported on the Year 2 income statement. Complete…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education